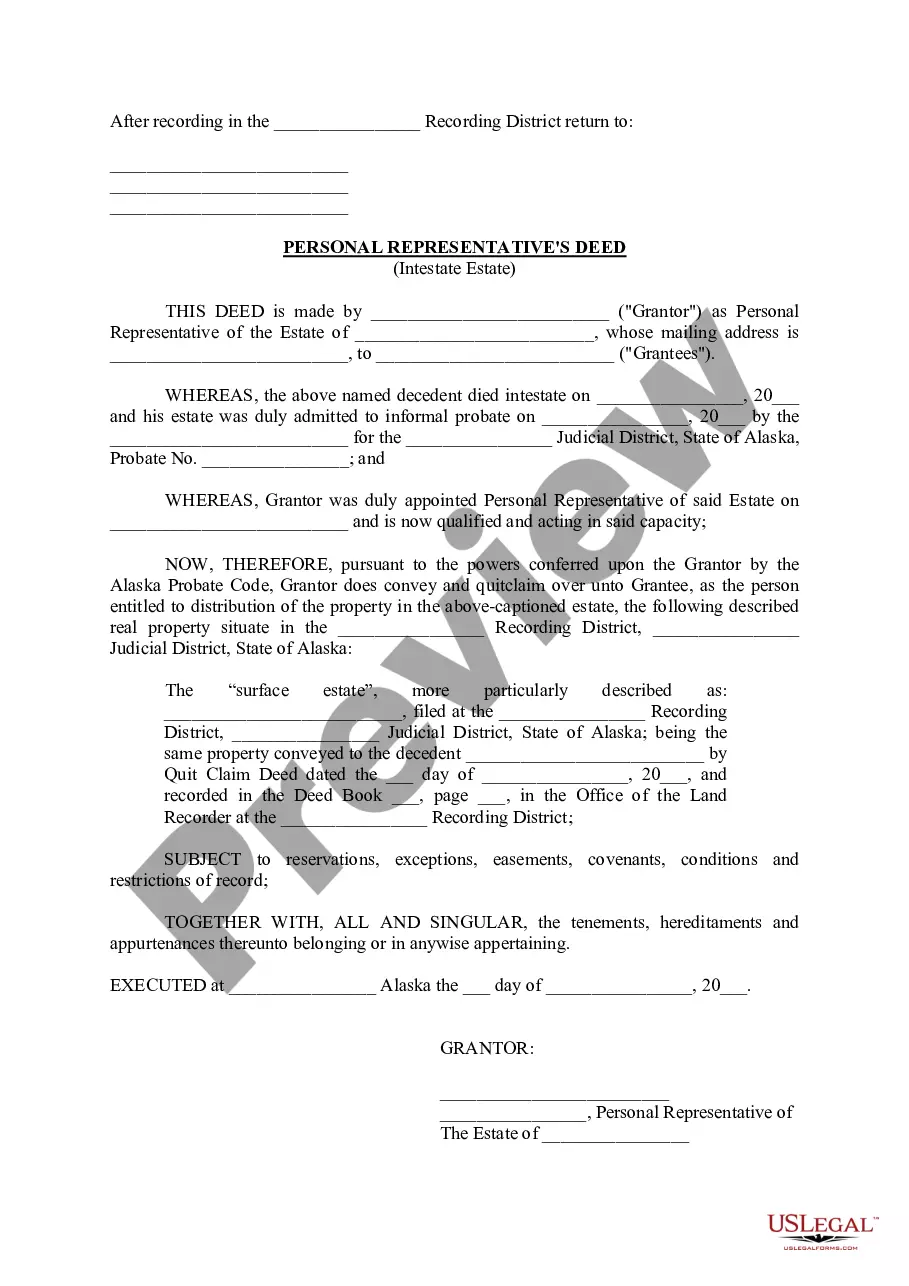

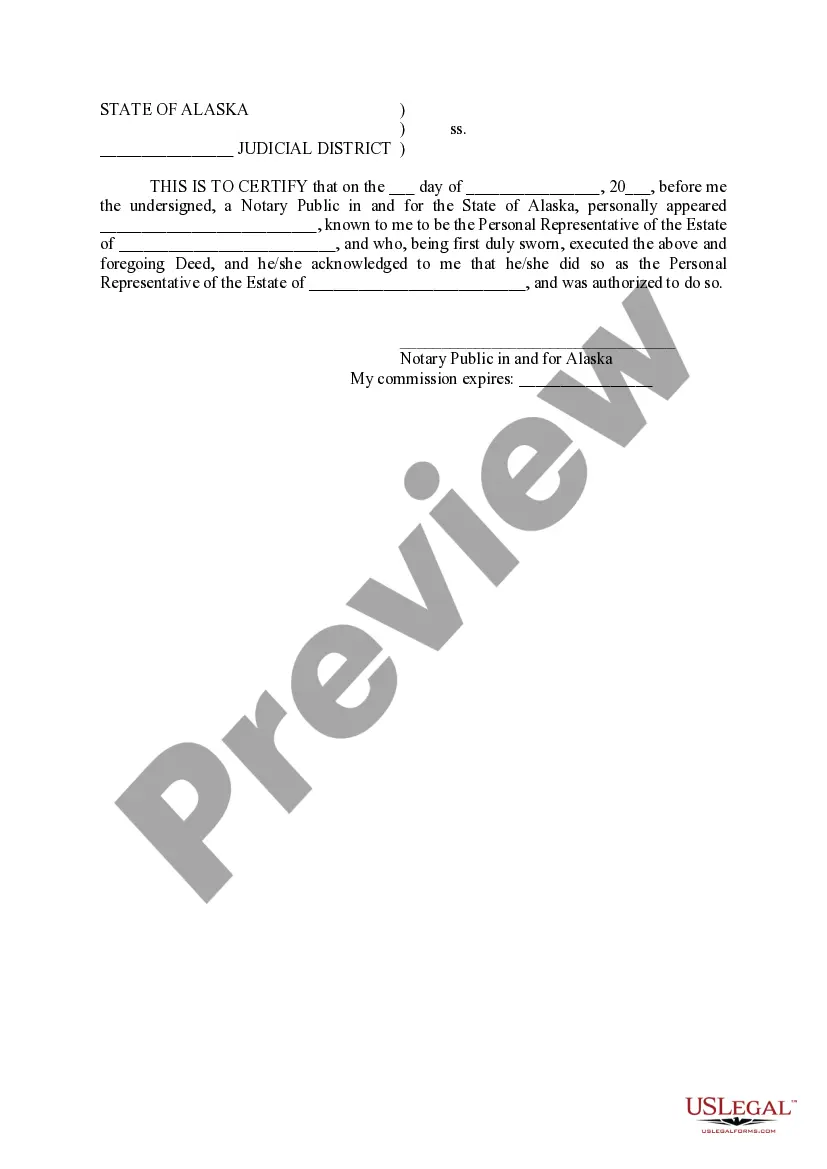

A Deed of Personal Representative form is a legal document that is created after the death of an individual to appoint a personal representative or executor who will handle the administration of the deceased person's estate. This form is typically used to transfer the assets, settle the debts, and distribute the estate according to the deceased person's will or state laws, if there is no will. The Deed of Personal Representative form is also referred to as the "Letters Testamentary" or "Letters of Administration" in some jurisdictions. It is a crucial document that grants legal authority to the appointed individual, allowing them to act on behalf of the deceased and carry out their final wishes. The main purpose of this form is to provide a clear and legally binding authorization to the personal representative or executor, ensuring that they have the necessary power and control to handle the affairs of the deceased person's estate. The form will typically include details such as the name of the deceased, the name and contact information of the appointed personal representative, and the date on which the document is executed. There are different types of Deed of Personal Representative forms after death, depending on the circumstances and legal requirements. These forms may include: 1. Testate Deed of Personal Representative: This form is used when the deceased person had a valid will at the time of their death. The personal representative appointed in the will is named in this form, and they are responsible for executing the provisions of the will, including distributing assets and settling debts. 2. Intestate Deed of Personal Representative: When an individual passes away without a valid will, their estate is considered intestate. In such cases, this form is used to appoint a personal representative who will distribute the assets and settle the debts according to the laws of intestacy in the jurisdiction. 3. Temporary Deed of Personal Representative: In situations where a personal representative needs to be appointed quickly, a temporary form may be used. This temporary appointment provides immediate authority for the personal representative to begin handling the estate until a permanent representative is appointed. 4. Ancillary Deed of Personal Representative: This type of form is used when an estate needs to be administered in a different jurisdiction. For instance, if the deceased person owned property in multiple states or countries, an ancillary form may be required to ensure the proper administration of the estate in each jurisdiction. In conclusion, a Deed of Personal Representative form after death is a crucial legal document used to appoint a personal representative or executor who will handle the administration of the deceased person's estate. It is important to consult with an attorney or legal professional to understand the specific requirements and laws related to this form in the relevant jurisdiction.

Deed Of Personal Representative Form After Death

Description

How to fill out Deed Of Personal Representative Form After Death?

It’s no secret that you can’t become a law professional overnight, nor can you learn how to quickly draft Deed Of Personal Representative Form After Death without the need of a specialized background. Putting together legal forms is a long venture requiring a specific training and skills. So why not leave the creation of the Deed Of Personal Representative Form After Death to the specialists?

With US Legal Forms, one of the most extensive legal document libraries, you can find anything from court paperwork to templates for in-office communication. We understand how crucial compliance and adherence to federal and state laws are. That’s why, on our website, all templates are location specific and up to date.

Here’s how you can get started with our platform and obtain the form you require in mere minutes:

- Find the form you need by using the search bar at the top of the page.

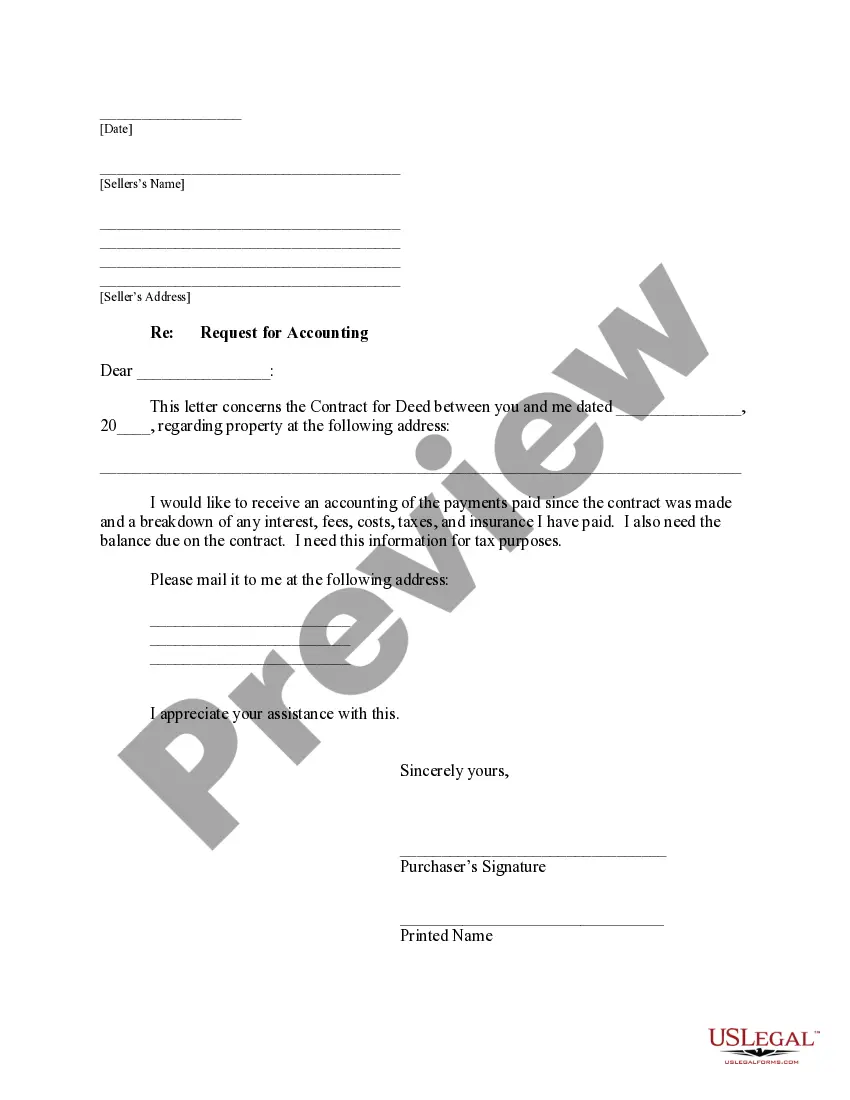

- Preview it (if this option provided) and read the supporting description to figure out whether Deed Of Personal Representative Form After Death is what you’re looking for.

- Start your search over if you need any other template.

- Set up a free account and select a subscription option to buy the template.

- Pick Buy now. Once the transaction is through, you can download the Deed Of Personal Representative Form After Death, fill it out, print it, and send or mail it to the necessary individuals or entities.

You can re-access your forms from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and find and download the template from the same tab.

Regardless of the purpose of your forms-be it financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

If the deceased property owner had a Will stating who the property should be transferred to, the Will should be filed for Probate within 4 years of the date of death. The property may subsequently be transferred or sold by the Executor named in the Will ing to the wishes of the deceased owner.

Yes, it's quite common for the personal representative to also be the beneficiary. Oftentimes, that personal representative/beneficiary is a surviving spouse or immediate family member.

Generally, the person who oversees your estate is known as your ?personal representative.? California law also refers to a personal representative as an ?executor? or ?administrator.? All three terms describe the same function, although there is a legal distinction between their method of appointment.

The surviving spouse who is a devisee of the decedent has the highest priority for consideration as the personal representative in informal probate proceedings.

This statute outlines the order of priority for appointment of a personal representative, with the decedent's surviving spouse having first priority unless they waive their right to serve or are found to be unsuitable by the court.