Get Wv Dor It-140w 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WV DoR IT-140W online

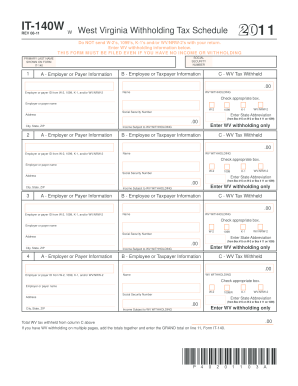

The WV DoR IT-140W is a crucial form for reporting withholding tax in West Virginia. This guide will provide you with a step-by-step approach to ensure that you complete the form accurately and efficiently.

Follow the steps to successfully fill out the form

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- Begin by entering your personal information in the 'Employee or Taxpayer Information' section. Provide your name, Social Security number, and address details.

- In the 'Employer or Payer Information' section, fill in the name and ID of your employer or payer as shown on your W-2, 1099, K-1, or WV/NRW-2 form. Select the appropriate box to indicate the type of document you are using.

- In the 'WV Tax Withheld' section, record the amount of West Virginia tax that was withheld from your earnings. Make sure to enter this amount accurately as it reflects your tax liabilities.

- If you have multiple forms of income subject to West Virginia withholding, repeat steps 2-4 for each employer or payer, making sure to list each entry in the designated fields.

- Once all information is entered, sum the withholding amounts from each section. Enter the grand total on line 11 of Form IT-140.

- Finally, save your changes. You can download, print, or share the completed form as needed.

Complete your WV DoR IT-140W online to ensure accurate tax reporting and compliance.

Get form

Related links form

A driving record refers to the official document that details all recorded violations, points, and accidents associated with your license. In contrast, driving history is a broader term that includes all your driving experiences, such as licenses held, states driven in, and overall behavior as a driver. Understanding the difference is important when you apply for insurance or jobs that require driving. Keeping your driving record clean can positively impact your driving history.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.