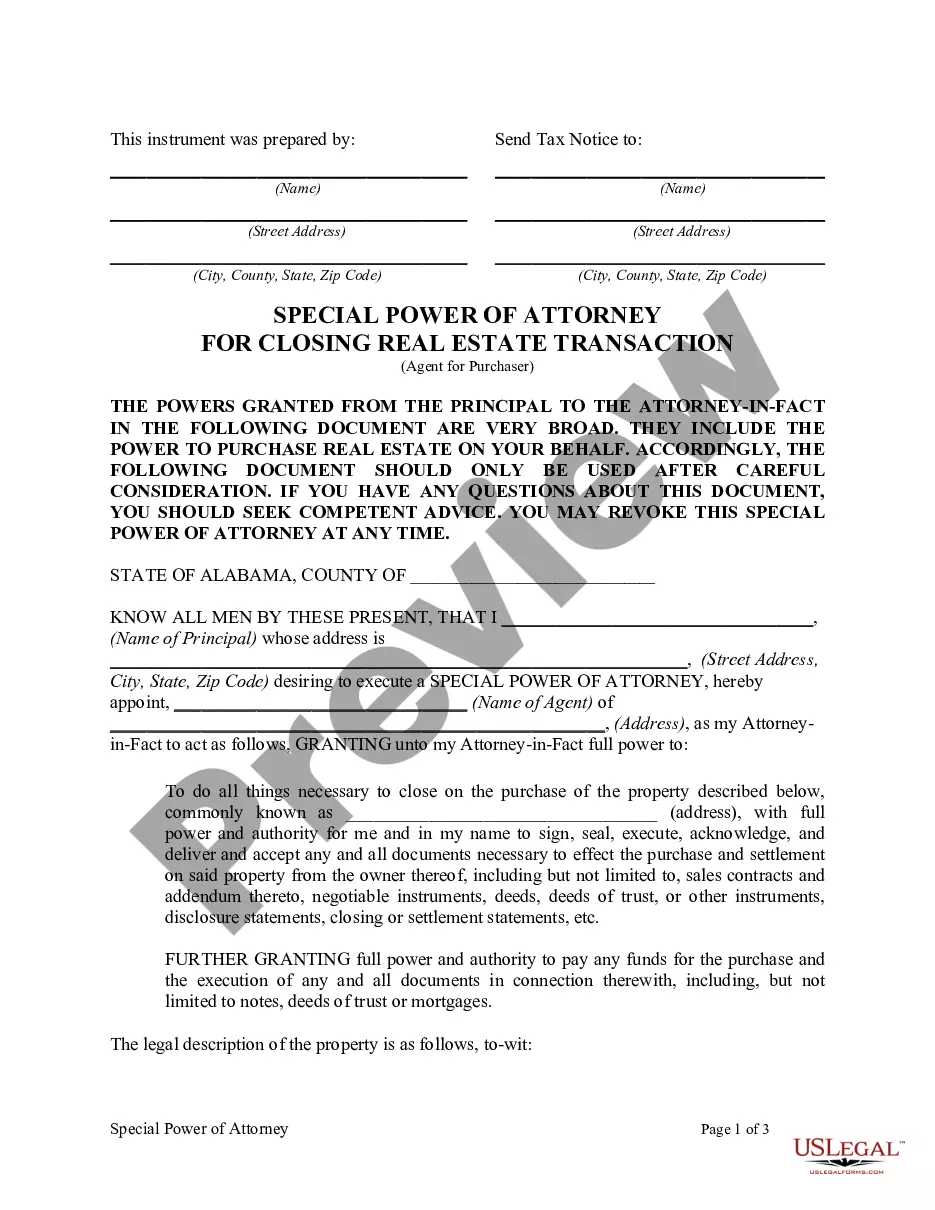

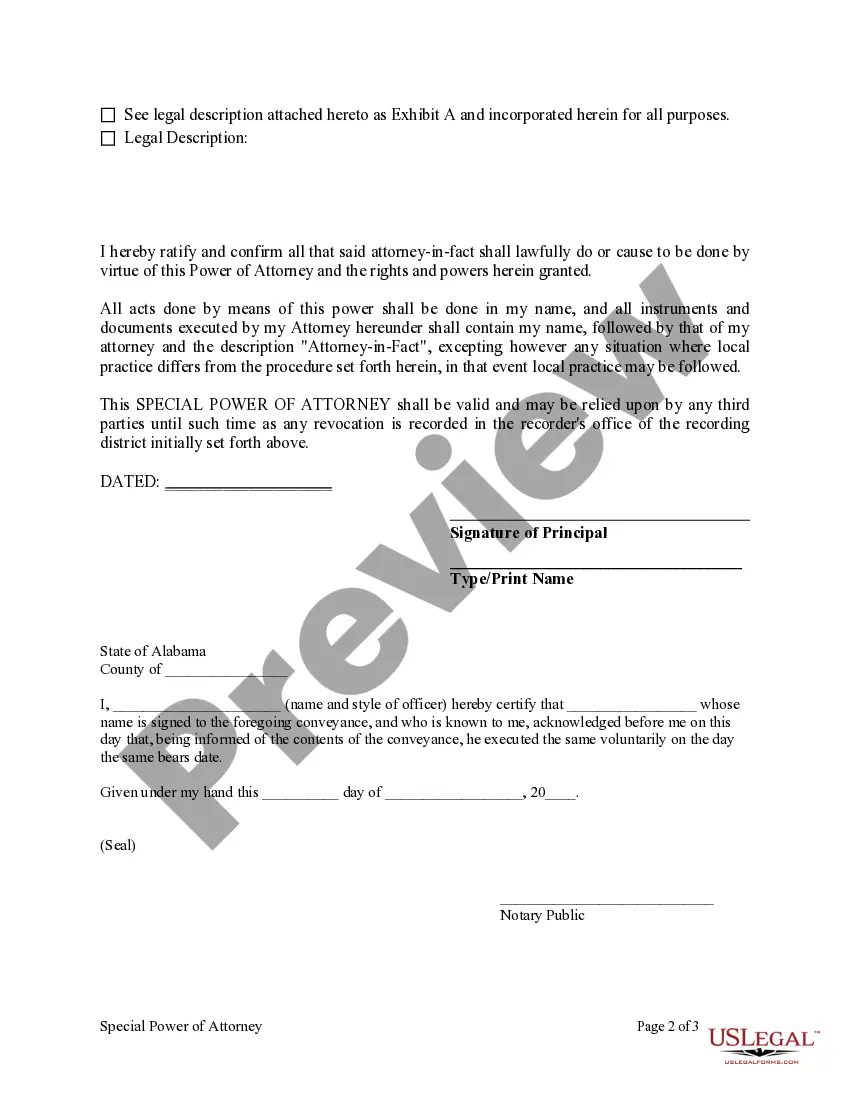

This Power of Attorney for Real Estate Transaction form is for a Purchaser to authorize an attorney-in-fact to execute all documents and do all things necessary to purchase a particular parcel of real estate for purchaser, including loan documents. This form must be signed and notarized.

Alabama Poa Real Estate Transaction Withholding

Description

Form popularity

FAQ

To apply for withholding tax in Alabama, you need to complete the appropriate application form and submit it to the relevant state department. This application typically requires details about your business activities or real estate transactions concerning Alabama poa real estate transaction withholding. Utilizing resources like uslegalforms can streamline this application process, ensuring you have all necessary documentation ready. This approach will help you fulfill your tax obligations successfully.

Applying for a withholding account in Alabama involves submitting a completed application to the state's tax department. You will need to provide relevant information about your business or property transactions, specifically related to Alabama poa real estate transaction withholding. Uslegalforms can simplify this process by providing the right forms and detailed instructions. This way, you can move forward with your transactions confidently.

To set up withholding in Alabama, you generally need to fill out the necessary state forms and submit them to the tax authority. This would involve reporting the details of your Alabama poa real estate transaction withholding. Additionally, you may want to consult platforms like uslegalforms to access the necessary documents and guidance. Taking these steps ensures that you comply with Alabama's tax laws.

Yes, Alabama has a specific withholding form designed for real estate transactions. This form is essential for documenting Alabama poa real estate transaction withholding, ensuring compliance with state tax requirements. It details the transaction and informs the state of the withholding amounts. Using this form helps streamline the withholding process and reduces the risk of errors.

A state withholding account is a specific account that allows for the collection and remittance of state taxes from various transactions, including real estate sales. Whenever Alabama poa real estate transaction withholding occurs, the proceeds may be subject to state tax withholding. This account ensures that the appropriate taxes are withheld and correctly reported to the state. Having a withholding account helps sellers manage their tax obligations efficiently.

Submitting your power of attorney in Alabama typically involves delivering it to the respective parties or entities that will accept it. If your POA relates to real estate transactions, ensure that the document is correctly completed and signed. While formal submission is usually not necessary unless required by specific entities, having it recorded can help reduce any disputes. Resources like US Legal Forms provide detailed instructions on properly managing Alabama POA real estate transaction withholding.

To fill out an A4 form in Alabama, you will need to provide the details of the real estate transaction, including the buyer's and seller's information. Specify whether you are claiming an exemption from withholding based on your residency status. Completing this form correctly is essential if you're involved in Alabama POA real estate transaction withholding, as it aids in facilitating legal compliance. Consider using templates available on platforms like US Legal Forms for clarity.

Filling out a withholding exemption form in Alabama involves providing details such as the seller's information and the reasons for the exemption. Common exemptions could involve residency status or specific circumstances recognized by the Alabama tax authority. It's crucial to ensure accuracy on this form to avoid complications with Alabama POA real estate transaction withholding. When in doubt, resources from US Legal Forms can guide you through this process.

Alabama does not directly accept federal Form 2848 for state tax purposes; instead, you must submit state-specific forms. However, if your POA is for federal matters, such as tax issues, Form 2848 can be beneficial. Be mindful that for Alabama POA real estate transaction withholding, you may need to fill out applicable state documents to ensure compliance. Always check which forms are required for your specific situation.

To grant someone power of attorney in Alabama, you must create a written document that clearly states your intentions. The document should specify the powers you grant and must be signed by you, the principal. If you choose to have your POA used for real estate transactions, particularly for Alabama POA real estate transaction withholding, ensure it is tailored to meet those specific needs. Using platforms like US Legal Forms can simplify this process.