Sample Settlement Agreement For Debt

Description

How to fill out Alabama Sample Of A Settlement Agreement?

Individuals often connect legal documentation with complexity that can only be managed by an expert.

In a certain sense, this is accurate, as crafting a Sample Settlement Agreement For Debt necessitates considerable understanding of the relevant details, including state and local statutes.

However, with US Legal Forms, the process has gotten simpler: pre-prepared legal documents for any personal and business event tailored to state legislation are compiled in a unified online directory and are now accessible to all.

All templates in our collection are reusable: once obtained, they remain saved in your profile. You can access them anytime needed via the My documents tab. Explore all the benefits of using the US Legal Forms platform. Sign up now!

- Check the page content thoroughly to confirm it meets your requirements.

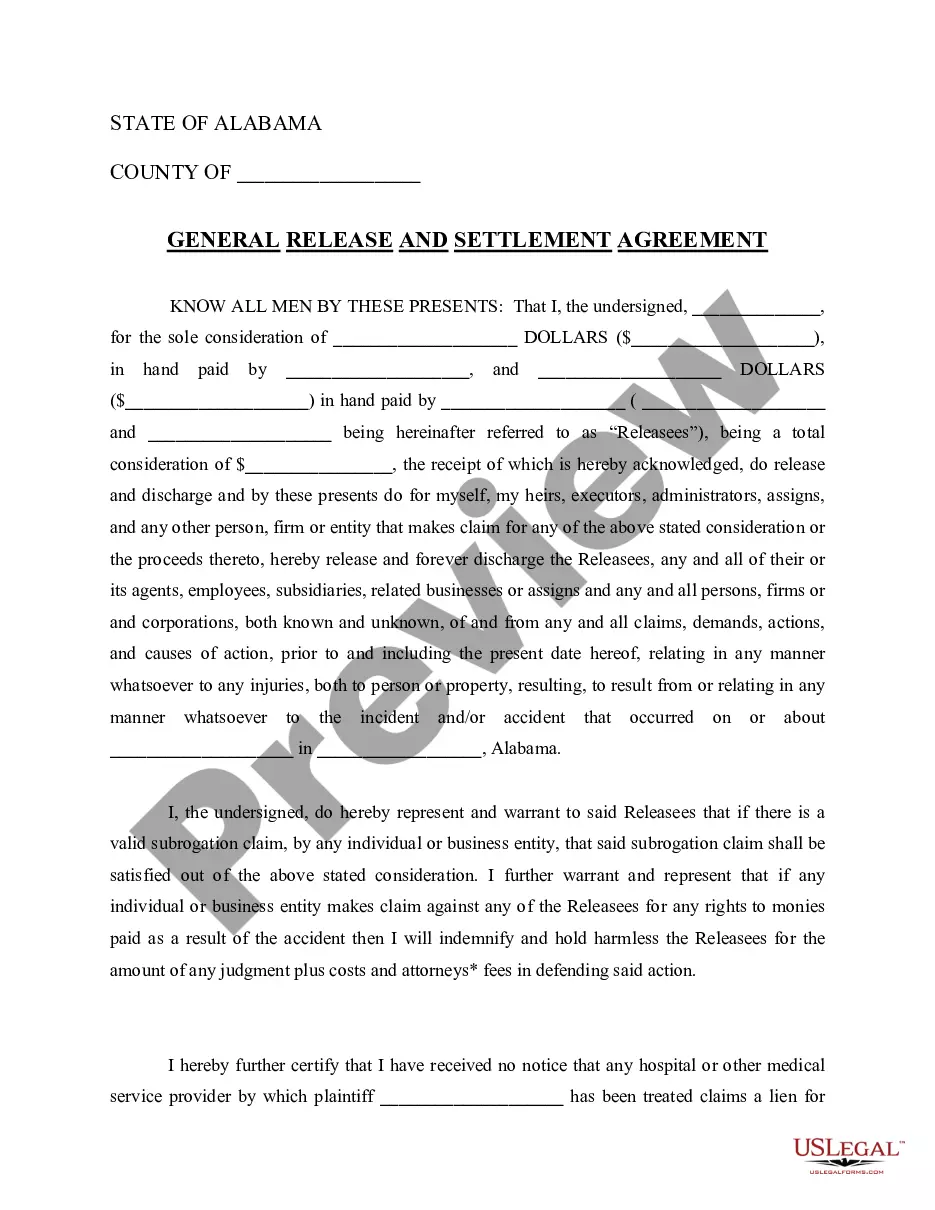

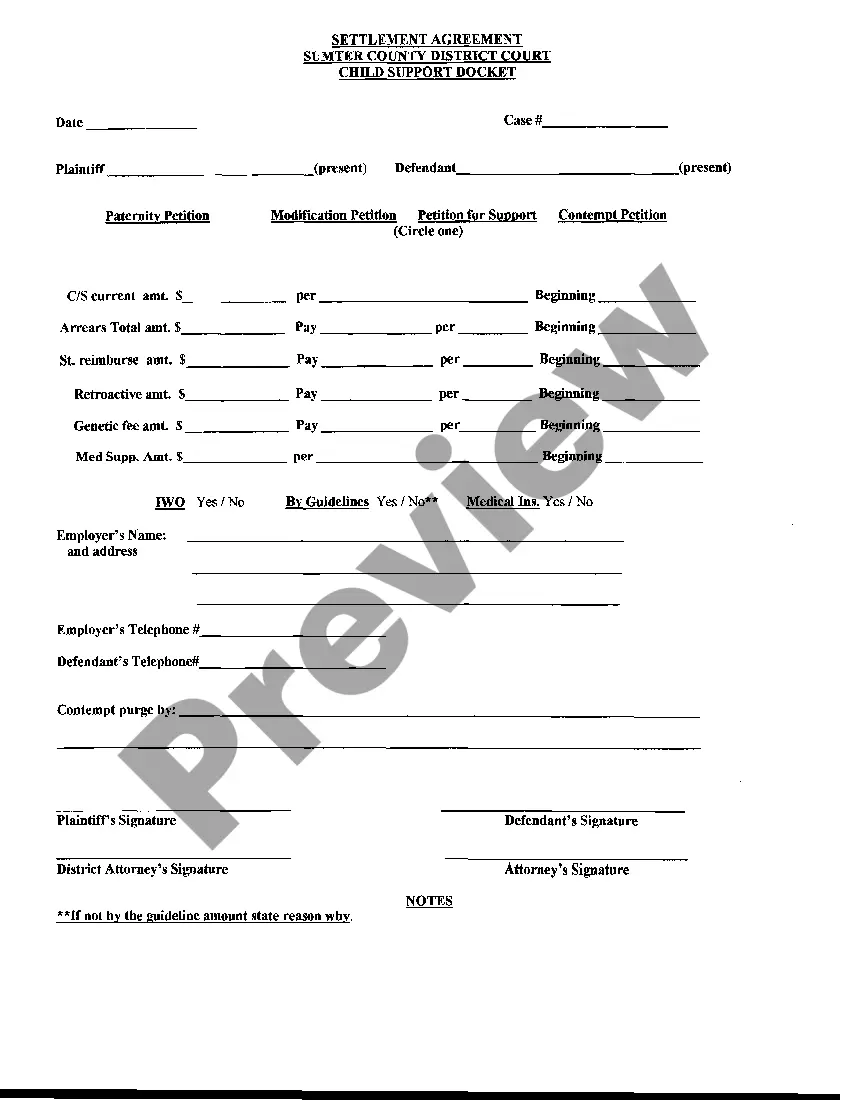

- Examine the form description or verify it using the Preview option.

- Search for another sample using the Search field above if the previous one doesn't meet your needs.

- Click Buy Now when you locate the suitable Sample Settlement Agreement For Debt.

- Choose a subscription plan that fits your needs and financial plan.

- Create an account or Log In to proceed to the payment section.

- Pay for your subscription via PayPal or with your credit card.

- Select the file format and click Download.

- Print your document or upload it to an online editor for expedient completion.

Form popularity

FAQ

The following terms and conditions should be included in a settlement.Original creditor and collection agent's company name.Date the letter was written.Your name.Your account number.Outstanding balance owed on the account (optional)Amount agreed to as settlement.More items...

Offer a specific dollar amount that is roughly 30% of your outstanding account balance. The lender will probably counter with a higher percentage or dollar amount. If anything above 50% is suggested, consider trying to settle with a different creditor or simply put the money in savings to help pay future monthly bills.

Typical debt settlement offers range from 10% to 50% of what you owe. The longer you allow debt to go unpaid, the greater your risk of being sued. Creditors are under no obligation to reduce your debt, even if you are working with a reputable debt settlement company.

The percentage of a debt typically accepted in a settlement is 30% to 80%. This percentage fluctuates due to several factors, including the debt holder's financial situation and cash on hand, the age of the debt, and the creditor in question.

A Debt Settlement Agreement is a document used by a Debtor (the person who owes money) or Creditor (the person who is owed money) to resolve an outstanding debt that is owed. Often, a Debtor finds themselves unable to pay the full amount of a debt that they owe to a Creditor.