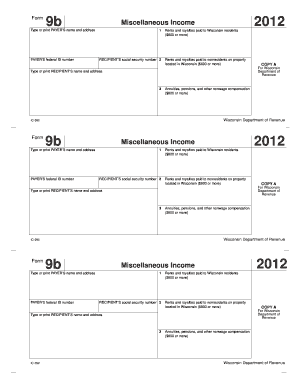

Get Wi Dor 9b 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Noncorporate online

How to fill out and sign Fiduciaries online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Tax blank completion can become a significant challenge and extreme headache if no appropriate assistance offered. US Legal Forms is produced as an on-line solution for WI DoR 9b e-filing and gives many advantages for the taxpayers.

Use the guidelines on how to fill out the WI DoR 9b:

-

Find the template on the webpage in the respective section or via the Search engine.

-

Click on the orange button to open it and wait until it?s done.

-

Review the blank and stick to the recommendations. If you have never accomplished the template earlier, stick to the line-to-line recommendations.

-

Focus on the yellowish fields. These are fillable and demand particular info to get inserted. If you are uncertain what information to insert, see the instructions.

-

Always sign the WI DoR 9b. Utilize the built-in instrument to create the e-signature.

-

Select the date field to automatically place the appropriate date.

-

Re-read the template to check and change it before the submission.

- Hit the Done button in the upper menu in case you have finished it.

-

Save, download or export the completed form.

Employ US Legal Forms to guarantee comfortable as well as simple WI DoR 9b completion

How to edit CO-001: customize forms online

Take full advantage of our extensive online document editor while completing your paperwork. Complete the CO-001, emphasize on the most significant details, and easily make any other essential modifications to its content.

Preparing paperwork electronically is not only time-saving but also comes with an opportunity to modify the sample in accordance with your needs. If you’re about to work on CO-001, consider completing it with our comprehensive online editing tools. Whether you make a typo or enter the requested details into the wrong area, you can rapidly make changes to the document without the need to restart it from the beginning as during manual fill-out. Apart from that, you can point out the vital data in your paperwork by highlighting certain pieces of content with colors, underlining them, or circling them.

Follow these simple and quick steps to complete and modify your CO-001 online:

- Open the file in the editor.

- Provide the required information in the blank fields using Text, Check, and Cross tools.

- Adhere to the form navigation to avoid missing any required fields in the sample.

- Circle some of the significant details and add a URL to it if necessary.

- Use the Highlight or Line options to point out the most significant pieces of content.

- Select colors and thickness for these lines to make your form look professional.

- Erase or blackout the facts you don’t want to be visible to other people.

- Replace pieces of content that contain errors and type in text that you need.

- End up editing with the Done button as soon as you make sure everything is correct in the form.

Our robust online solutions are the simplest way to complete and customize CO-001 according to your requirements. Use it to prepare personal or business paperwork from anyplace. Open it in a browser, make any adjustments to your forms, and get back to them at any moment in the future - they all will be safely kept in the cloud.

Video instructions and help with filling out and completing IC-092

Use our easy-to-follow video to prepare online W-2 in a simple manner. Maintain readily available web templates and enjoy our best instructions to simplify routing paperwork.

Related links form

Individuals, fiduciaries, partnerships, limited liability companies, and corporations doing business in Wisconsin and making payments to individuals of rents, royalties, or certain nonwage compensation must file Form 1099 or Form 9b, except payers other than corporations must report rents and royalties only if the ...

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.