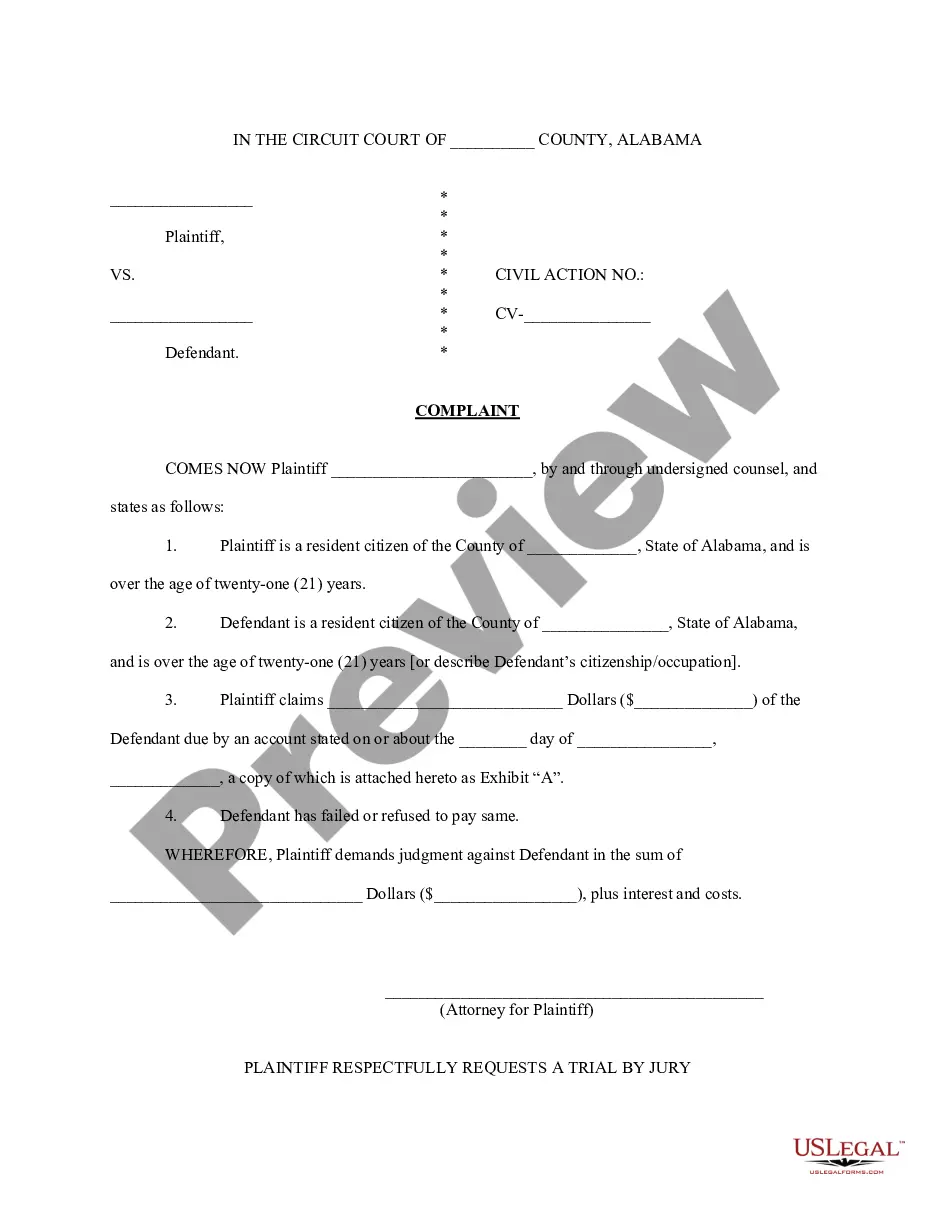

Alabama sample complaint filed in Circuit Court to collect a debt.

Account Stated For Credit Card Debt

Description

How to fill out Account Stated For Credit Card Debt?

Regardless of whether you handle documentation frequently or you occasionally need to submit a legal report, it is crucial to have a source where all samples remain pertinent and current.

The first action you must take with an Account Stated For Credit Card Debt is to verify that it is indeed the most recent version, as this determines if it can be submitted.

If you wish to simplify your search for the most recent document examples, look for them on US Legal Forms.

To acquire a form without having an account, undertake these steps: Use the search bar to locate the form you need. Review the Account Stated For Credit Card Debt preview and description to confirm it is precisely what you are searching for. After verifying the form, simply click Buy Now. Choose a subscription plan that suits you. Create an account or Log In to your existing one. Utilize your credit card details or PayPal account to finalize the purchase. Choose the document format for download and confirm it. Say goodbye to the confusion associated with handling legal documents. All your templates will be organized and validated with an account at US Legal Forms.

- US Legal Forms is a collection of legal documents that includes almost any document example you may need.

- Search for the templates you need, immediately check their relevance, and learn more about their application.

- With US Legal Forms, you gain access to over 85,000 form templates across various fields.

- Acquire the Account Stated For Credit Card Debt examples with just a few clicks and save them at any time in your account.

- A profile at US Legal Forms will enable you to obtain all the samples you need with more ease and less trouble.

- Simply click Log In in the site header and open the My documents section to have all the necessary forms readily available.

- You won’t have to waste time searching for the ideal template or validating its correctness.

Form popularity

FAQ

To file a dispute or add information to someone's credit report, you typically must provide the credit bureau with your documentation supporting your claim. This can include details about an account stated for credit card debt to substantiate your position. Consider using platforms like USLegalForms, which can provide templates and guidance for this process, ensuring you submit the necessary information correctly.

Generally, a credit report can show negative information for up to seven years. However, certain bankruptcies may remain on your report for up to ten years. If you’re dealing with an account stated for credit card debt, it’s essential to understand how long the information can impact your credit score and when you can expect it to be removed.

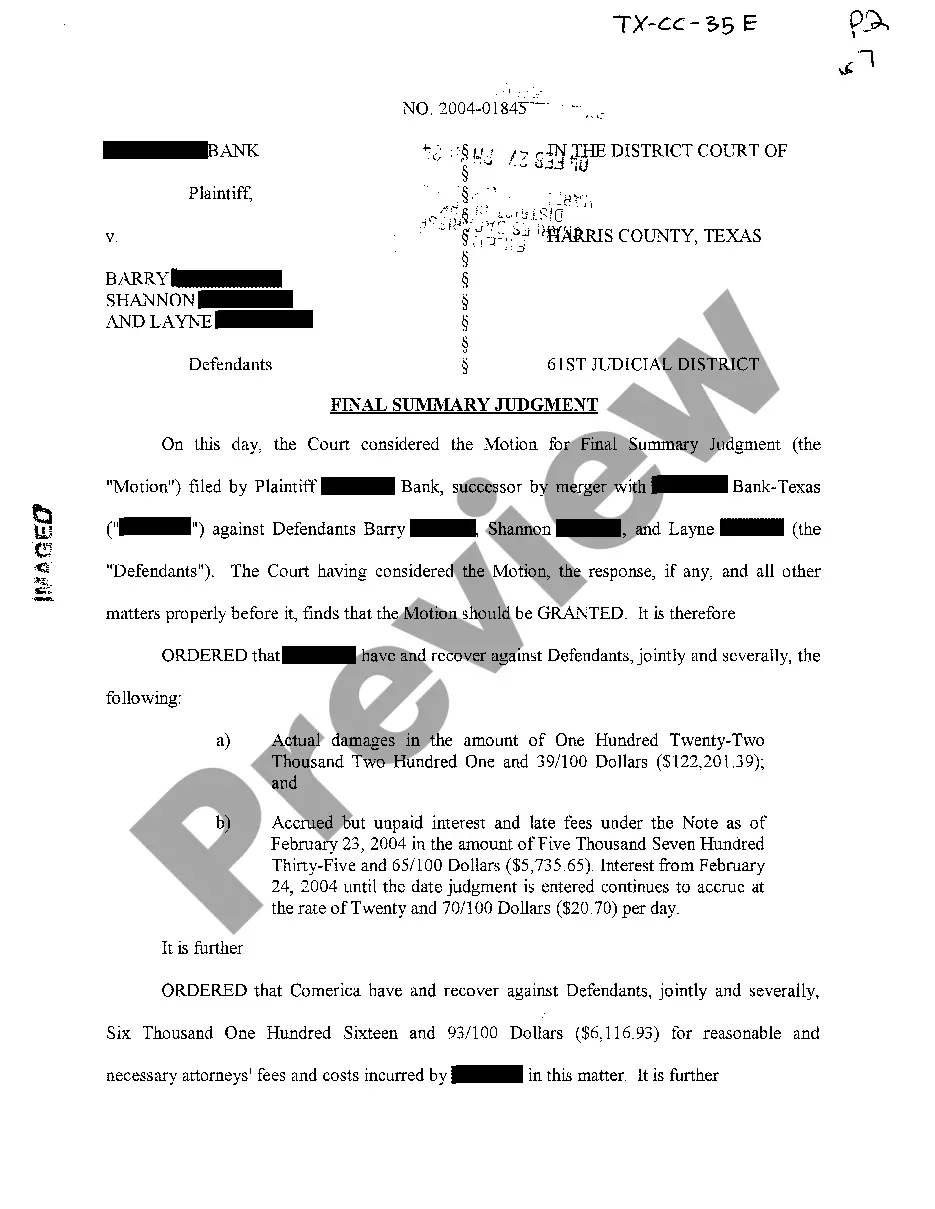

To place a judgment on someone's credit report, you must first obtain a court judgment against them. This requires filing a lawsuit, and if you win, the court will issue a judgment, which can then be reported to credit bureaus. Keep in mind that an account stated for credit card debt can serve as the basis for such a judgment, provided you have adequate documentation of the debt.

An example of a claim statement is, 'I owe $3,000 in credit card debt based on the account stated for credit card debt, which both parties agreed upon.' This assertive statement highlights the obligation and the agreement, making it clear that you acknowledge the debt. Having a well-defined claim statement can be beneficial in negotiations or legal discussions.

Start by addressing your creditor and clearly stating your intentions to settle the debt. Include details about your account and reference any prior communications, emphasizing the account stated for credit card debt. It's helpful to propose a specific settlement amount that you can afford while remaining respectful and professional.

To state a claim in an essay, begin by clearly articulating your main idea in a concise manner. Support this claim with relevant examples and facts related to the topic, including recent studies or testimonials that discuss account stated for credit card debt. A well-stated claim invites readers to engage with your argument and strengthens your overall writing.

Stating a claim involves articulating a specific assertion supported by evidence or documentation. When discussing account stated for credit card debt, it refers to your claim regarding the validity and amount of the debt. By formally stating your claim, you set the groundwork for negotiation or legal action against the creditor.

To state the claim means to present the basis of your argument clearly and effectively. In the context of an account stated for credit card debt, it involves detailing the amount owed and the agreement on that debt. This clarity helps in resolving disputes and establishing responsibilities between the creditor and debtor.

Debt collectors may have the ability to find your bank accounts through various means, such as public records or credit reports. While they generally cannot access every detail of your financial life, they often have sufficient information to pursue collections. It's crucial to understand your rights and consider legal assistance if you face aggressive collection efforts related to your account stated for credit card debt.

Yes, $20,000 in credit card debt is considered a significant amount. Such a high balance can lead to financial stress and higher interest charges, which can complicate your financial situation. It is essential to consult with financial professionals or platforms like uslegalforms to explore options for handling an account stated for credit card debt.