Loading

Get Wv Cst-240 Instructions 2016-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WV CST-240 Instructions online

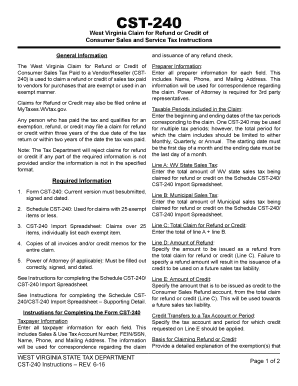

The WV CST-240 form is essential for individuals seeking a refund or credit for sales tax paid on exempt purchases. This guide provides clear and supportive instructions to navigate the online filling process, ensuring that you provide all required information correctly.

Follow the steps to successfully complete the WV CST-240 online.

- Click the ‘Get Form’ button to access the WV CST-240 form and open it in your preferred digital format.

- Fill out all taxpayer information, including your sales and use tax account number, federal employer identification number or social security number, name, phone number, and mailing address. This information will be used for correspondence related to your claim.

- Provide the preparer information, if applicable, including name, phone number, and mailing address. Ensure this section is complete for communication regarding the claim.

- Enter the beginning and ending dates for the tax periods related to your claim. Keep in mind that the starting date must be the first day of a month, and the ending date must be the last day of a month.

- Populate Line A with the total amount of West Virginia state sales tax you are claiming for refund or credit.

- Complete Line B with the total municipal sales tax claimed for a refund or credit.

- For claims with over 25 exempt items, utilize the CST-240 Import Spreadsheet to list each exempt item individually.

- Calculate and enter the total of Line A and Line B in Line C, which represents the total claim for refund or credit.

- Specify the refund amount you wish to receive on Line D and complete Line E if you are opting for a credit instead of a refund.

- Provide a detailed explanation of the exemptions related to your claim, citing any relevant state codes or regulations.

- Indicate any supporting documents attached to your claim by marking the appropriate boxes.

- Ensure that you sign and date the claim before submission.

- After completing the form, save changes, download it, print a copy for your records, or share it electronically as required.

Complete your WV CST-240 form online today to ensure timely processing of your claim.

Related links form

State refunds in West Virginia can take varying amounts of time, generally ranging from 10 days to several weeks. Your filing method can impact this timeline, with online filings being processed faster. For a thorough understanding of the timelines, the WV CST-240 Instructions provide valuable insights.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.