Loading

Get Wi P-626 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WI P-626 online

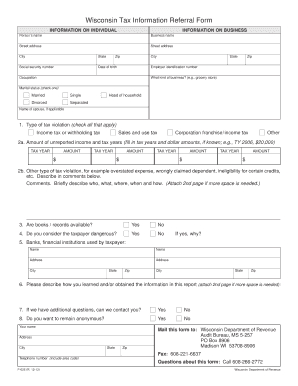

Filling out the Wisconsin Tax Information Referral Form (WI P-626) is a straightforward process when approached step by step. This guide will walk you through each section of the form to ensure you provide all necessary information accurately.

Follow the steps to complete the WI P-626 online.

- Click the ‘Get Form’ button to access the WI P-626 and open it in the editor.

- Begin with the information section: Fill out the person's name, social security number, date of birth, and occupation. Ensure that you provide accurate information to avoid any issues.

- Include the individual's street address, city, state, and zip code. Then, move on to the business section and provide the business name and its corresponding address details.

- In the marital status section, select one of the options: married, single, divorced, separated, or head of household. If applicable, provide the name of the spouse.

- Identify the type of tax violation by checking all that apply. Options include income tax or withholding tax, sales and use tax, corporation franchise/income tax, or other.

- Provide details for unreported income in the specified fields, noting the tax years and corresponding amounts. If required, fill in additional amounts in the space provided.

- If applicable, describe any other tax violations in the comments section. You may attach a second page if more space is needed.

- Indicate whether books and records are available by checking 'Yes' or 'No.'

- Decide if you consider the taxpayer dangerous. If you select 'Yes,' provide a brief explanation.

- List any banks or financial institutions used by the taxpayer, including names and addresses.

- Describe how you came to possess the information reported in this form; attach more pages if necessary.

- Choose whether you can be contacted for additional questions with a 'Yes' or 'No.'

- Specify if you wish to remain anonymous. If not, provide your name and contact details.

- Once you have completed the form, review all entries for accuracy. Then save your changes, download, print, or share the form as necessary.

Complete your Wisconsin Tax Information Referral Form online for a seamless submission process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Yes, many post offices carry tax forms, including the WI P-626 for Wisconsin residents. While not every location may have all forms, they often stock popular items during tax season. It can be a good idea to call ahead to check for availability if you prefer to pick up your forms in person.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.