Get Wi Pr-230 2001

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WI PR-230 online

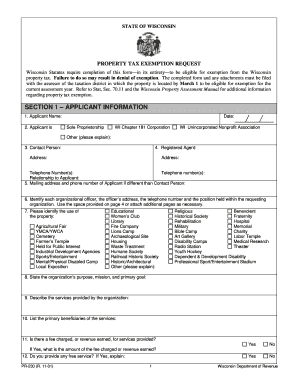

The Wisconsin Property Tax Exemption Request (WI PR-230) is a crucial form for organizations seeking exemption from property tax obligations. Filling it out accurately and completely is essential to ensure eligibility for tax exemption.

Follow the steps to complete the WI PR-230 online.

- Click ‘Get Form’ button to access the form and open it in your preferred online editor.

- In Section 1, provide applicant information. Fill out the applicant name, select the type of applicant (such as sole proprietorship or nonprofit association), contact person, and mailing address. Ensure to include the telephone number and relationship to the applicant.

- Continue in Section 1 by identifying all organizational officers, their addresses, telephone numbers, and positions held. If necessary, use additional pages for this information.

- Indicate the use of the property from the list provided, specifying if it serves educational, religious, charitable, or other qualifying purposes.

- Explain the organization’s purpose and mission in detail, along with the services it offers and the primary beneficiaries of those services.

- Answer questions regarding fees, revenue, and any free services provided, including the percentage of recipients receiving free or reduced-rate services.

- In Section 2, provide the subject property information, including the property address, tax parcel number, acreage, and estimated fair market value. If an appraisal has been conducted, include details of the appraiser and appraisal purpose.

- State the relationship between the owner and the applicant and explain how the applicant uses the subject property. Supporting details on property use and eligibility for tax exemption should be included.

- In Section 3, identify all entities or individuals who occupy or use the subject property, detailing their respective agreements and how they utilize the property.

- Compile all necessary attachments, including proof of the organization’s nonprofit status and other relevant documents as outlined in Section 4.

- Finally, you will need to complete the affidavit at the end of the form, certifying the accuracy of the information provided. Ensure the form is signed and dated by an authorized individual.

- Once completed, save any changes made to the document, then download, print, or share the WI PR-230 form as required.

Complete and submit your documents online to ensure timely filing for property tax exemption.

Get form

Related links form

A homestead application can be denied for various reasons, including incomplete information, failure to meet residency or income criteria, or missing deadlines. It's vital to double-check all required documents and ensure that your application aligns with the standards outlined, such as those mentioned in the WI PR-230 guidelines. If your application is denied, you can usually appeal the decision or reapply with the necessary corrections.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.