Loading

Get Wv Wv/raf-1

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WV WV/RAF-1 online

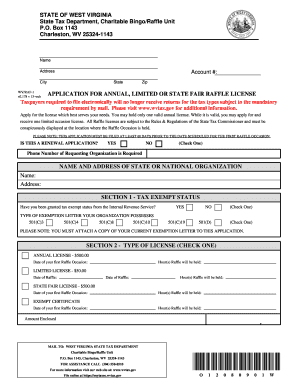

The WV WV/RAF-1 form is essential for applying for an annual, limited, or state fair raffle license in West Virginia. Completing this form accurately is critical to ensure compliance with state regulations and to facilitate a smooth application process.

Follow the steps to complete the WV WV/RAF-1 form online.

- Click the ‘Get Form’ button to obtain the WV WV/RAF-1 form and open it in your preferred form editor.

- Fill in your organization’s name and address in the designated fields, ensuring to include city, state, and zip code. Provide your account number if applicable.

- Indicate whether this application is a renewal by selecting 'Yes' or 'No' as appropriate.

- Enter the phone number of the requesting organization in the specified field.

- In Section 1, answer whether your organization has been granted tax-exempt status by the IRS and select the appropriate exemption type from the listed options.

- Choose the type of license you are applying for in Section 2 by checking the corresponding box—annual, limited, or state fair license—and fill in the required dates and times for the raffle occasion.

- Complete Section 3 by providing the address where the raffle will occur, and indicate if you own or rent the premises. Attach a copy of the current rental or lease agreement if necessary.

- In Section 4, list the names, home addresses, and home telephone numbers of all officers and board members of your organization, ensuring that all officers are over 18.

- Section 5 requires you to list the names and contact information of persons who will be in charge of the raffle. Ensure to meet the requirements for the number of names based on the type of license.

- Provide information for the highest elected officer and appointed designee of your organization in Section 6, ensuring both are over 18 and available for raffle occasions.

- Answer the questions in Section 7 regarding past applications and any felony or misdemeanor convictions related to gambling within the past 10 years.

- Complete Section 8 by providing the name, address, and phone number of your raffle supplies distributor.

- In Section 9, identify the recipient of the proceeds from the raffle, confirming their IRS exemption status and detailing the intended use of proceeds.

- If your organization is not a renewal applicant, answer the questions in Section 10 regarding the duration of your organization’s existence in West Virginia and provide necessary proof.

- Section 11 requires you to answer whether concessions will be operated during the raffle and, if applicable, to describe the arrangements.

- Review the agreement in Section 12, providing your name, signature, telephone number, email address, and date. Ensure that all statements provided in the application are correct.

- After filling in all sections, review the form for accuracy. Save your changes, then download, print, or share the completed WV WV/RAF-1 form as needed.

Complete your WV WV/RAF-1 form online efficiently and ensure compliance with state regulations.

To obtain a WV business license, start by determining the type of business you are operating, as different licenses may apply. Next, register your business with the West Virginia Secretary of State and any applicable local governments. Consider using uslegalforms to effortlessly navigate through the registration process and ensure you are compliant with all necessary regulations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.