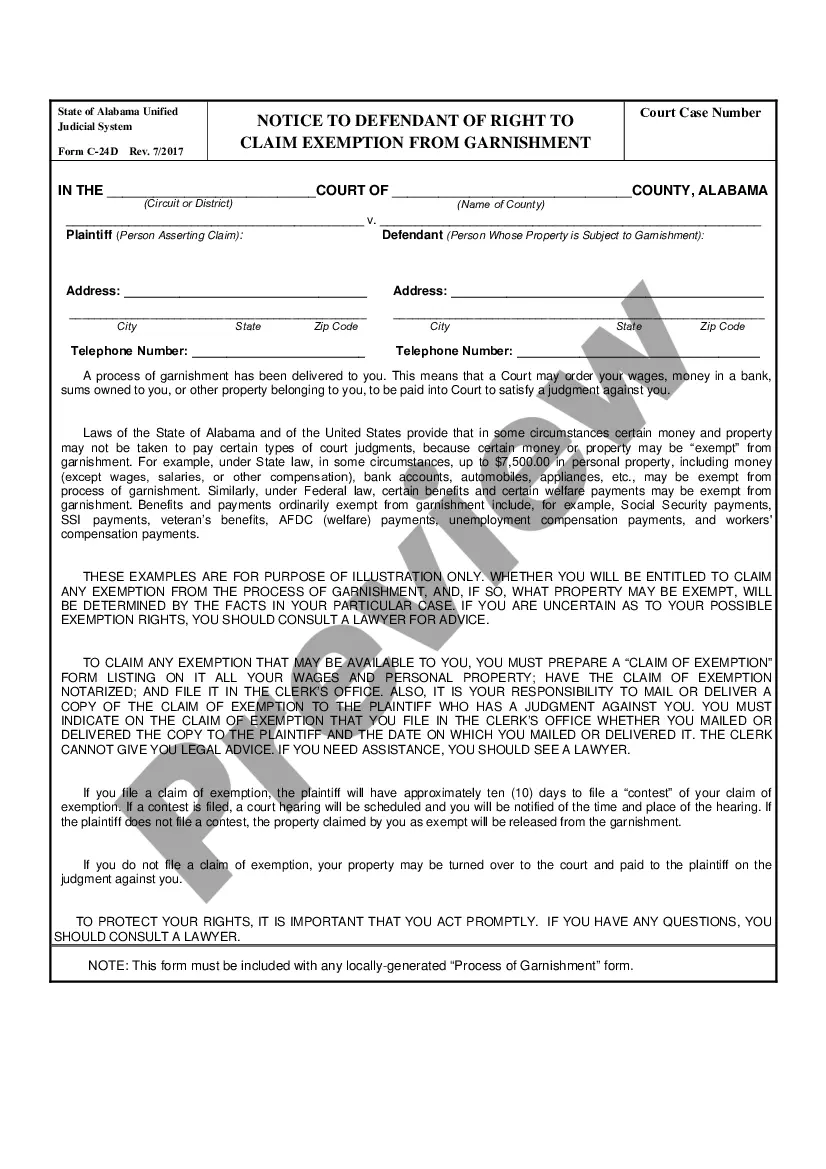

Alabama Official Form - Notice to Defendant of Right to Claim Exemption from Garnishment.

Garnishments For Unemployment

State:

Alabama

Control #:

AL-C-24D

Format:

PDF

Instant download