Loading

Get Wi Wt-4 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WI WT-4 online

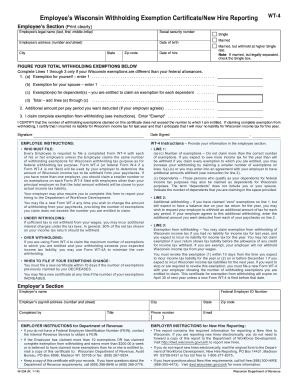

The WI WT-4 form is a crucial document used by employees in Wisconsin to provide tax withholding information to their employers. This guide offers clear, step-by-step instructions for filling out the form online, ensuring you complete it accurately to help manage your tax withholdings effectively.

Follow the steps to complete the WI WT-4 form online.

- Press the 'Get Form' button to access the WI WT-4 form and open it in your online editor.

- In the Employee’s section, clearly print your legal name, social security number, and mailing address. Include your date of birth, city, state, and zip code.

- Indicate your marital status by checking the appropriate box: Single, Married, or Married but withhold at a higher Single rate. If married and legally separated, check the Single box.

- Enter your date of hire in the designated field.

- Complete Lines 1 through 3 to figure your total withholding exemptions. For each exemption request, indicate if it's for yourself, your spouse, and dependents.

- If applicable, fill in any additional amount you wish to be deducted from your pay period under Line 2.

- If you meet the requirements for exemption from withholding, enter 'Exempt' in Line 3.

- Sign and date the form to certify that the information is accurate and that you are entitled to the exemptions claimed.

- Once completed, save your changes. You can then download, print, or share the form as needed with your employer.

Complete your WI WT-4 form online to manage your tax withholdings effectively.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The W-4T form is typically referred to as a tax form for claiming certain earnings and tax withholdings. It is important to ensure you are using the correct version, such as the WI WT-4, specifically for Wisconsin withholding. Utilizing the right forms can help you avoid complications with your taxes.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.