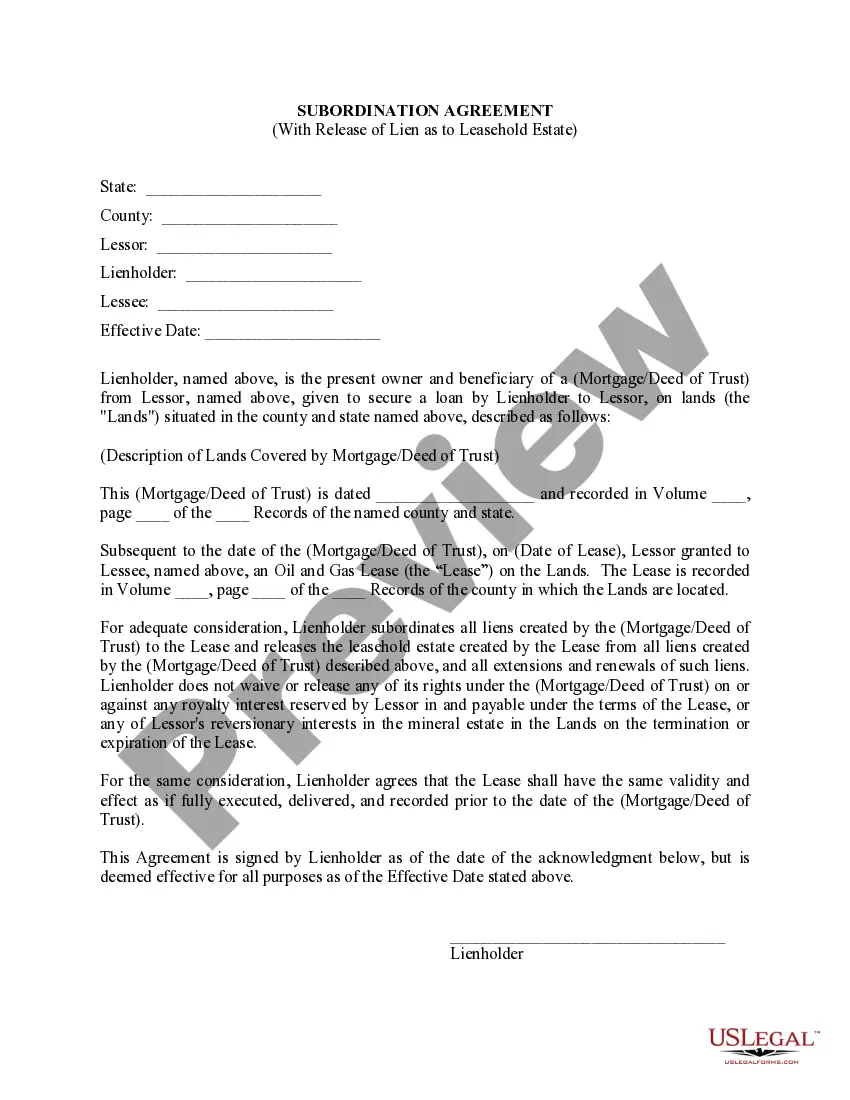

What is the most reliable service to secure the Subordination Agreement With Irs and other up-to-date versions of legal forms? US Legal Forms is the solution! It boasts the largest assortment of legal documents for any occasion.

Each template is thoroughly crafted and reviewed for adherence to federal and local regulations. They are organized by area and state of application, making it simple to locate the one you require.

Search for alternative forms. If there are discrepancies, use the search box at the top of the page to find a different template. Click Buy Now to choose the correct one.

Account setup and subscription purchase. Select the best pricing plan, sign in or create a new account, and complete your subscription payment through PayPal or credit card.

File download. Choose the format you prefer to save the Subordination Agreement With Irs (PDF or DOCX) and click Download to acquire it.

US Legal Forms is an excellent solution for anyone needing to manage legal documentation. Premium members can enjoy additional features as they finalize and approve previously saved files electronically at any time using the integrated PDF editing tool. Give it a try today!

- Experienced users of the website only need to Log In to the platform, verify if their subscription is active, and click the Download button next to the Subordination Agreement With Irs to retrieve it.

- After saving, the template will be accessible for additional use within the My documents section of your account.

- If you don't have an account with us yet, here are the steps to follow to create one.

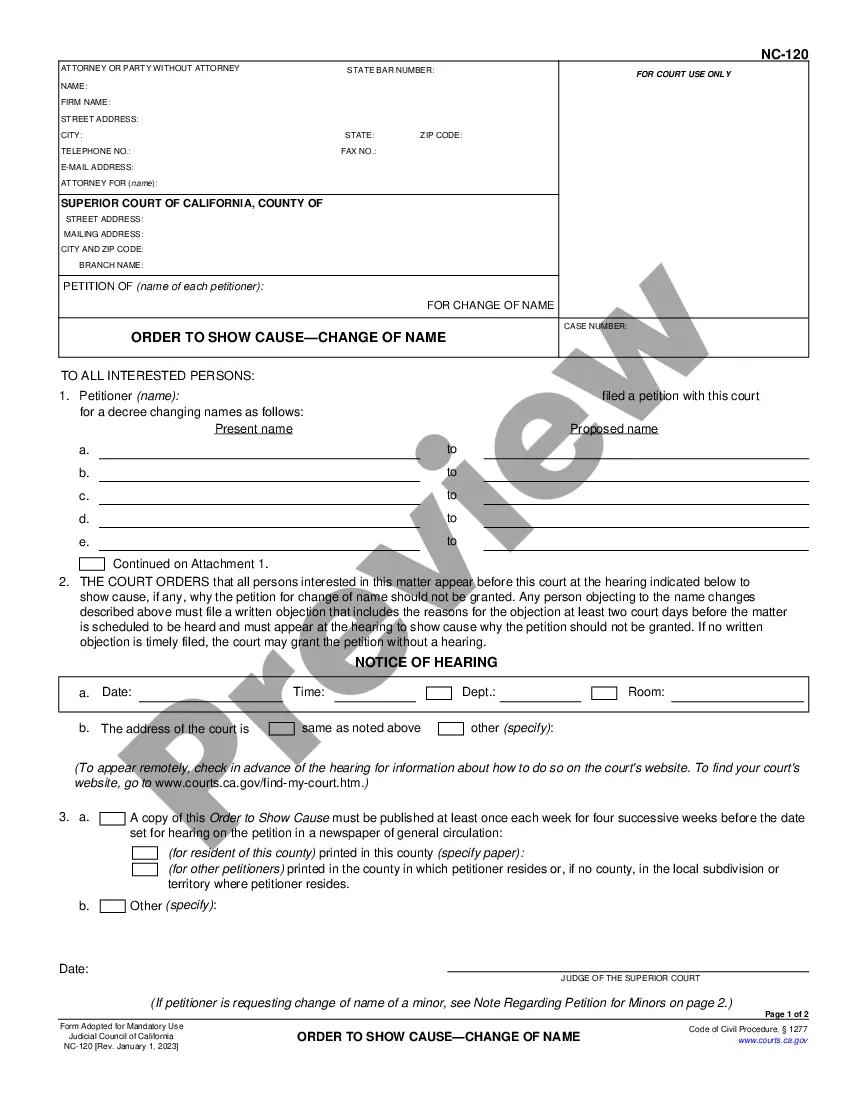

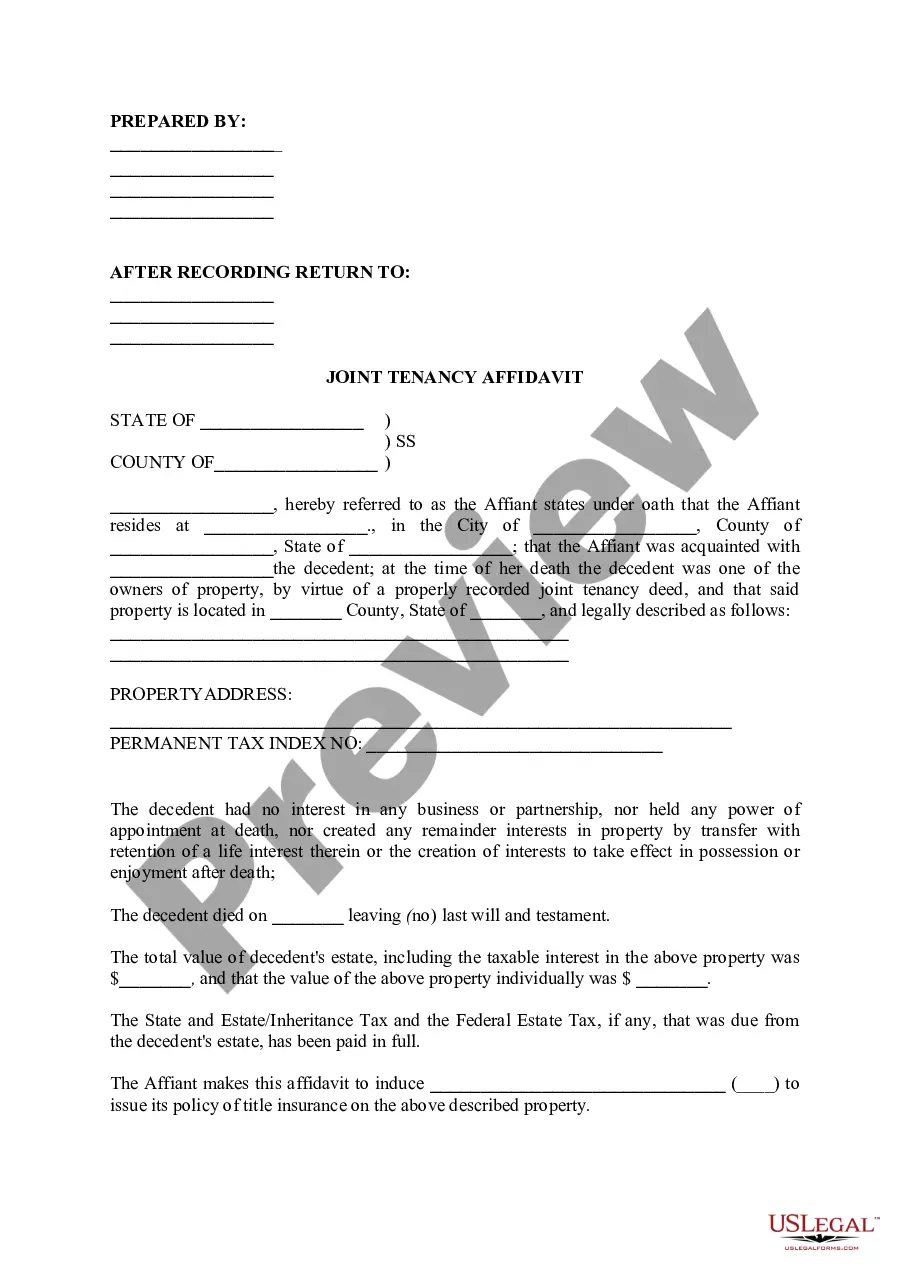

- Form compliance assessment. Before accessing any template, ensure it meets your requirements and aligns with the laws of your state or county. Review the form description and utilize the Preview feature if available.

If the IRS agrees to subordinate your tax lien, they will provide you with a Certificate of Subordination. This is known as subordination of the federal tax lien.The IRS may issue a certificate of subordination to a federal tax lien. The United States will receive an amount equal to the lien or interest to which the certificate of subordination is issued. Taxpayers may apply for a subordination of a federal tax lien if they are refinancing or restructuring their mortgage. Are selling real or personal property, and; the proceeds from the sale will not be enough to pay your warranted balance in full. (Address to the IRS office that filed the lien. Use.