Get Wi Dor Schedule Wd 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign WI DoR Schedule WD online

How to fill out and sign WI DoR Schedule WD online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Completing tax paperwork can turn into a significant challenge and substantial nuisance if suitable assistance is not provided. US Legal Forms has been developed as an online solution for WI DoR Schedule WD electronic filing and offers various benefits for the taxpayers.

Utilize the guidelines on how to complete the WI DoR Schedule WD:

Utilize US Legal Forms to ensure a convenient and straightforward WI DoR Schedule WD completion.

- Locate the template on the website within the specific section or through the Search engine.

- Click the orange button to access it and wait until it is finished.

- Review the template and follow the instructions. If you have not completed the sample before, adhere to the line-by-line guidelines.

- Focus on the yellow fields. These are editable and require specific information to be entered. If you are uncertain what information to provide, consult the instructions.

- Always sign the WI DoR Schedule WD. Use the built-in tool to create your e-signature.

- Select the date field to automatically insert the correct date.

- Re-read the sample to verify and adjust it before submission.

- Press the Done button in the upper menu once you have finished it.

- Save, download, or export the finalized form.

How to modify Get WI DoR Schedule WD 2013: personalize forms online

Sign and distribute Get WI DoR Schedule WD 2013 along with any additional business and personal documents online without expending time and resources on printing and mailing. Maximize our online form creator using a built-in compliant electronic signature feature.

Approving and submitting Get WI DoR Schedule WD 2013 documents electronically is faster and more efficient than managing them physically. However, it necessitates utilizing online solutions that guarantee a high level of data security and offer you a compliant tool for generating eSignatures. Our robust online editor is precisely what you need to prepare your Get WI DoR Schedule WD 2013 and other personal and business or tax templates accurately and properly according to all regulations. It includes all the key tools to swiftly and easily fill out, modify, and sign documents online and incorporate Signature fields for other signers, indicating who and where is to sign.

It takes just a few straightforward actions to finalize and sign Get WI DoR Schedule WD 2013 online:

Share your document with others using one of the available methods. When signing Get WI DoR Schedule WD 2013 with our powerful online editor, you can always be confident that it is legally binding and admissible in court. Prepare and submit documents in the most advantageous manner possible!

- Access the chosen file for further management.

- Use the top toolbar to add Text, Initials, Image, Check, and Cross markers to your template.

- Highlight the most important information and black out or erase the confidential parts if necessary.

- Click the Sign feature above and select your preferred method to eSign your document.

- Draw your signature, type it out, upload its image, or choose another method that works for you.

- Switch to the Edit Fillable Fields panel and drop Signature zones for others.

- Click Add Signer and input your recipient’s email to assign this field to them.

- Verify that all information submitted is complete and accurate before clicking Done.

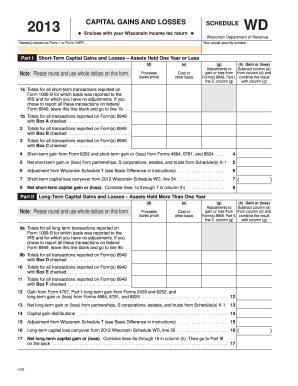

Schedule 4W in Wisconsin is used to report capital gains and losses on the sale of property. This schedule complements the WI DoR Schedule WD by detailing your transactions and ensuring compliance with state regulations. Complete this form carefully to help maximize your tax benefits and avoid unnecessary tax liability.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.