Get Wv Cnf-120 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WV CNF-120 online

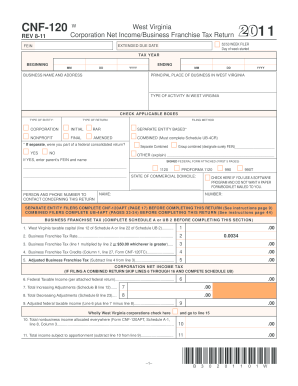

Filling out the West Virginia Corporation Net Income/Business Franchise Tax Return (Form CNF-120) online requires careful attention to detail. This guide is designed to assist users in completing each section of the form accurately and efficiently.

Follow the steps to successfully complete the WV CNF-120 online.

- Use the ‘Get Form’ button to download the WV CNF-120 and open it in your online document editor.

- Enter the business name and address in the designated fields. Ensure that this information matches your official records to avoid discrepancies.

- Fill in your Federal Employer Identification Number (FEIN) accurately, as it is essential for identifying your business.

- Indicate the type of entity by checking the appropriate box (Corporation, Nonprofit, etc.) and specify if this is an initial, final, amended, or combined return.

- Complete the tax year fields by entering the beginning and ending dates accurately in the MM/DD/YYYY format.

- For corporations filing a combined return, complete the schedule required for that method. Ensure that all required schedules (like Schedule UB-4CR) are attached.

- Calculate your West Virginia taxable capital and Business Franchise Tax using the provided lines on the form. This involves completing relevant calculations based on the attached schedules.

- Complete the Corporate Net Income Tax section if applicable. If you are unsure about any adjustments or calculations, refer to the accompanying instructions.

- Review all entries for accuracy before signing. Include the signature of an authorized officer and the necessary contact information.

- Once all sections are filled accurately, save changes to the form. You can then opt to download, print, or share the completed document as needed.

Complete your tax documents online today for efficient filing and management.

Get form

Related links form

Filling out a withholding exemption form requires you to provide specific personal information and your desired exemptions. Utilize the guidance available through the WV CNF-120 to understand how to calculate your allowances accurately. It's essential to complete this form correctly to ensure that your withholding aligns with your tax responsibilities. If you find any part of the process challenging, consider using resources from uslegalforms for support.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.