Loading

Get Wi Dor Schedule Cc 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WI DoR Schedule CC online

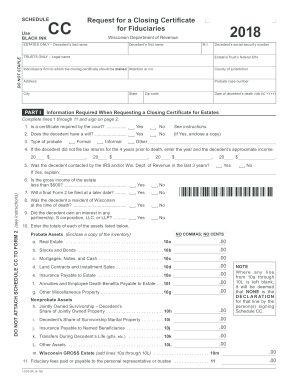

Filing the Wisconsin Department of Revenue Schedule CC form online can streamline the process of requesting a closing certificate for estates and trusts. This guide will provide clear, step-by-step instructions to help you successfully navigate each section of the form.

Follow the steps to fill out the Schedule CC form online.

- Click ‘Get Form’ button to access the Schedule CC form and open it in your chosen editor.

- Begin by entering the decedent's last name, first name, middle initial, and social security number at the top of the form.

- For estates, indicate whether a certificate is required by the court. Choose 'Yes' or 'No' based on your situation.

- Next, indicate if the decedent had a will. If the answer is 'Yes,' ensure to attach a copy of the will.

- Select the type of probate: formal, informal, or other, as applicable.

- If the decedent did not file tax returns for the four years prior to death, provide the year and approximate income for each year.

- Indicate if the decedent was contacted by the IRS or Wisconsin Department of Revenue in the last three years, and provide an explanation if 'Yes.'

- Select 'Yes' or 'No' to indicate if the gross income of the estate is less than $600.

- Indicate if a final Form 2 will be filed at a later date by choosing 'Yes' or 'No.'

- Mark whether the decedent was a resident of Wisconsin at the time of death.

- Indicate if the decedent owned an interest in any partnership, S corporation, LLC, or LLP.

- Fill out the totals of each type of probate and nonprobate assets as specified in the form, ensuring to follow the 'NO COMMAS; NO CENTS' rule.

- Complete the fiduciary fees paid or payable section.

- In Part II, if applicable to trusts, provide the required information, including whether a certificate is needed by the court and details about the trust.

- Sign the form to certify the accuracy of the information provided in accordance with legal requirements.

- Finally, save your changes, download the completed form, and prepare for mailing it to the Wisconsin Department of Revenue or to share it as necessary.

Start completing the WI DoR Schedule CC online today to ensure accurate and timely submission.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

In Wisconsin, you can file your taxes late, but you should aim to do so within three years of the original due date. Filing late may result in penalties, but addressing your return promptly remains important. If you are unable to file in time, consider seeking assistance from Uslegalforms, which offers tools to help you navigate late filings.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.