Loading

Get Wi Dor Pa-003 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WI DoR PA-003 online

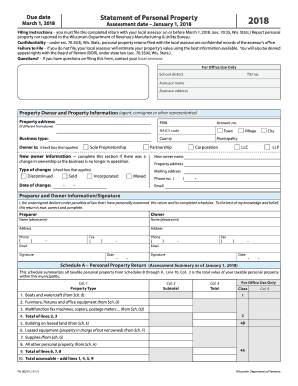

Filling out the Wisconsin Department of Revenue Personal Property Return (WI DoR PA-003) online can streamline your reporting process for personal property taxes. This guide provides you with step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the WI DoR PA-003 online.

- Click the 'Get Form' button to access the form and open it in the editor.

- Provide your property address. Include the Federal Employer Identification Number (FEIN) if it differs from the property address.

- Select your business type by checking the appropriate box for sole proprietorship, partnership, LLC, LLP, or corporation.

- If there has been a change in ownership, complete the new owner information section, selecting the type of change—such as sold or discontinued—and provide the new owner's details.

- Fill out the preparer and owner information, ensuring that names and signatures are printed and dated accurately.

- Complete the Schedule A by summarizing all taxable personal property items. Detailed reporting will be required in Schedules B through H for boats, machinery, office equipment, and other categories.

- For each schedule, provide the necessary details such as acquisition year, original cost, and any adjustments like additions or disposals as required.

- Review each section for completeness, ensuring all fields are filled out correctly.

- After completing the form, you can save changes, download a copy, print it, or share it as needed.

Start filling out your WI DoR PA-003 online today to ensure accurate and timely reporting.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Wisconsin has not completely eliminated the personal property tax, but it has made changes to reduce its impact. Many businesses benefit from exemptions that lessen their personal property tax burden. For updated information and resources, consider consulting the WI DoR PA-003 to understand how it affects you.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.