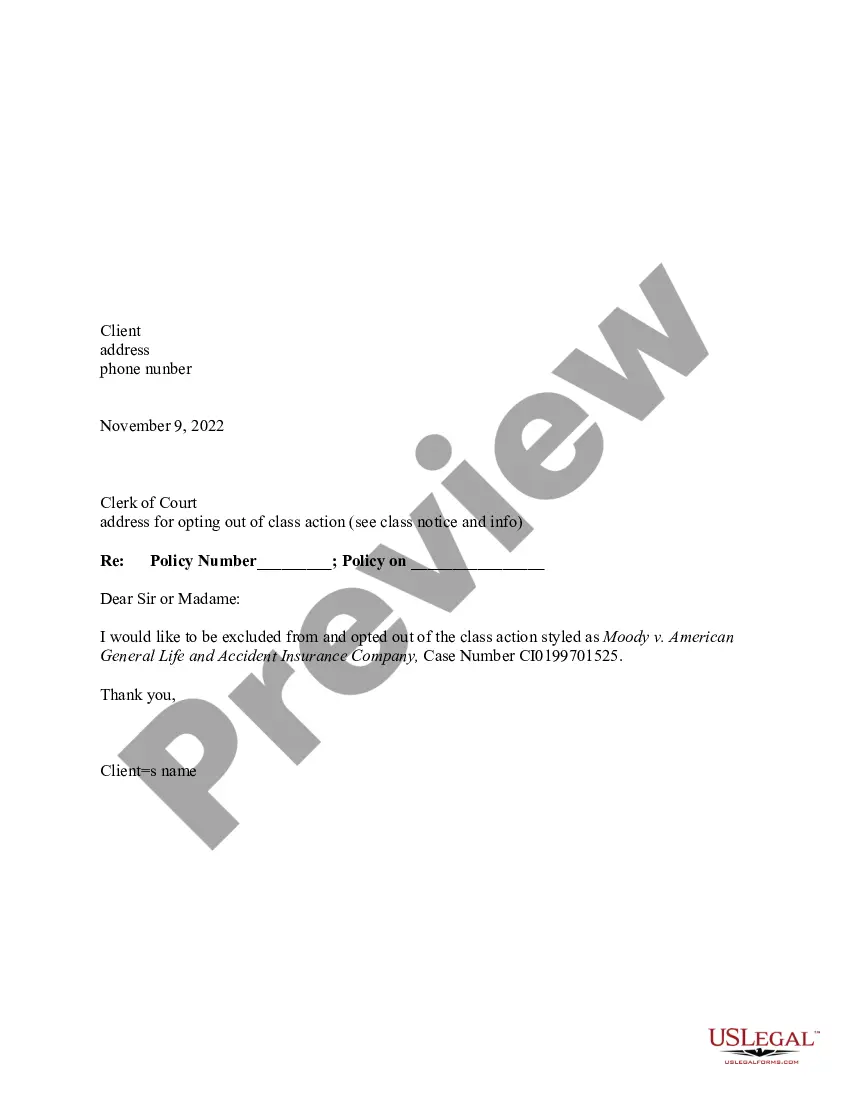

This is a sample exclusion letter signed by a potential member of a class. The signor elects to "opt out" of the class action lawsuit.

Letter Class Action With Blue Cross Blue Shield

Description

How to fill out Letter Class Action With Blue Cross Blue Shield?

Whether you handle documents frequently or occasionally need to send a legal report, it is vital to find a valuable resource where all the examples are relevant and current.

One action you should take with a Letter Class Action With Blue Cross Blue Shield is to ensure that it is indeed the most recent version, as this determines its eligibility for submission.

If you wish to streamline your quest for the most current document samples, seek them out on US Legal Forms.

Use the search menu to locate the desired form. Review the preview and details of the Letter Class Action With Blue Cross Blue Shield to confirm it is exactly what you need. After verifying the form, simply click Buy Now. Select a subscription plan that suits you. Register for an account or Log In to your existing one. Enter your credit card information or PayPal account to complete the purchase. Choose the document format for download and confirm it. Eliminate the confusion when handling legal documents. All your templates will be organized and validated with a US Legal Forms account.

- US Legal Forms is a repository of legal documents that includes nearly any document template you may need.

- Search for the forms you require, assess their relevance immediately, and learn more about their application.

- With US Legal Forms, you can access around 85,000 document templates across various sectors.

- Locate the Letter Class Action With Blue Cross Blue Shield samples in just a few clicks and save them anytime in your account.

- A US Legal Forms account will provide you with all the forms you need, making it convenient and hassle-free.

- Simply click Log In in the header of the website and access the My documents section which has all the forms readily available, eliminating the need to spend time searching for the right template or verifying its validity.

- To obtain a form without an account, follow these instructions.

Form popularity

FAQ

We have filed a class action lawsuit against Blue Shield in Los Angeles County to cover all California subscribers of full-service Blue Shield individual/family health plans who received an untimely notice of an increased annual renewal premium in violation of the law and paid a new, higher premium over the prior

Blue Cross Blue Shield reached a $2.67 billion settlement in a class-action antitrust lawsuit in October 2020.

In most cases, it is a good idea to join the class action if you believe you suffered injuries or financial losses caused by the defendant. We do recommend you give us a call and discuss your situation with one of our class action lawsuit attorneys before you make a decision, however.

The tentative $2.67 billion settlement was reached in October 2020 after more than 35 Blue Cross Blue Shield health insurance plans, including Highmark, were sued for allegedly violating antitrust laws, according to , the settlement's official website.

Help for Customers Who Have Been Wrongly Denied Coverage When this basic expectation isn't met, customers may have a right to take legal action against Blue Shield for their bad faith denials of coverage.