Get Wi Pr-230 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WI PR-230 online

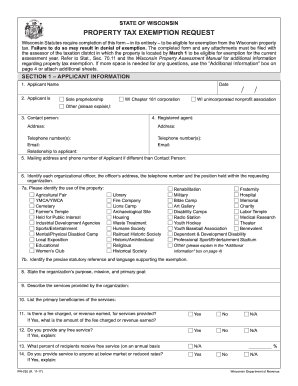

The WI PR-230 form is essential for individuals seeking property tax exemption in Wisconsin. Completing this form accurately and thoroughly is crucial for a successful request. This guide will walk you through each section of the form, emphasizing clear and user-friendly instructions.

Follow the steps to complete the WI PR-230 form online.

- Click ‘Get Form’ button to access the form and open it for completion.

- Fill out Section 1 – Applicant Information. Provide the applicant's name, date, entity type (e.g., sole proprietorship, corporation), and contact person details. Ensure all available contact information is up-to-date.

- In Section 1, continue with identifying relevant officers and their roles within the organization. Clearly specify the purpose and nature of the property use in Section 1, question 7a.

- Detail the organization's purpose and describe the services provided in questions 8 and 9. Be specific about the primary beneficiaries of these services.

- Proceed to Section 2 – Subject Property Information. Enter the property address, tax parcel number, and any other relevant details regarding the subject property.

- Provide estimated market value in Section 2, along with any appraisal information if applicable. Clearly specify the owner of the subject property.

- In Section 3, complete the Tenant Information, identifying any individuals or entities that utilize the subject property besides the owner, and include detailed explanations of their usage.

- Attach necessary documents as outlined in Section 4. These may include proof of nonprofit status, leases, and any other pertinent documents that support your application.

- Complete Section 5 – Affidavit. Ensure that the authorized person signs and dates the form, confirming the accuracy of all provided information.

- After finishing the form, review all details for accuracy. Save your changes, and consider downloading, printing, or sharing the form as needed.

Complete your WI PR-230 form online today to ensure your property tax exemption request is submitted accurately.

Get form

Related links form

Lowering property taxes in Wisconsin can be achieved through various means, including applying for exemptions or credits that you may qualify for. Another strategy could be to appeal your property assessment if you believe it is too high. Familiarizing yourself with the options available through WI PR-230 can empower you to make informed decisions. Additionally, US Legal Forms can offer resources and forms to facilitate this process.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.