Get Wi A-772 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

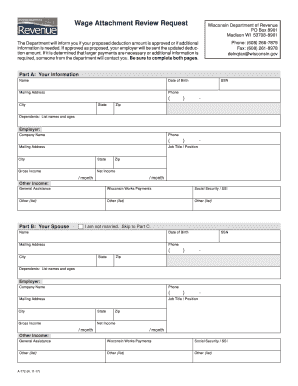

Tips on how to fill out, edit and sign WI A-772 online

How to fill out and sign WI A-772 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Filling out tax documents can turn into a significant hurdle and a major nuisance if adequate help is not available. US Legal Forms serves as an online resource for WI A-772 e-filing and provides numerous advantages for taxpayers.

Utilize the guidance on how to complete the WI A-772:

Press the Done button in the top menu once you have finished it. Save, download, or export the completed template. Use US Legal Forms to ensure an easy and convenient WI A-772 filing experience.

- Obtain the template from the website within the designated section or through the search engine.

- Click the orange button to access it and wait for it to load.

- Review the template and follow the directions. If you are unfamiliar with the template, adhere to the step-by-step instructions.

- Pay attention to the highlighted fields. These are fillable and need specific information to be entered. If you're unsure of what to input, refer to the instructions.

- Always sign the WI A-772. Use the built-in tool to create your e-signature.

- Click on the date field to automatically insert the correct date.

- Review the template to check and amend it before e-filing.

How to modify Get WI A-772 2017: personalize forms online

Place the correct document management resources at your disposal. Complete Get WI A-772 2017 with our dependable service that merges editing and eSignature capabilities.

If you wish to process and sign Get WI A-772 2017 online effortlessly, our cloud-based option is the perfect resolution. We provide an abundant catalog of template-based forms ready for modification and completion online. Furthermore, there is no requirement to print the document or employ external solutions to make it fillable. All essential features will be accessible for your use once you access the document in the editor.

Let’s explore our online editing features and their primary capabilities. The editor boasts an intuitive interface, so it won't take long to grasp how to use it. We will examine three key sections that allow you to:

In addition to the functionalities discussed above, you can safeguard your document with a password, apply a watermark, convert the document into the required format, and much more.

Our editor simplifies altering and certifying the Get WI A-772 2017. It allows you to do virtually everything concerning form management. Moreover, we always guarantee that your experience in editing documents is secure and adheres to the major regulatory standards. All these factors enhance the enjoyment of utilizing our tool.

Retrieve Get WI A-772 2017, make the necessary revisions and adjustments, and download it in your preferred file format. Experience it today!

- Alter and annotate the template

- The upper toolbar includes features that assist you in highlighting and obscuring text, excluding graphics and visual elements (lines, arrows, and checkmarks, etc.), adding your signature, initializing, dating the document, and more.

- Organize your documents

- Utilize the toolbar on the left if you want to rearrange the document or remove pages.

- Make them shareable

- If you wish to render the template fillable for other users and share it, you can employ the instruments on the right to add various fillable fields, a signature and date, text box, etc.

In Wisconsin, the rules for wage garnishment are primarily governed by statute WI A-772. This law outlines the circumstances under which a creditor can garnish your wages, typically following a court judgment. It is important to note that garnishments cannot exceed 20% of your disposable income. If you seek guidance on navigating wage garnishments, uslegalforms provides resources that can help you understand your rights and obligations.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.