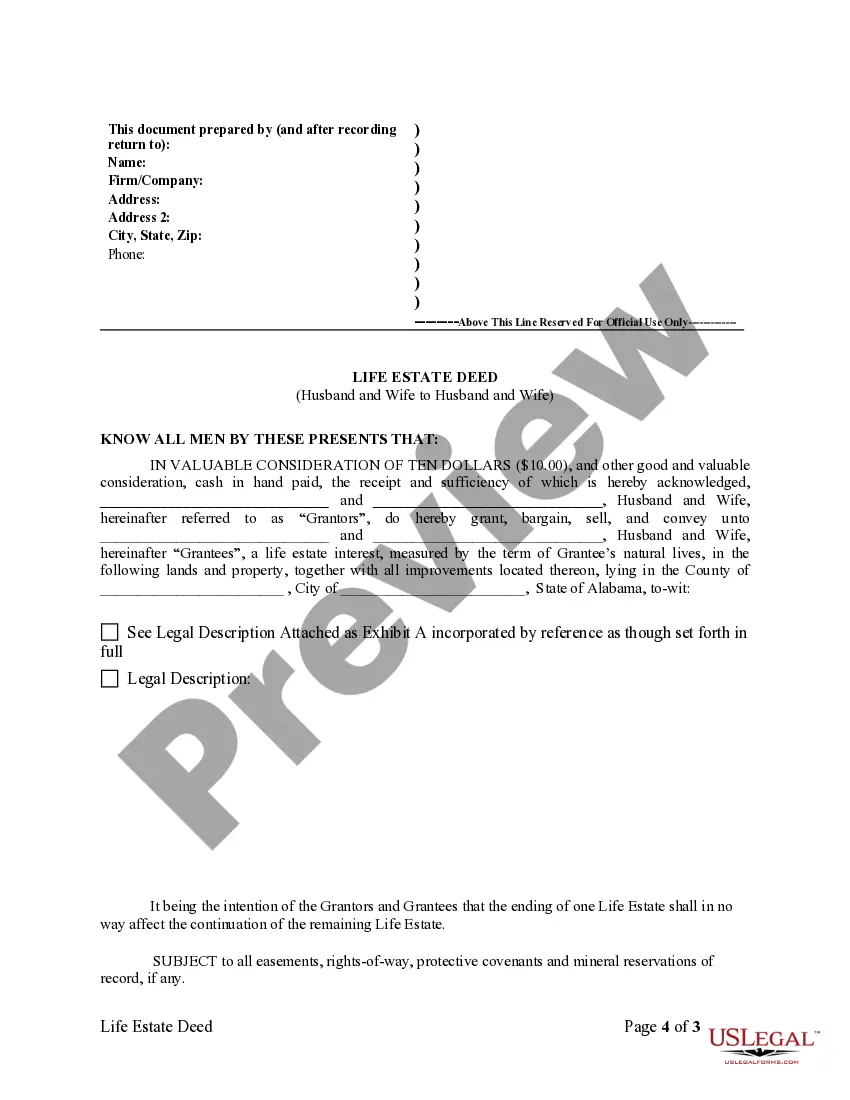

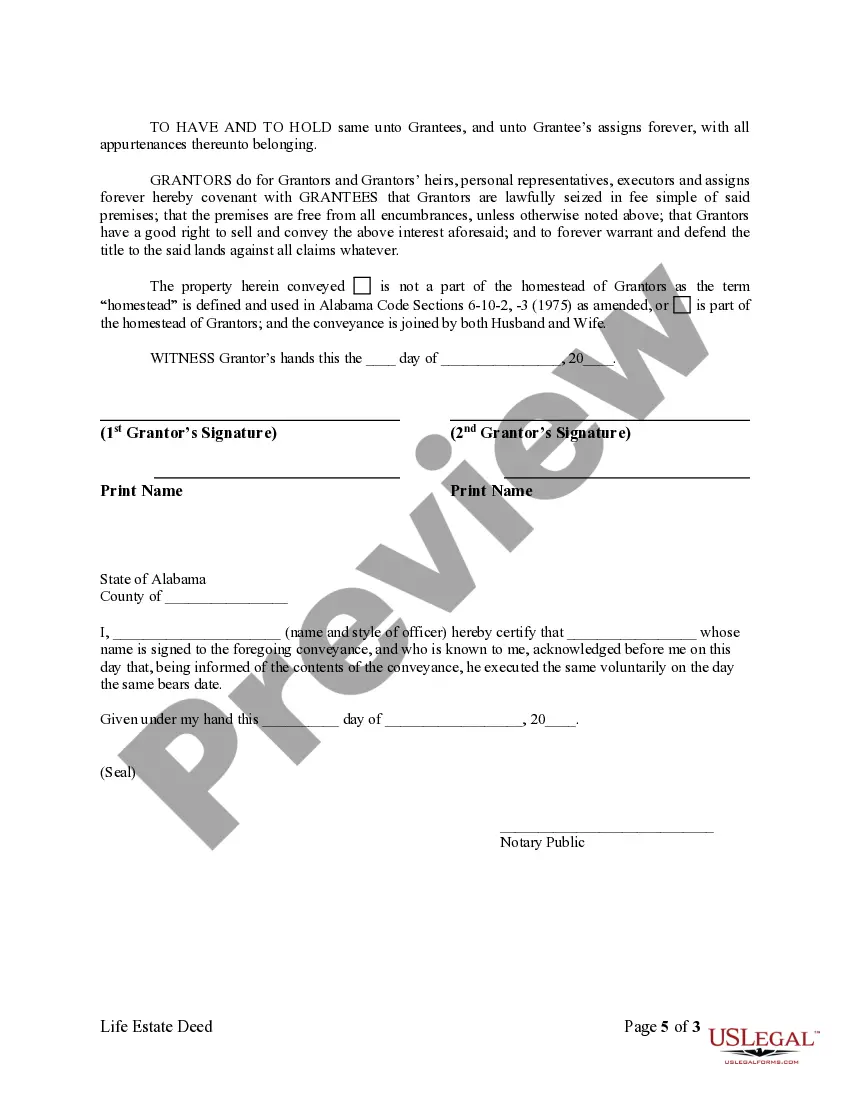

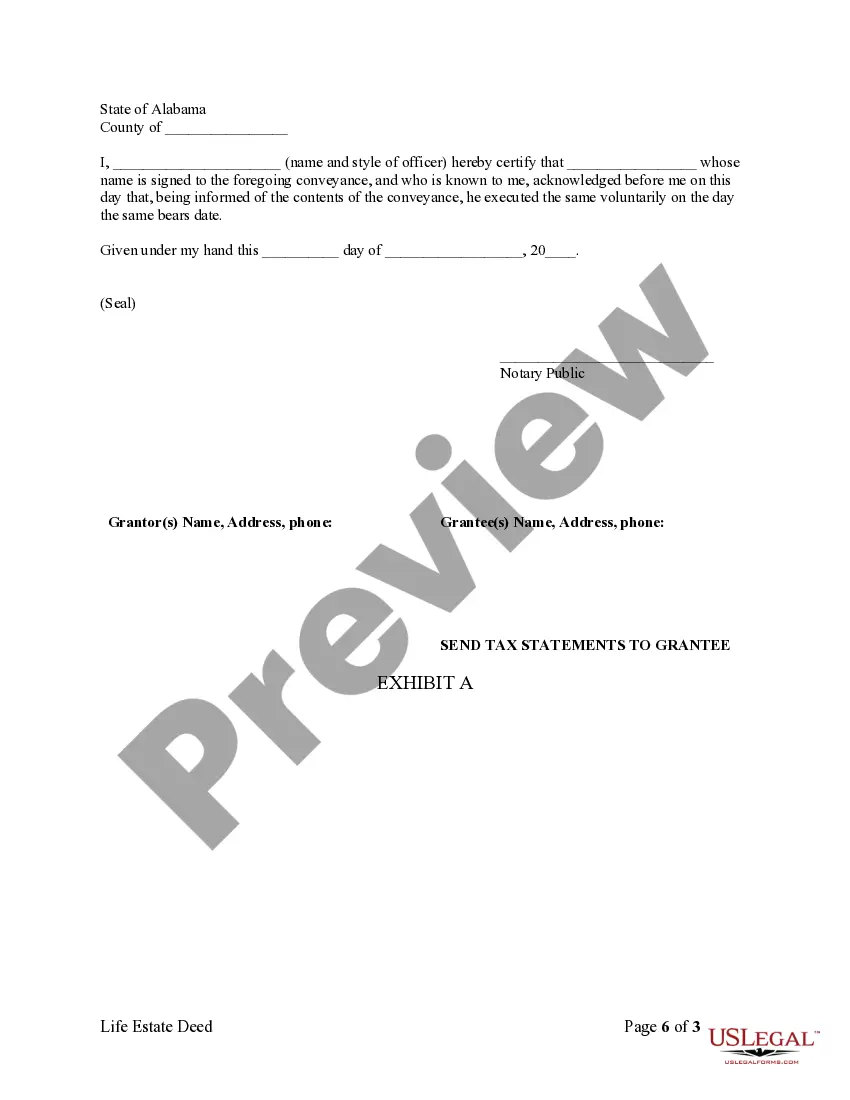

This form is a Warranty Deed where the grantors are husband and wife and the grantees are husband and wife. The grantees have a life estate interest in the named property.

Alabama Life Estate With Existing Mortgage

Description

Form popularity

FAQ

Yes, generally, a mortgage does not automatically get wiped out upon the death of the homeowner. Instead, the responsibility for repaying the mortgage typically falls to the estate or the heirs, especially if the property is subject to an Alabama life estate with existing mortgage. The mortgage company may seek repayment from the estate before assets are distributed. It's advisable to consult with a financial or legal advisor to understand your obligations.

If a homeowner in Alabama dies without a will, their property will undergo probate, with the state laws determining its distribution. In such cases, an Alabama life estate with existing mortgage can create complexities, especially regarding responsibilities for the mortgage. Typically, the house may pass to the deceased's heirs according to the state's intestacy laws. Working with a legal service, like uslegalforms, can guide you through this process.

When someone dies, their bank accounts generally go through a legal process known as probate. If the account is in the deceased's name alone, the funds may not be accessible until the estate is settled. However, if the account is part of an Alabama life estate with existing mortgage, the rules governing the estate's assets will apply. Ensure that you review the account's beneficiary designations, as this can affect how the funds are distributed.

In Alabama, you may be responsible for your spouse's debts after their death if those debts were joint or incurred during the marriage. However, your liability depends on the source of the debt and whether you co-signed or took the debt out together. It's important to review the Alabama life estate with existing mortgage laws to understand how property and debts are handled. Consulting with a legal expert can help clarify your financial responsibilities.

In Canada, a life estate grants ownership to one individual, known as the life tenant, for the duration of their life. The property is transferred to a remainderman upon the life tenant's death. However, if you are dealing with an Alabama life estate with existing mortgage, it's crucial to understand that the obligations tied to the mortgage may complicate matters. Proper legal guidance can help clarify ownership and responsibilities in different jurisdictions.

A ladybird deed is a unique estate planning tool used in Alabama that allows property owners to transfer their real estate to a beneficiary while retaining control over the property during their lifetime. With a ladybird deed, the owner can sell, maintain, or mortgage the property without needing the beneficiary's consent. This approach can be particularly useful when dealing with an Alabama life estate with existing mortgage, as it helps avoid probate and simplifies the transfer of assets upon death.

Yes, property can be transferred without probate in Alabama if it falls under certain exemptions. If the property is held as an Alabama life estate with an existing mortgage, the surviving tenant might be able to assume ownership without probate. However, this may depend on the specific circumstances of the mortgage and the estate. Utilizing platforms like USLegalForms can simplify this process by providing the necessary forms and guidance to help you navigate your options.

Transferring a deed after death in Alabama involves identifying the type of estate the deceased had. If the property was held in an Alabama life estate with an existing mortgage, you will need to address the mortgage terms during the transfer. Once the mortgage is resolved, prepare and file a new deed with the local probate office, outlining the terms of the transfer. It's advisable to seek guidance from an attorney to ensure compliance with all legal requirements.

To transfer a property deed after death in Alabama, you need to ensure that the deceased owned the property as a life estate. In many cases, if the deceased had a life estate with an existing mortgage, the mortgage must be settled before the transfer. You can often initiate this process by filing a new deed with the probate court, following state regulations. Consulting with a legal expert can help streamline this process, ensuring that you navigate the specific requirements in Alabama.

In Alabama, a deed generally takes precedence over a will regarding property transfer. This means that if a deed conveys property to someone, that person owns the property regardless of the will's instructions. Understanding the implications of an Alabama life estate with existing mortgage and how deeds work is vital for making informed decisions about your property.