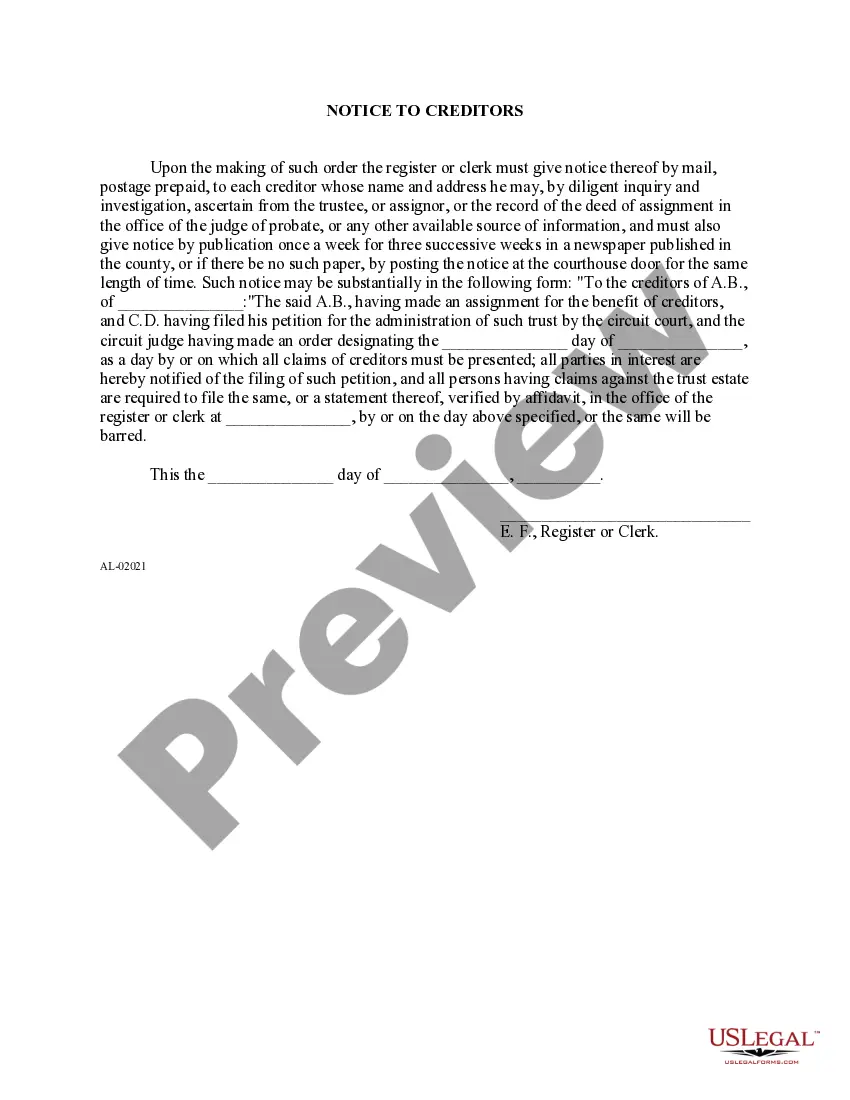

This is a publication notice to creditors in connection with the assignment for benefit creditor signed by the probate court judge or clerk.

Notice To Creditors Template

Description

How to fill out Notice To Creditors Template?

How to obtain expert legal documents that adhere to your state laws and prepare the Notice To Creditors Template without the aid of an attorney.

Numerous online services offer templates for various legal matters and requirements.

However, it may require time to determine which available examples meet both functional and legal standards for your needs.

Download the Notice To Creditors Template using the corresponding button adjacent to the file name. If you do not possess an account with US Legal Forms, follow the instructions below: Examine the webpage you've opened to see if the form meets your requirements. Use the form description and preview options if available. Look for another example in the header catering to your state if necessary. Hit the Buy Now button once you identify the suitable document. Select the most appropriate pricing plan, then sign in or create an account. Choose your preferred payment option (either credit card or via PayPal). Decide on the file format for your Notice To Creditors Template and click Download. The downloaded templates remain in your ownership: you can always revisit them in the My documents tab of your profile. Enroll in our platform and create legal documents independently like a seasoned legal professional!

- US Legal Forms is a trustworthy service that assists you in finding official documents crafted according to the latest state law revisions and saves you costs on legal help.

- US Legal Forms is not merely a standard online directory.

- It consists of over 85,000 validated templates for different business and personal scenarios.

- All documents are organized by category and state to streamline your searching process.

- Furthermore, it incorporates powerful tools for PDF editing and eSignature, enabling Premium users to promptly complete their paperwork online.

- It requires minimal time and effort to acquire the necessary documents.

- If you already have an account, Log In and verify that your subscription is current.

Form popularity

FAQ

A good hardship letter should explain your financial difficulties in a straightforward manner. Start with a brief introduction of your situation, then outline the specific hardships you’re facing. To strengthen your letter, use a Notice to Creditors template, which can help organize your thoughts and present a clear and persuasive argument for your request.

To create a good debt settlement letter, start with a respectful tone and clearly state your intention to settle your debt. Clearly outline your circumstances and propose a specific offer or payment plan that you can manage. Utilizing a Notice to Creditors template can streamline this process, as it guides you in presenting your offer convincingly to your creditors.

When writing a letter to your creditors, begin by stating your purpose clearly. Include your account number, personal details, and the specific issue you're addressing. Using a Notice to Creditors template can help organize your thoughts and present your case professionally, ensuring your creditors understand your situation and your request.

Writing a notice to your creditors starts with a clear statement about your financial situation. You should include the date, your full name, and contact information at the top. Additionally, specify your intention to communicate regarding your debts and attach any relevant documents, such as a Notice to Creditors template. This template ensures you cover all necessary details, making your communication effective.

In the UK, creditors can typically pursue a debt for up to 6 years after a person's death, depending on the type of debt. However, if a notice to creditors is published following the deceased’s passing, it may affect how claims are processed. To manage these claims effectively, it is wise to use a notice to creditors template, as it can capture all necessary information and meet legal standards. This assists executors in handling the debts responsibly and timely.

A notice to creditors in a deceased estate is a formal announcement that alerts creditors of the deceased person’s passing and invites them to submit claims against the estate. This notice is crucial for protecting the estate’s assets and ensuring a fair settlement of debts. Utilizing a notice to creditors template can simplify the drafting process while ensuring all legal requirements are met. This allows the executor to focus on other estate administration tasks.

To publish a notice to creditors in Texas, you must file with the court that is handling the deceased’s estate. Following this, you can use a notice to creditors template to draft a notice indicating that creditors have a specific period to file their claims. Typically, this notice must be published in a local newspaper once a week for several consecutive weeks. This process helps safeguard the estate by attracting any outstanding creditor claims.

The 3-year rule for a deceased estate refers to the timeframe during which creditors can make claims against the estate of a deceased person. In many states, this period begins when the estate is opened and a notice to creditors is published. By using a notice to creditors template, you can ensure you inform all potential creditors about the estate’s assets and liabilities. This helps facilitate the proper distribution of the estate in compliance with law.

The 777 rule with debt collectors refers to a guideline where you should ideally limit communication about a debt to seven times in a seven-day period. This helps prevent harassment and maintains reasonable boundaries. Understanding this rule can empower you when dealing with aggressive debt collectors and establish your rights during such interactions.

Writing a letter to creditors for someone deceased with no estate should be done clearly and respectfully. Explain the situation, noting that there are no assets to cover debts. Include a request to cease communication if there are no further claims to act upon. A notice to creditors template can assist you in drafting a professional letter.