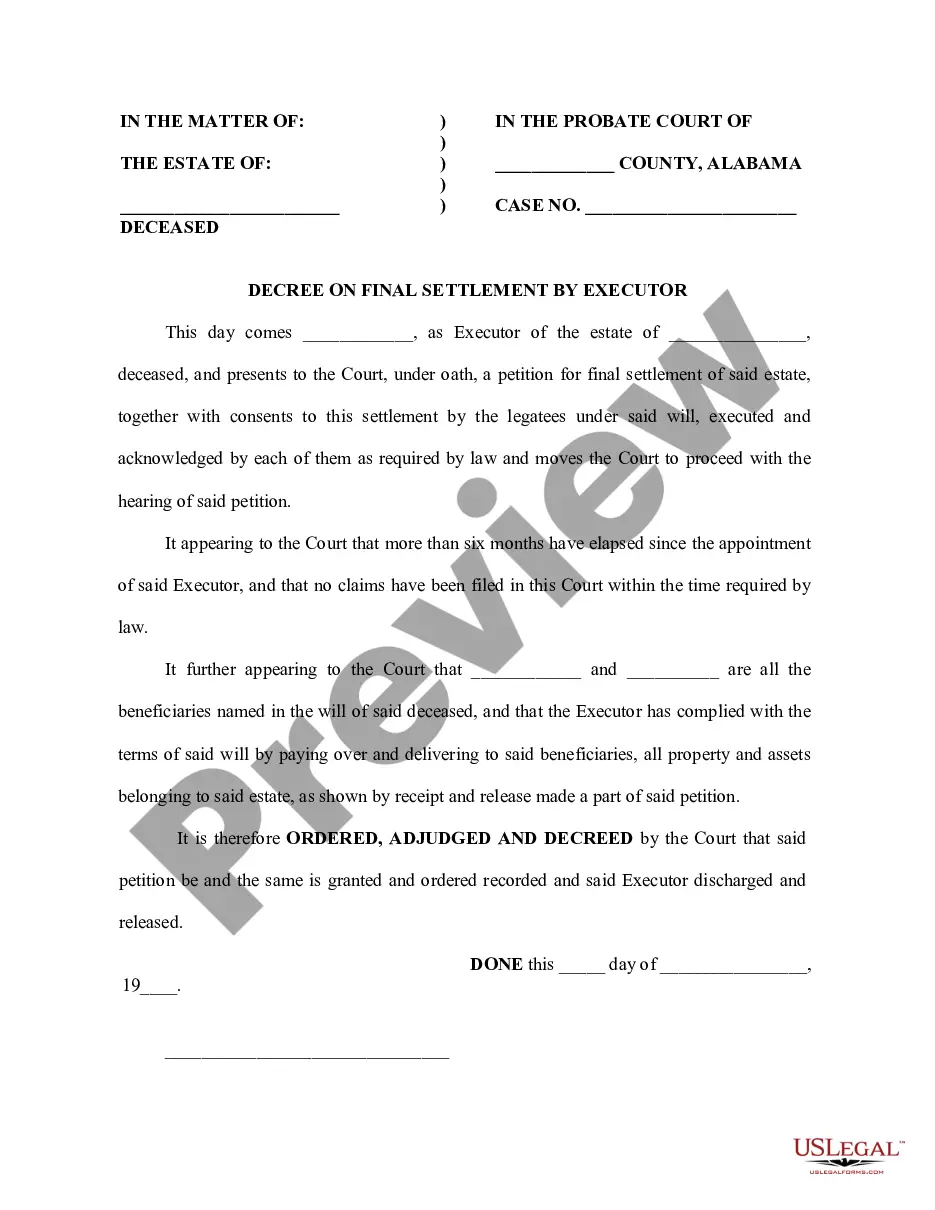

This is a sample decree of the probate court for settling the administration of an estate.

Alabama Estate Executor With A Trust

Instant download

Description

Free preview

This is a sample decree of the probate court for settling the administration of an estate.