Loading

Get Wi Dor Schedule Cc 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WI DoR Schedule CC online

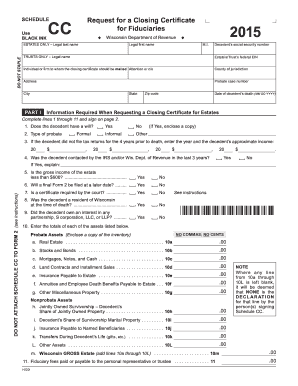

The WI DoR Schedule CC is a crucial form used for requesting a closing certificate for estates and trusts in Wisconsin. This guide provides clear, step-by-step instructions to help users fill out the form accurately and efficiently.

Follow the steps to complete the WI DoR Schedule CC online.

- Click ‘Get Form’ button to obtain the form and open it in an online editor.

- Begin by filling in the decedent's legal last name, first name, middle initial, and social security number for estates or the trust name and federal EIN for trusts. Ensure all information is accurate.

- Specify the county of jurisdiction and provide the mailing address for the individual or firm that will receive the closing certificate. Include attention or c/o if necessary.

- In Part I for estates, answer whether the decedent had a will and specify the type of probate (informal, formal, or other). Attach any necessary documents if applicable.

- For tax-related questions, report if the decedent did not file tax returns for the last four years, along with their approximate income.

- Indicate whether the decedent was contacted by the IRS or the Wisconsin Department of Revenue in the last three years and provide an explanation if necessary.

- Confirm whether the estate's gross income is less than $600 and whether a final Form 2 will be filed later.

- Complete the information regarding the decedent's residency and any interests in partnerships or corporations.

- Enter the values of the various assets listed, ensuring not to leave any lines blank. Include all probate and nonprobate assets as outlined.

- In Part II for trusts, submit a copy of the trust instrument along with the names and social security numbers of grantors and grantees.

- Confirm details on the trust funding date, any communication with tax authorities, and whether a court petition has been filed regarding the trust.

- Provide the total fair market value of the trust's assets and ensure you sign the form, including the date and daytime phone number.

- After completing the form, review all information for accuracy. Then, save your changes, download, print, or share the completed form as needed.

Start filling out your WI DoR Schedule CC online to ensure a smooth filing process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Wisconsin does not impose an inheritance tax, making it favorable for inheritors. While estate taxes may apply at the federal level, residents benefit from the absence of state inheritance taxes. For more information regarding estate responsibilities, the WI DoR Schedule CC can provide helpful insights.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.