There's no longer a necessity to squander hours searching for legal documents to comply with your local state laws.

US Legal Forms has compiled all of them in a single location and enhanced their accessibility.

Our website offers over 85,000 templates for any business and personal legal needs, organized by state and area of application.

Utilize the Search field above to find another template if the previous one did not meet your requirements.

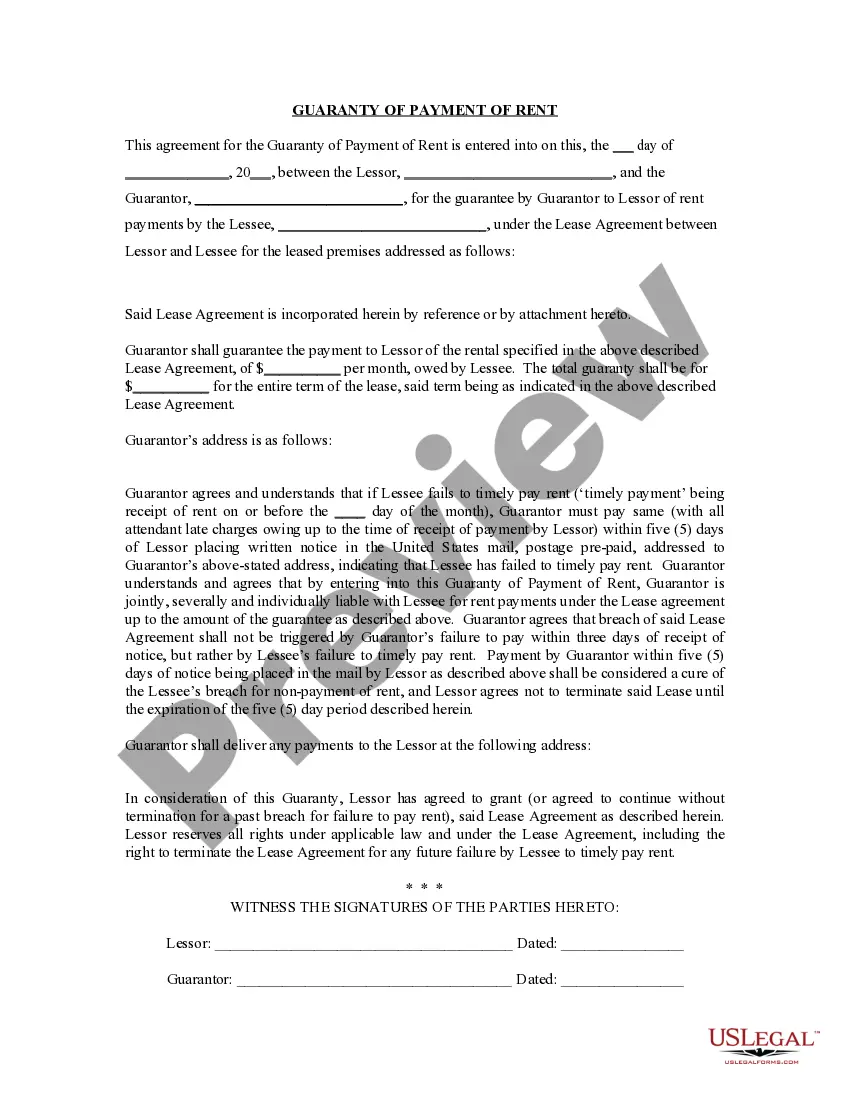

- All forms are expertly crafted and verified for accuracy, assuring you can acquire a current Personal Guarantee Of Payment Form.

- If you are acquainted with our service and already possess an account, you need to confirm your subscription is active before obtaining any templates.

- Log In to your account, select the document, and click Download.

- You can also access all saved documents at any time needed by navigating to the My documents tab in your profile.

- If you've never used our service before, the process will require a few additional steps to complete.

- Here's how new users can secure the Personal Guarantee Of Payment Form from our collection.

- Thoroughly read the page content to confirm it includes the sample you need.

- Use the form description and preview options if available.

Appendix E — Form of Personal Guarantee. Secure a personal guarantee of payment.Directors Personal Guarantee Deed. This is an important document. As the name suggests, you personally guarantee to pay the money back if your company can't pay in the future.