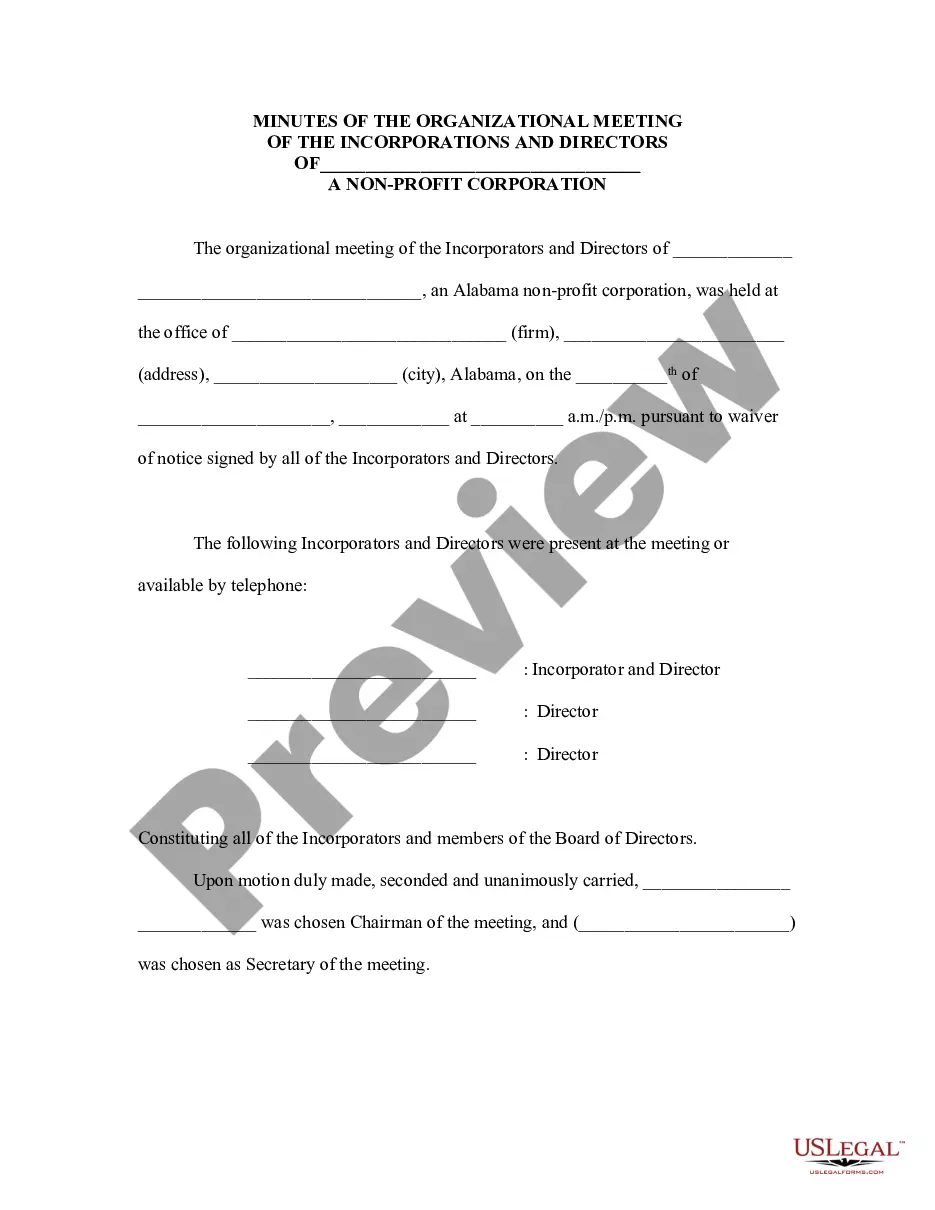

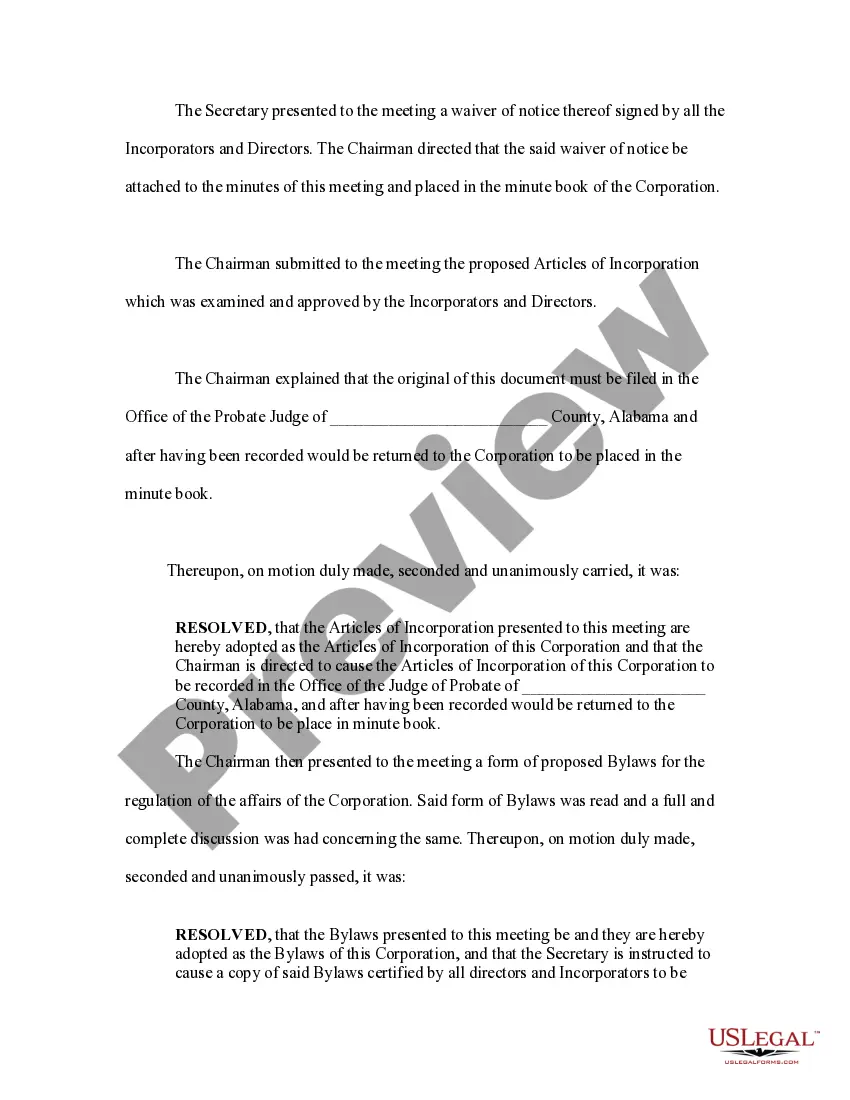

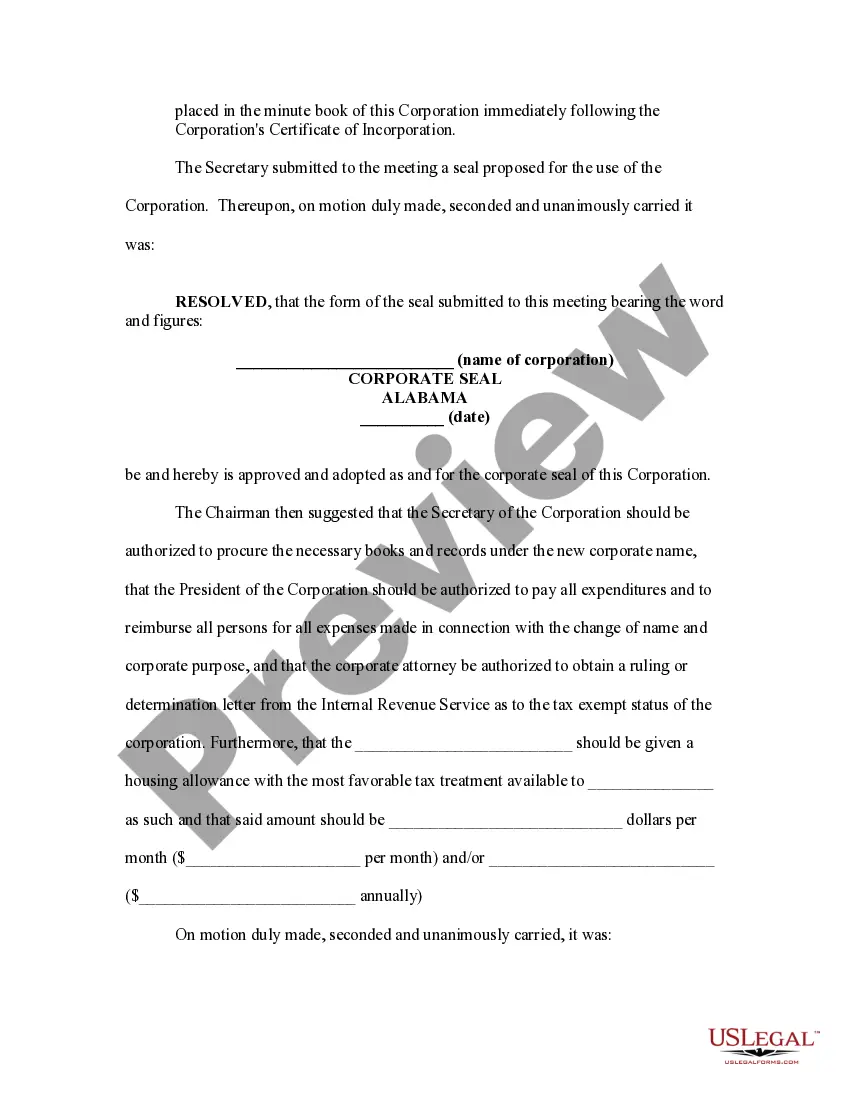

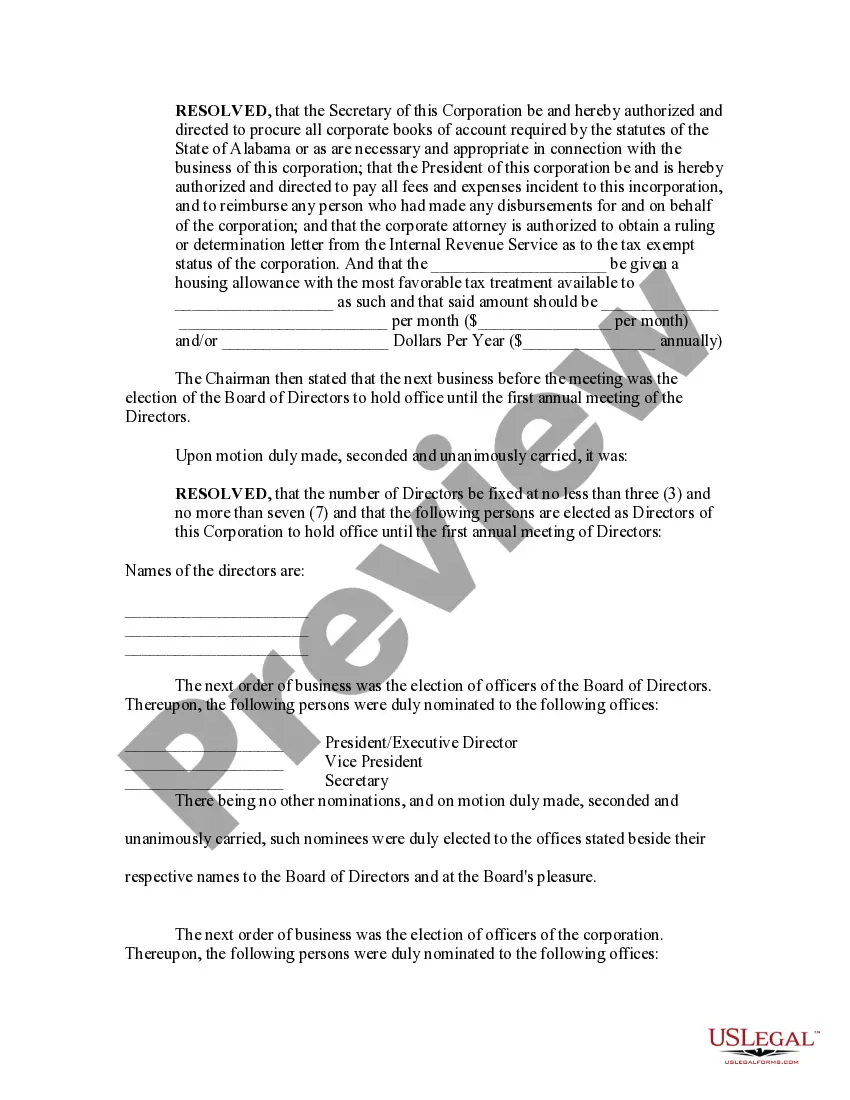

Minutes of the Organizational Meeting of the Incorporators and Directors of a Non-Profit Corporation

Incorporation For Startups

Instant download

Description

Free preview

Minutes of the Organizational Meeting of the Incorporators and Directors of a Non-Profit Corporation