Loading

Get Wi A-772 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WI A-772 online

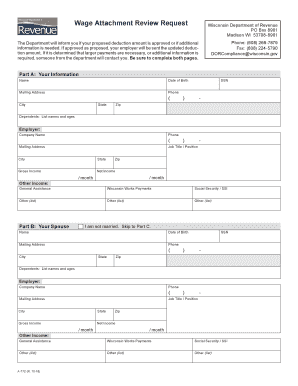

The WI A-772 form is essential for requesting a wage attachment review from the Wisconsin Department of Revenue. This guide provides step-by-step instructions to help you fill out the form accurately and efficiently online.

Follow the steps to complete the WI A-772 form effectively.

- Press the ‘Get Form’ button to download the WI A-772 form and open it in your preferred editing tool.

- In Part A, provide your personal information including your full name, date of birth, mailing address, phone number, and Social Security Number (SSN). Remember to include details about your dependents, employer, job title, and income sources.

- If applicable, navigate to Part B to input information about your spouse. If you are not married, skip to Part C. Include their name, date of birth, mailing address, SSN, phone number, dependents, and income details.

- In Part C, list all banks and other financial institutions where you hold accounts. Indicate the type of account (checking, savings, etc.) and the balance for each.

- Continue to Part D to document your motor vehicles, boats, or other recreational vehicles. Provide details such as the year, make, model, fair market value, lien holder, and balance owed for each vehicle.

- In Part E, detail any real estate you own. Include the location, fair market value, mortgage holder, and balance due.

- In Part F, list your monthly expenses alongside the total balance owed for each category, including mortgage or rent, vehicle payments, utilities, food, insurance, and any loans or credit cards.

- Review the additional information regarding tax filings and your obligations. Confirm your understanding of the implications of inaccurate or false information.

- In Part G, sign and date the form to attest that the provided information is accurate to the best of your knowledge. If applicable, your spouse should also sign.

- After completing all sections, save your changes, download, print, or share the filled-out form as necessary.

Complete your documents online for a seamless submission experience.

Form 763 S is for nonresidents or part-year residents of Wisconsin who need to file taxes. To complete the form, you must report income earned in Wisconsin and any applicable deductions. Using resources from uslegalforms could simplify the process of filling out the form accurately and ensure you meet the criteria of WI A-772.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.