Quitclaim Deed With Mortgage Owed

Description

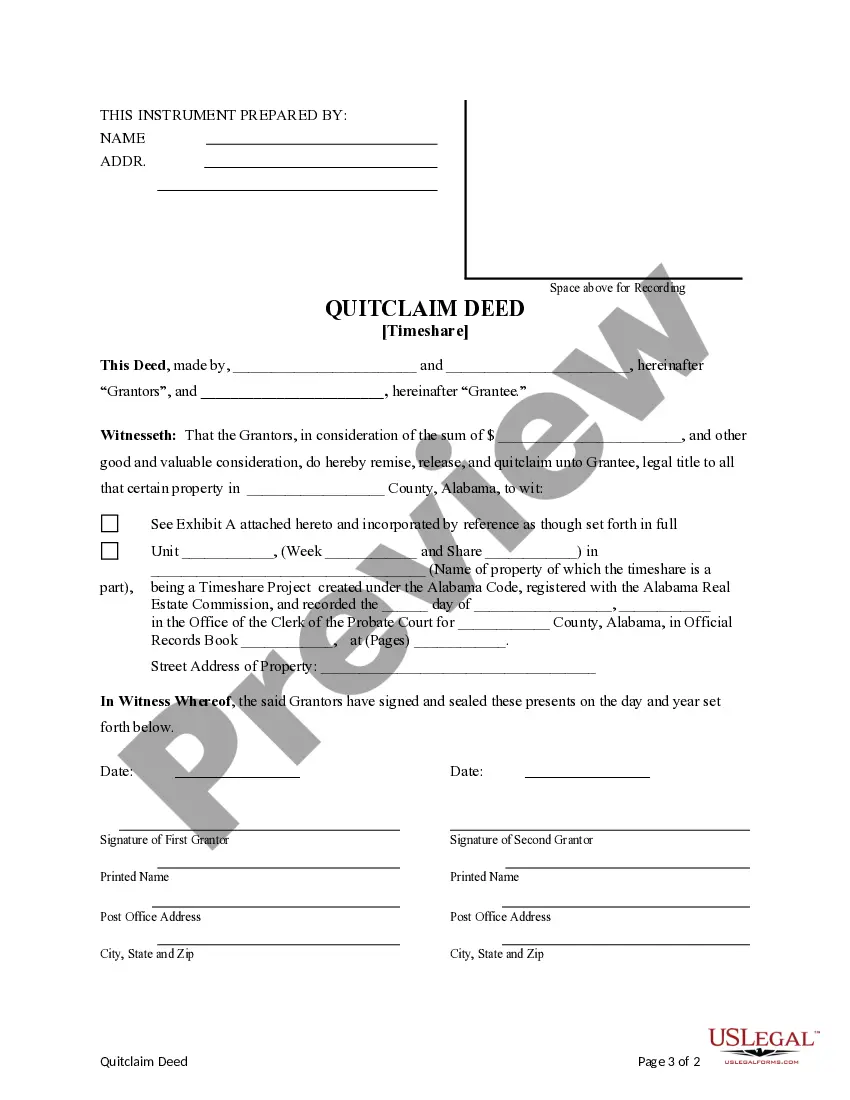

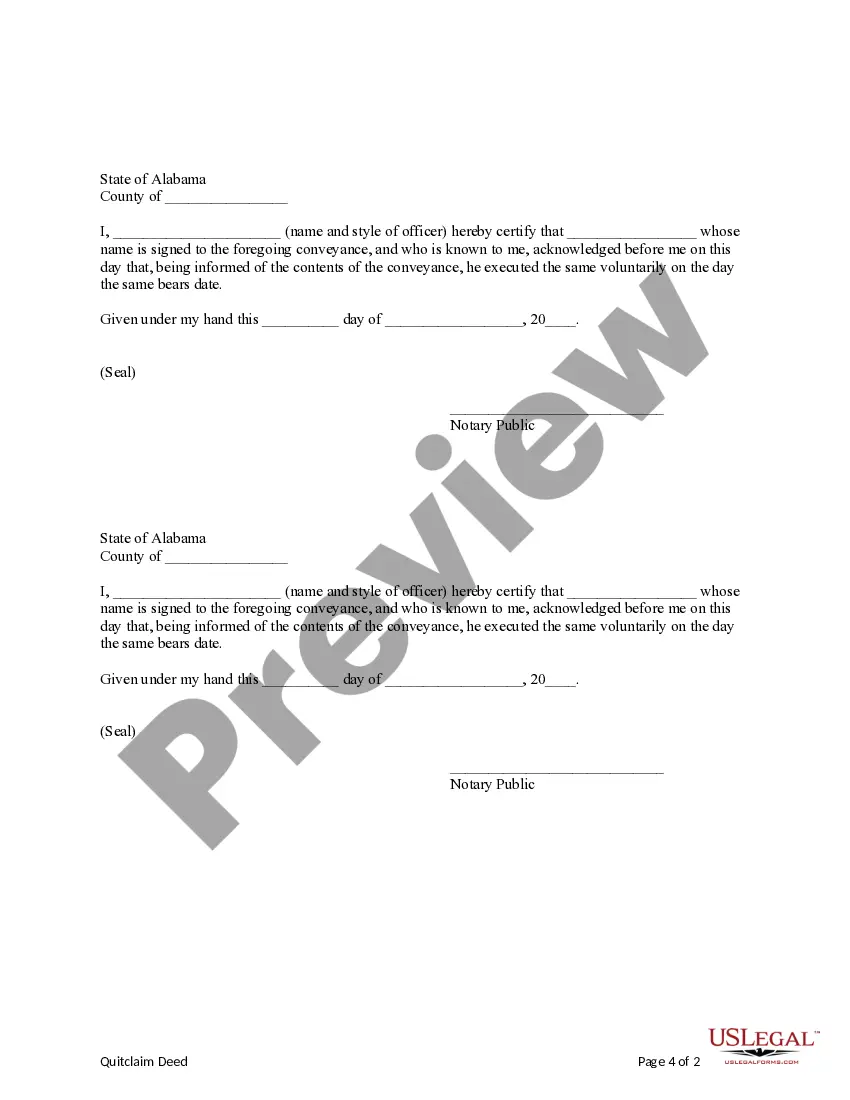

How to fill out Alabama Quitclaim Deed For A Timeshare - Two Individuals To One Individual?

Individuals frequently link legal documentation with complexity that only an expert can manage.

In a certain sense, this is accurate, as composing a Quitclaim Deed With Mortgage Owed needs considerable expertise in relevant criteria, including state and regional laws.

Nevertheless, with US Legal Forms, everything has turned more user-friendly: pre-made legal templates for any personal and professional situation conforming to state regulations are compiled in a single online directory and are now accessible to all.

All forms in our collection are reusable: once purchased, they are saved in your profile. Access them whenever necessary through the My documents tab. Discover all advantages of utilizing the US Legal Forms platform. Subscribe now!

- US Legal Forms provides over 85,000 current documents categorized by state and purpose, allowing you to search for a Quitclaim Deed With Mortgage Owed or any specific template in just a few minutes.

- Existing users with an active subscription must Log In to their account and click Download to retrieve the form.

- New users to the platform will need to create an account and subscribe before they can save any documents.

- Here is the detailed guide on how to acquire the Quitclaim Deed With Mortgage Owed.

- Carefully review the content of the page to ensure it meets your requirements.

- Read the form description or check it through the Preview feature.

- If the previous sample does not meet your needs, find another template using the Search bar above.

- Once you locate the appropriate Quitclaim Deed With Mortgage Owed, click Buy Now.

- Select a pricing plan that aligns with your requirements and financial capacity.

- Create an account or Log In to move on to the payment page.

- Make your subscription payment via PayPal or a credit card.

- Choose the format for your document and click Download.

- You can print your document or import it to an online editor for quicker completion.

Form popularity

FAQ

Mortgage companies may accept a quitclaim deed with mortgage owed, but they often evaluate the situation closely. Acceptance usually depends on the lender's policies and the property’s value. It's wise to discuss your plans with your mortgage company beforehand to determine their stance on using a quitclaim in your specific case.

Individuals involved in family transfers, such as parents gifting property to children, often benefit from a quitclaim deed with mortgage owed. It simplifies the process and provides a quick transfer without lengthy negotiations. Additionally, it can be advantageous in settling disputes among family members, giving them peace of mind regarding property ownership.

Yes, obtaining a mortgage with a quitclaim deed with mortgage owed can be possible, but it is typically more complex. Lenders often require a clear property title for financing, and a quitclaim may not offer this assurance. It's crucial to consult with a lender who appreciates your unique situation and understands the implications of a quitclaim.

A quitclaim deed with mortgage owed cannot be used when there are multiple owners who disagree on the transaction. It is also ineffective in cases where you need to transfer property as part of a tax sale or public auction, where formalities and guarantees are required. Always ensure you understand the legal implications before proceeding.

One major disadvantage of a quitclaim deed with mortgage owed is the lack of warranties about the title's validity. This means you may unknowingly take on hidden liens or disputes. Furthermore, if the original owner is still liable for the mortgage, creditors may still pursue them without affecting the quitclaim holder.

A quitclaim deed with mortgage owed is not suitable for transferring property during divorce settlements when a fair market value needs consideration. Additionally, if you require a clear title to resolve disputes over ownership, opting for a warranty deed would be advisable. Quitclaim deeds do not guarantee protection against claims, making them unsuitable for complicated real estate transactions.