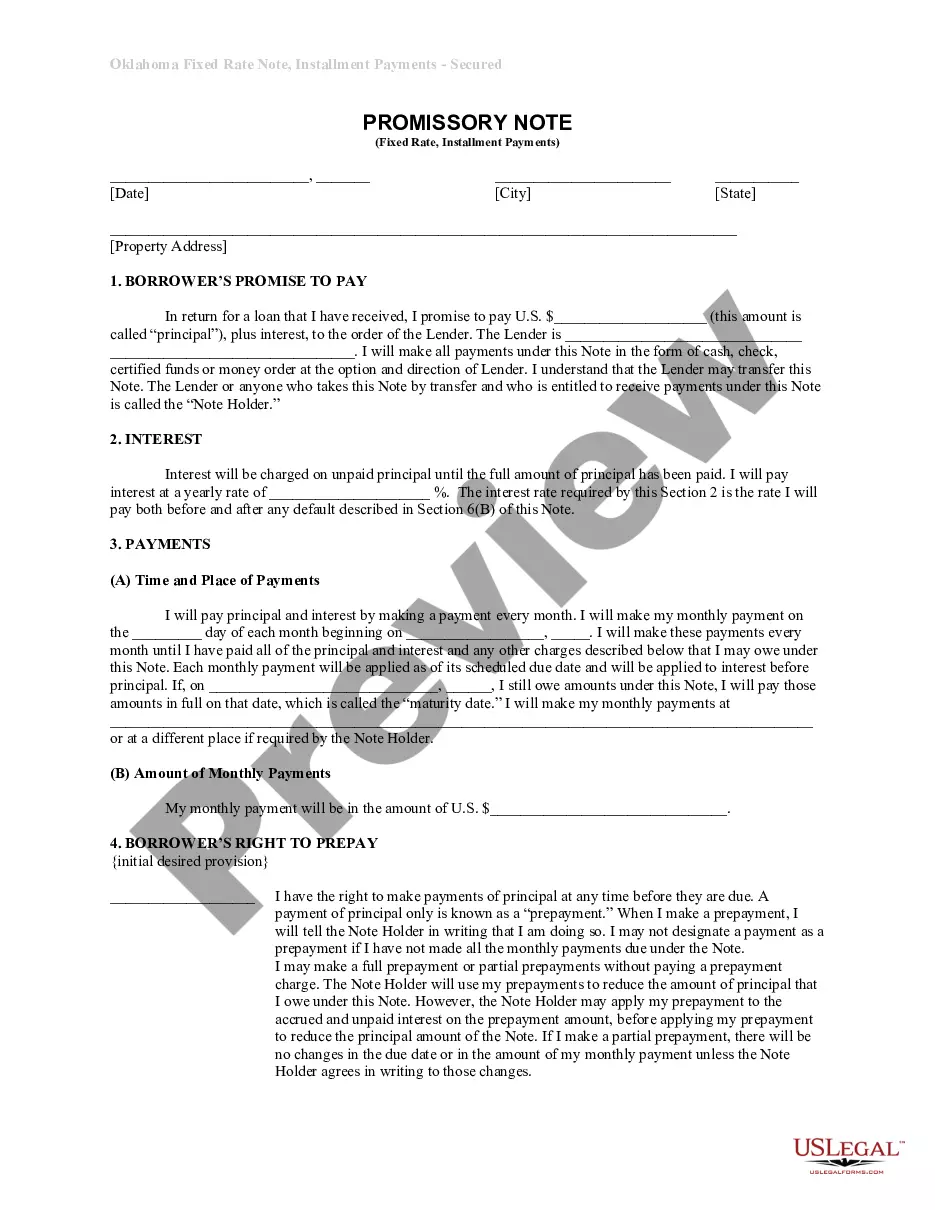

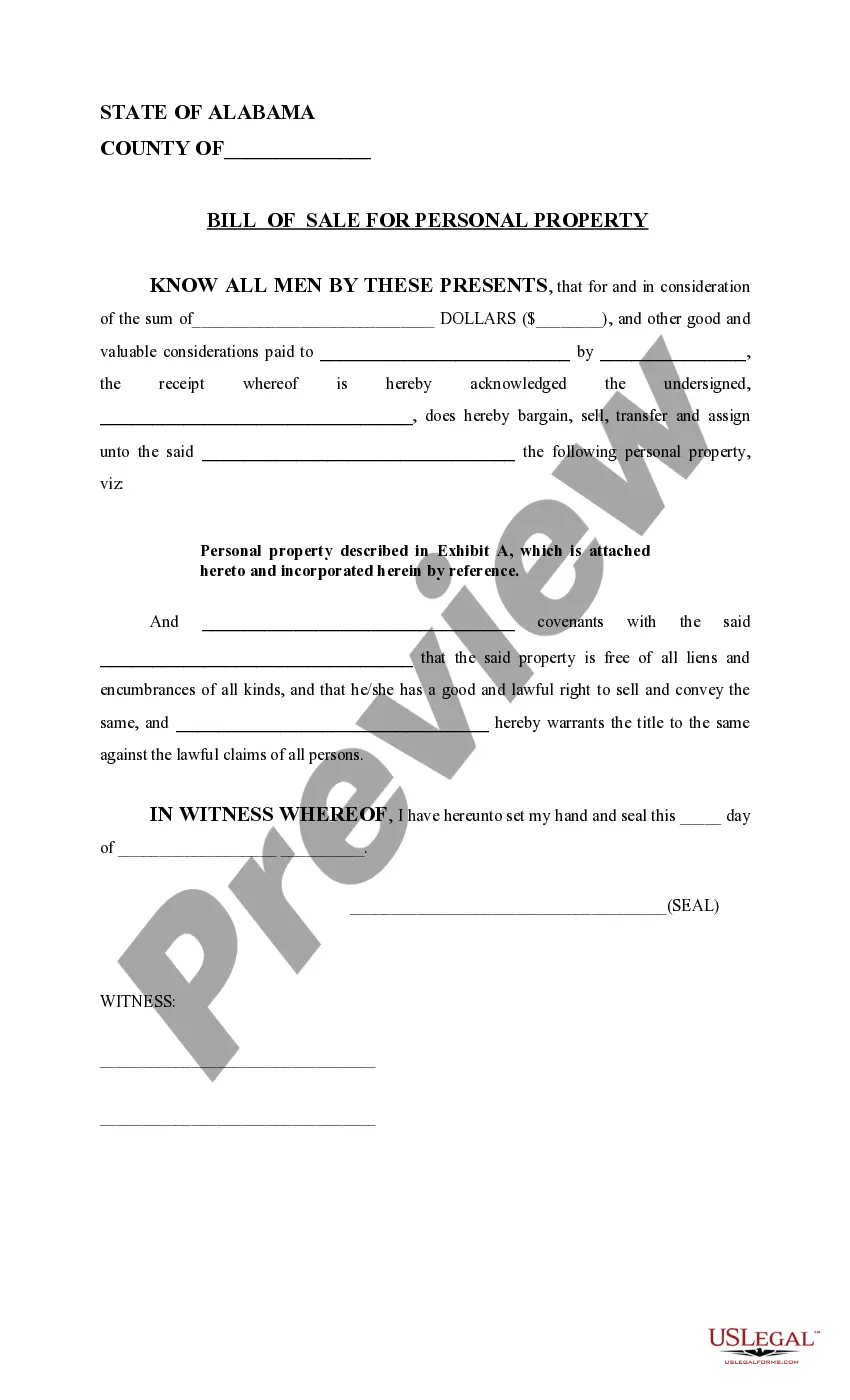

This form is a bill of sale document for personal property that transfers ownership of an asset from a seller to the buyer, a basic agreement for sale of goods, and a sales receipt.

Alabama Bill Of Sale For Mobile Home

Description

How to fill out Alabama Bill Of Sale For Mobile Home?

There's no longer any justification for spending hours searching for legal documents to satisfy your local state obligations.

US Legal Forms has compiled all of them in one location and enhanced their availability.

Our website offers over 85,000 templates for any business and personal legal situations categorized by state and area of use.

Preparing official documents in compliance with federal and state regulations is quick and easy with our platform. Try US Legal Forms today to keep your paperwork organized!

- All forms are expertly crafted and verified for accuracy, allowing you to be sure of obtaining a current Alabama Bill Of Sale For Mobile Home.

- If you're acquainted with our service and already possess an account, ensure your subscription is valid before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all obtained documents at any time by accessing the My documents tab in your profile.

- If you've never used our service before, you'll need to follow a few additional steps to complete the process.

- Here's how new users can obtain the Alabama Bill Of Sale For Mobile Home from our catalog.

- Carefully examine the page content to verify it includes the sample you require.

- To do this, take advantage of the form description and preview options, if available.

Form popularity

FAQ

Manufactured Homes must be registered in the License Department or the Tax Assessor's office. Decals will be issued in the appropriate office. The License Department decal is a rectangle with the outline of the state of Alabama; the Assessor/Collector decal will be square with Ad Valorem Taxes printed on the decal.

Every person, firm, or corporation who owns, maintains, or keeps in this state a manufactured home, which is located on land owned by someone other than the manufactured home owner, or manufactured homes located on land owned by the manufactured home owner, and such manufactured homes are rented or leased for business

Manufactured Homes must be registered in the License Department or the Tax Assessor's office. Decals will be issued in the appropriate office. The License Department decal is a rectangle with the outline of the state of Alabama; the Assessor/Collector decal will be square with Ad Valorem Taxes printed on the decal.

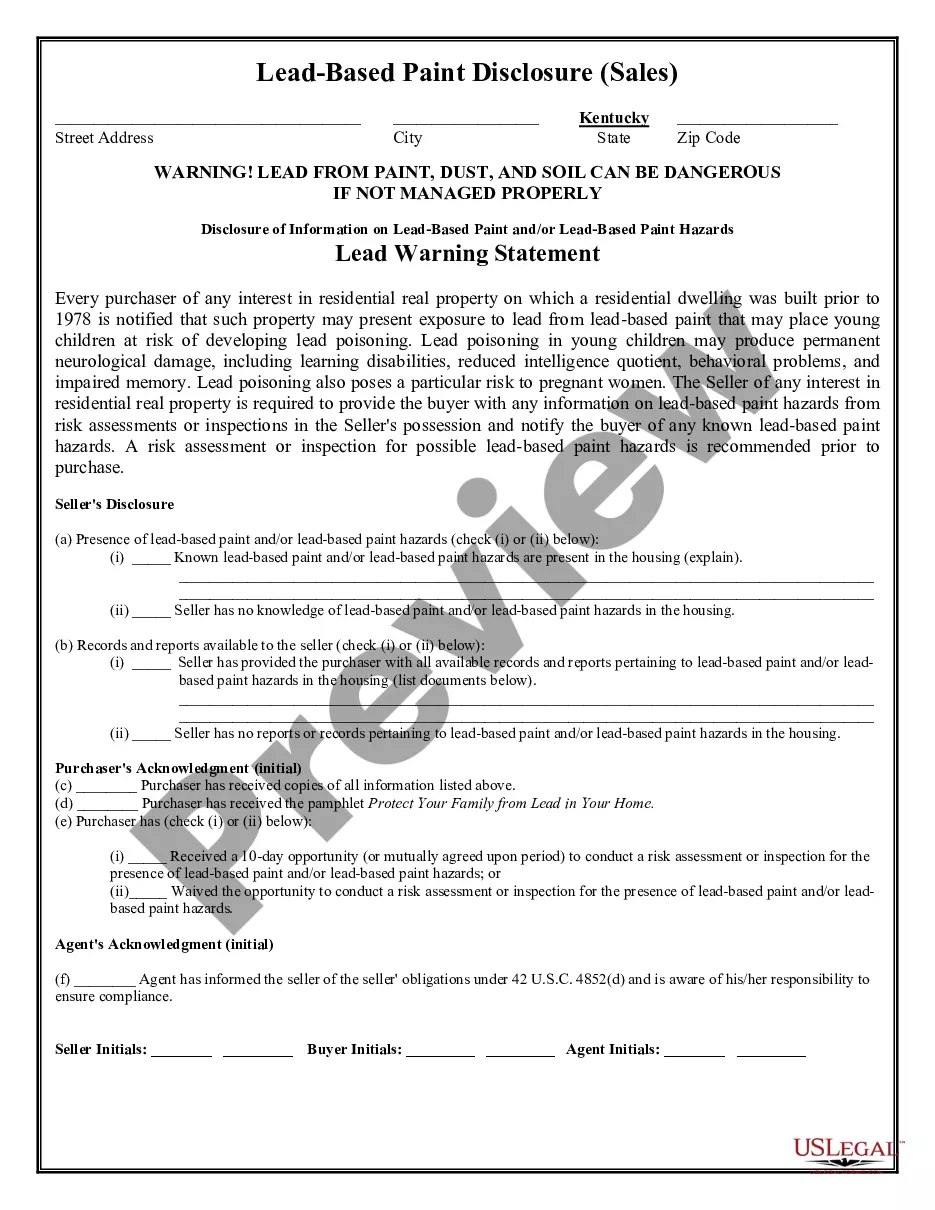

A Bill of Sale typically includes:The full names and contact information of the buyer and seller.A statement that transfers ownership of the item from the seller to the buyer.A complete description of the item being purchased.A clause indicating the item is sold "as-is"The item's price (including sales tax)More items...

The Alabama Manufactured Home Certificate of Title Act mandates the following: All manufactured homes that are equal to or less than 20 model years old are required to be titled in Alabama. A separate certificate of title is required for each side of a manufactured home (i.e. A & B)