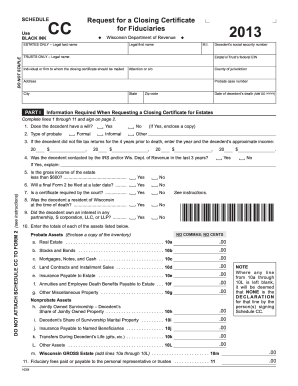

Get Wi Dor Schedule Cc 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign WI DoR Schedule CC online

How to fill out and sign WI DoR Schedule CC online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Filling out tax blanks can become a significant issue and a major headache if no suitable help is provided.

US Legal Forms has been created as an online solution for WI DoR Schedule CC e-filing and provides numerous benefits for taxpayers.

Press the Done button on the top menu once you have finished it. Save, download, or export the completed form. Use US Legal Forms to ensure secure and easy WI DoR Schedule CC completion.

- Acquire the blank from the website in the relevant section or through the Search engine.

- Click the orange button to access it and wait until it loads.

- Review the template and take note of the instructions. If you have not filled out the sample before, adhere to the line-by-line guidance.

- Pay attention to the yellow fields. They are fillable and require specific information to be entered. If you are uncertain about what information to provide, consult the guidelines.

- Always sign the WI DoR Schedule CC. Utilize the integrated tool to create the e-signature.

- Select the date field to automatically input the current date.

- Re-examine the sample to verify and modify it before e-filing.

How to modify Get WI DoR Schedule CC 2013: personalize forms online

Utilize our sophisticated editor to convert a basic online template into a finalized document. Keep reading to understand how to adjust Get WI DoR Schedule CC 2013 online effortlessly.

Once you find an ideal Get WI DoR Schedule CC 2013, all you need to do is revise the template to suit your tastes or legal standards. Besides filling out the form with precise information, you may wish to eliminate certain sections in the document that are not applicable to your situation. Alternatively, you may desire to add some missing elements in the original template. Our advanced document editing tools are the optimal way to amend and modify the document.

The editor enables you to alter the content of any form, even if the document is in PDF format. You can insert and remove text, add fillable fields, and implement additional changes while preserving the original formatting of the document. You may also rearrange the structure of the document by modifying page sequences.

You don’t need to print the Get WI DoR Schedule CC 2013 to sign it. The editor is equipped with electronic signature features. Most forms already include signature fields. Therefore, you only need to add your signature and request one from the other signing party with a few clicks.

Adhere to this step-by-step guide to formulate your Get WI DoR Schedule CC 2013:

Once all parties have signed the document, you will receive a signed copy which you can download, print, and share with others.

Our services allow you to save a significant amount of your time and reduce the likelihood of errors in your documents. Optimize your document workflows with efficient editing tools and a robust eSignature solution.

- Open the desired template.

- Utilize the toolbar to customize the form to your liking.

- Complete the form with accurate details.

- Select the signature field and insert your eSignature.

- Send the document for signing to other signers if necessary.

Wisconsin does not impose a gift tax, allowing individuals to give financial gifts without state tax penalties. However, federal gift tax rules may still apply, so it's essential to stay informed about these regulations. If you plan to give significant gifts, consider reviewing relevant documents and filing forms like the WI DoR Schedule CC. This precaution helps in maintaining compliance and avoiding future tax issues.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.