Loading

Get Wv Wv/nrer 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WV WV/NRER online

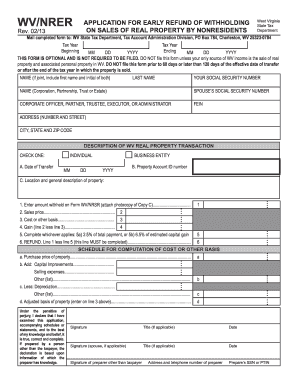

This guide provides a clear and supportive approach for completing the WV WV/NRER form, which is necessary for applying for an early refund of withholding on sales of real property by nonresidents. By following these instructions, users can navigate the form with confidence.

Follow the steps to successfully complete the form.

- Use the ‘Get Form’ button to access the WV WV/NRER form and open it in your chosen editor.

- Enter the tax year for both the beginning and ending dates in the designated fields formatted as MM/DD/YYYY.

- Provide your name, including both first and last names. If applicable, include the name of your partner as well.

- Enter your Social Security number and, if filing jointly, your partner's Social Security number.

- For businesses, enter the name of the corporation, partnership, trust, or estate and include the federal employer identification number (FEIN).

- Fill in your address, including number, street, city, state, and ZIP code.

- Describe the WV real property transaction by checking the correct box for type of taxpayer, entering the date of transfer, the property account ID number, and a general property description.

- Record the amount withheld from Form WV/NRSR, ensuring to attach a photocopy of Copy C.

- Input the sales price and cost or basis related to the property sale. Complete whichever applies for the refund calculation.

- Complete the refund line by subtracting the appropriate amount from the tax withheld.

- Sign the form, ensuring both partners sign if applicable. Include the date and title if necessary.

- After completing the form, ensure to save any changes, download a copy, print it out, or share it as needed.

Start filling out the WV WV/NRER form online today for a smoother application process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The amount of WV state tax that should be withheld depends on various factors, including your income level and filing status. Consulting withholding tables or using tax software could help you determine the appropriate amount. Keeping accurate records and accessing tools through platforms like uslegalforms can simplify this process.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.