Transfer on Death Deed - Arkansas - Individual to Individual: This deed is used to transfer the ownership or title of a parcel of land, attaching any existing covenants, upon the death of the Grantor to the Grantee. It does not transfer any present ownership interest in the property and is revocable at any time. Therefore, it is commonly used to avoid probate upon death.

- US Legal Forms

- Deeds

-

Arkansas Transfer on Death Deed or TOD - Beneficiary Deed for...

Beneficiary Deed Arkansas Form

Description Transfer On Death Deed Arkansas

Death Tod Beneficiary Related forms

View Financed house lend for sale kent in Arizona

View Financed house lend for sale kent in Phoenix

View Financed house lend for sale kent in Maricopa

View Financed house lend for sale kent in Pima

View Financed house lend for sale kent in Florida

Related legal definitions

How to fill out Death Beneficiary Form?

Bureaucracy demands precision and accuracy. If you do not deal with filling in documents like Beneficiary Deed Arkansas Form daily, it can result in some confusion. Choosing the right sample from the start will guarantee that your document submission will go efficiently and prevent any inconveniences of re-submitting a file or performing the same work completely from scratch. You can always find the correct sample for your documentation in US Legal Forms.

US Legal Forms is the biggest online forms collection that offers over 85 thousand samples for multiple fields. You can obtain the latest and the most relevant version of the Beneficiary Deed Arkansas Form by simply browsing it on the platform. Find, store, and download templates in your account or consult with the description to make sure you have the right one at hand.

With an account at US Legal Forms, it is possible to acquire, store in one place, and navigate the templates you save to access them in several clicks. When on the webpage, click the Log In button to authorize. Then, go to the My Forms page, where the list of your documents is kept. Explore the description of the forms and download the ones you require at any time. If you are not a subscribed user, locating the required sample would take a few additional steps:

- Find the template with the help of the search field.

- Ensure the Beneficiary Deed Arkansas Form you’ve located is relevant for your state or county.

- Open the preview or browse the description containing the details on the use of the sample.

- If the outcome matches your search, click the Buy Now button.

- Pick the suitable option among the proposed pricing plans.

- Log in to your account or create a new one.

- Complete the purchase with the help of a credit card or PayPal account.

- Download the form in the format of your choice.

Getting the right and updated samples for your documentation is a matter of a few minutes with an account at US Legal Forms. Drop the bureaucracy concerns and make your work with papers easier.

Transfer Death Deed Form Form Rating

Arkansas Death Individual Form popularity

Transfer Death Document Other Form Names

Beneficiary Deed Arkansas Form Related Searches

-

arkansas beneficiary deed form free

-

where can i get a beneficiary deed form

-

free beneficiary deed form

-

beneficiary deed arkansas medicaid

-

beneficiary deed in arkansas

-

transfer on death deed pdf

-

arkansas deed requirements

-

arkansas beneficiary deed statute

-

free beneficiary deed form

-

arkansas deed transfer form

-

arkansas deed requirements

-

beneficiary deed arkansas medicaid

Death Beneficiary Form Interesting Questions

A Beneficiary Deed in Arkansas is a legal document that allows a property owner to transfer their real estate property to one or more designated beneficiaries upon their death, without the need for probate.

Any property owner in Arkansas, who is of sound mind and legal age (18 years or older), can create a Beneficiary Deed to transfer their property to beneficiaries.

Using a Beneficiary Deed in Arkansas can help avoid probate, ensuring a faster and less expensive transfer of property after the owner's death. It also allows the owner to retain full control over the property during their lifetime.

Yes, a Beneficiary Deed in Arkansas can be changed or revoked at any time as long as the property owner is still alive and mentally competent. This can be done by executing a new deed or by recording a revocation notice with the County Recorder's Office.

While it is not required to have an attorney, it is highly recommended to consult with a qualified real estate attorney in Arkansas to ensure the proper execution and recording of the Beneficiary Deed.

Yes, a property with a mortgage can have a Beneficiary Deed in Arkansas. The property will be transferred subject to the existing mortgage, and the beneficiary will be responsible for continuing the mortgage payments.

If the designated beneficiary predeceases the property owner, it is advisable to have alternate or contingent beneficiaries named in the Beneficiary Deed. If there are no alternate beneficiaries named, the property will pass according to the property owner's will or through intestate succession if there is no will.

Beneficiary Deed statutes vary from state to state, so a Beneficiary Deed created in Arkansas may not be valid in another state. If you own property in multiple states, it is recommended to consult with an attorney in each state to ensure your estate planning goals are properly addressed.

In Arkansas, there is no real estate transfer tax or fee associated with executing a Beneficiary Deed. However, it is important to consider potential inheritance taxes that may be imposed at the state or federal level upon the property owner's death.

Transfer Death Deed Trusted and secure by over 3 million people of the world’s leading companies

-

No results found.

-

Arkansas

-

Alabama

-

Alaska

-

Arizona

-

California

-

Colorado

-

Connecticut

-

Georgia

-

Idaho

-

Illinois

-

Indiana

-

Iowa

-

Kansas

-

Kentucky

-

Maryland

-

Massachusetts

-

Minnesota

-

Missouri

-

Montana

-

Nebraska

-

Nevada

-

New Hampshire

-

New Mexico

-

North Carolina

-

North Dakota

-

Ohio

-

Pennsylvania

-

Rhode Island

-

South Carolina

-

Tennessee

-

Utah

-

Vermont

-

Virginia

-

Washington

-

West Virginia

-

Wisconsin

-

Wyoming

Contract for Deed - General - Arkansas

(3) An acknowledgment in any of these forms shall be sufficient to entitle the instrument to be recorded and to be read in evidence.

(b) The acknowledgment of a married person, both as to the disposition of his or her own property and as to the relinquishment of dower, curtesy, and homestead in the property of a spouse, may be made in the same form as if that person were sole and without any examination separate and apart from a spouse, and without necessity for a specific reference therein to the interest so conveyed or relinquished.

Acts 1937, No. 44, § 1; Pope’s Dig., § 1831; Acts 1981, No. 714, § 3; A.S.A. 1947, § 49-201.

Title 18. Property.

Subtitle 2. Real Property

Chapter 12. Conveyances.

Subchapter 2. Acknowledgment And Proof Of Instruments

18-12-203. Officers authorized to take proof or acknowledgment of real estate conveyances.

(a) The proof or acknowledgment of every deed or instrument of writing for the conveyance of any real estate shall be taken by one (1) of the following courts or officers:

(1) When acknowledged or proved within this state, before the Supreme Court, the circuit court, or any justices or judges thereof, the clerk of any court of record, any county judge, or before any notary public;

(2) When acknowledged or proved outside this state, and within the United States or its territories, or in any of the colonies or possessions or dependencies of the United States, before any court of the United States, or any state or territory, or colony or possession or dependency of the United States, having a seal, or a clerk of any such court, or before any notary public, or before the mayor of any incorporated city or town, or the chief officer of any city or town having a seal, or before a commissioner appointed by the Governor; and

(3) When acknowledged or proved outside the United States, before any:

(A) Court of any state, kingdom, or empire having a seal;

(B) Mayor or chief officer of any city or town having an official seal; or

(C) Officer of any foreign country who by the laws of that country is authorized to take probate of the conveyance of real estate of his or her own country if the officer has, by law, an official seal.

(b) The acknowledgment of any deed or mortgage, when taken outside the United States, may be taken and certified by a United States consul.

Rev. Stat., ch. 31, § 13; Acts 1874, No. 13, § 1, p. 58; 1887, No. 91, § 1, p. 142; 1897, No. 26, § 1, p. 33; 1899, No. 150, § 1, p. 276; C. & M. Dig., § 1516; Acts 1921, No. 233, § 1; 1923, No. 464, §§ 1, 2; Pope’s Dig., § 1825; A.S.A. 1947, §§ 49-202, 49-203; Acts 2003, No. 1185, § 252.

Title 18. Property.

Subtitle 2. Real Property

Chapter 12. Conveyances.

Subchapter 2. Acknowledgment And Proof Of Instruments

18-12-206. Manner of making acknowledgment – Proof of deed or instrument – Proof of identity of grantor or witness.

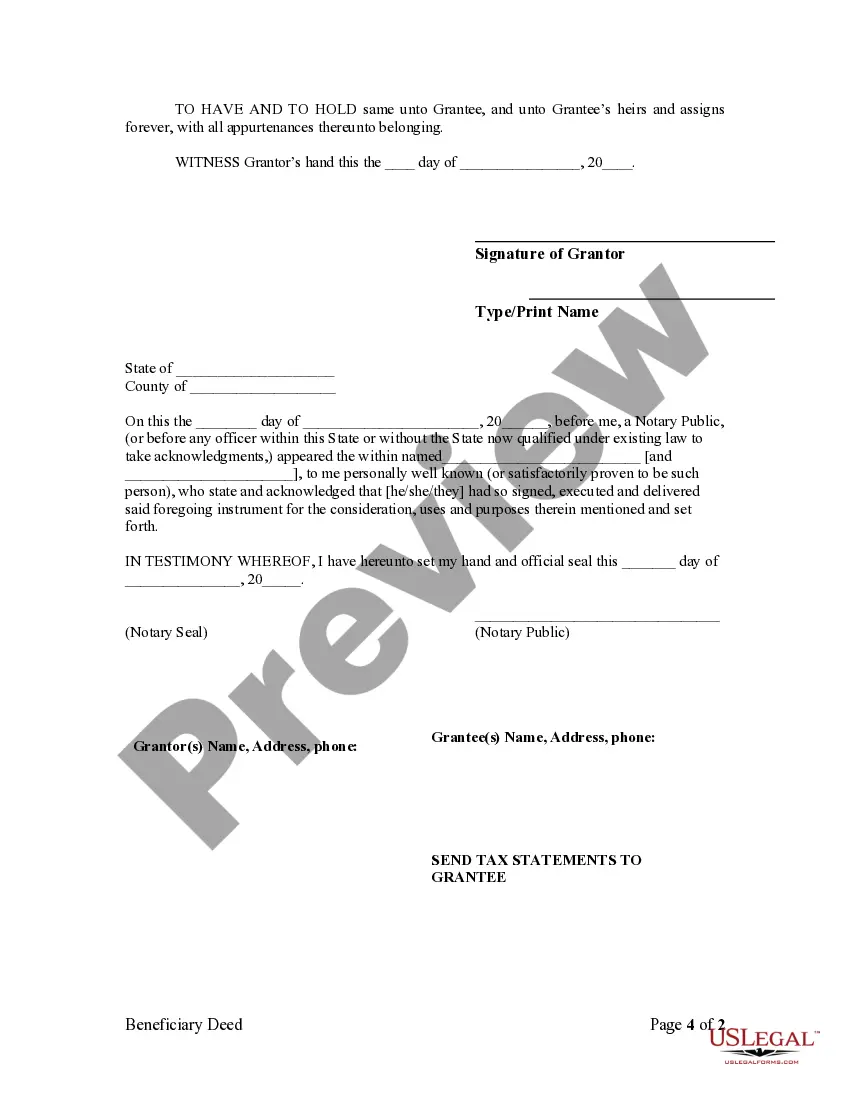

(a) The acknowledgment of deeds and instruments of writing for the conveyance of real estate, or whereby such real estate is to be affected in law or equity, shall be by the grantor appearing in person before a court or officer having the authority by law to take the acknowledgment and stating that he or she had executed the deed or instrument for the consideration and purposes therein mentioned and set forth.

(b) When a deed or instrument referred to in subsection (a) of this section is to be proved, it shall be done by one (1) or more of the subscribing witnesses personally appearing before the proper court or officer and stating on oath that he or she saw the grantor subscribe the deed or instrument of writing or that the grantor acknowledged in his or her presence that he or she had subscribed and executed the deed or instrument for the purposes and consideration therein mentioned, and that he or she had subscribed the deed or instrument as a witness at the request of the grantor.

(c) If any grantor has not acknowledged the execution of a deed or instrument referred to in subsection (a) of this section and the subscribing witnesses are dead or cannot be had, then the deed or instrument may be proved by the evidence of the handwriting of the grantor and of at least one (1) of the subscribing witnesses. This evidence shall consist of the deposition of two (2) or more disinterested persons, swearing to each signature.

(d) (1) When any grantor in any deed or instrument that conveys real estate or whereby any real estate may be affected in law or equity, or any witness to any like instrument, shall present himself or herself before any court or other officer for the purpose of acknowledging or proving the execution of the deed or instrument, if the grantor or witness shall be personally unknown to the court or officer, his or her identity and his or her being the person he or she purports to be on the face of such instrument of writing shall be proved to the court or officer.

(2) Proof may be made by witnesses known to the court or officer or by the affidavit of the grantor or witness if the court or officer shall be satisfied therewith. The proof or affidavit shall also be endorsed on the deed or instrument of writing.

Rev. Stat., ch. 31, §§ 17-20; C. & M. Dig., §§ 1520-1523; Pope’s Dig., §§ 1829, 1830, 1832, 1833; A.S.A. 1947, §§ 49-207 — 49-210.

Title 18. Property.

Subtitle 2. Real Property

Chapter 12. Conveyances.

Subchapter 2. Acknowledgment And Proof Of Instruments

18-12-208. Defects.

(a) All deeds, conveyances, deeds of trust, mortgages, marriage contracts, and other instruments in writing affecting or purporting to affect the title to any real estate or personal property situated in this state, which have been recorded and which are defective or ineffectual because:

(1) Of failure to comply with § 18-12-403;

(2) The officer who certified the acknowledgment or acknowledgments to such instruments omitted any words required by law to be in the certificate or acknowledgments;

(3) The officer failed or omitted to attach his or her seal to the certificate;

(4) The officer attached to any such certificate a seal not bearing the words and devices required by law;

(5) The officer was a mayor of a city or an incorporated town in the State of Arkansas and as such was not authorized to certify to executions and acknowledgments to such instruments, or was the deputy of an official duly authorized by law to take acknowledgments but whose deputy was not so authorized;

(6) The notary public failed to state the date of the expiration of his or her commission on the certificate of acknowledgment, or incorrectly stated it thereon;

(7) The officer incorrectly dated the certificate of acknowledgment or failed to state the county wherein the acknowledgment was taken; or

(8) The acknowledgment was certified in any county of the State of Arkansas by any person holding an unexpired commission as notary public under the laws of the state who had, at the time of the certification, ceased to be a resident of the county within and for which he or she was commissioned, shall be as binding and effectual as though the certificate of acknowledgment or proof of execution was in due form, bore the proper seal, and was certified to by a duly authorized officer.

(b) A deed, conveyance, deed of trust, mortgage, marriage contract, and other instrument in writing, affecting or purporting to affect the title to any real estate or personal property situated in this state, which is executed after August 13, 1993, shall not be deemed defective or ineffectual because:

(1) The officer failed or omitted to attach his or her seal to the certificate;

(2) The officer attached to any such certificate a seal not bearing the words and devices required by law;

(3) The notary public failed to state the date of the expiration of his or her commission on the certificate of acknowledgment, or incorrectly stated it thereon;

(4) The officer incorrectly dated the certificate of acknowledgment or failed to state the county wherein the acknowledgment was taken; or

(5) The acknowledgment was certified in any county of the State of Arkansas by any person holding an unexpired commission as notary public under the laws of the state who had, at the time of the certification, ceased to be a resident of the county within and for which he or she was commissioned.

(c) A deed, conveyance, deed of trust, mortgage, marriage contract, and any other instrument in writing, affecting or purporting to affect the title to any real estate or personal property situated in this state, whether executed before, on, or after the effective date of this subsection, shall not be found insufficient to satisfy the requirements of § 18-12-202:

(1) Because the acknowledgment thereof does not strictly comply with the form contained in § 16-47-107 or omits the words “for the consideration, uses, and purposes therein mentioned or set forth” or uses similar words;

(2) Because the gender listed in the acknowledgment thereof does not match the gender of the person acknowledging the instrument;

(3) Because the acknowledgment thereof does not identify the title or position of the person acknowledging the instrument on behalf of a corporation, partnership, company, trust, association, or other entity; or

(4) Where a good faith attempt at material compliance with § 16-47-107(a), (b), or (c), as applicable, has been made and there is no factual dispute as to the authenticity of the signature of the person making acknowledgement thereof.

(d) Notwithstanding an acknowledgment to a deed or other instrument which may contain one (1) or more of the defects set forth in this section, if a deed or other instrument is recorded, it shall:

(1) Provide constructive notice thereafter to all parties of the matters contained in the deed or other instrument; and

(2) Be treated as any other deed or instrument in writing under § 16-47-110, and may be read into evidence in any court in this state without further proof of execution.

(e) A valid jurat may act as a substitute for a certificate of acknowledgment for instruments recorded on or after the effective date of this subsection.

Acts 1955, No. 101, § 1; A.S.A. 1947, § 49-213; Acts 1993, No. 1081, §§ 1, 2; 2013, No. 999, § 4.

18-12-209. Recorded deed or written instrument affecting real estate.

(a) Every deed or instrument in writing which conveys or affects real estate and which is acknowledged or proved and certified as prescribed by this act may, together with the certificate of acknowledgment, proof, or relinquishment of dower, be recorded by the recorder of the county where such land to be conveyed or affected thereby is located, and when so recorded may be read in evidence in any court in this state without further proof of execution.

(b) If it appears at any time that any deed or instrument duly acknowledged or proved and recorded as prescribed by this act is lost or not within the power and control of the party wishing to use the deed or instrument, the record thereof, or a transcript of the record certified by the recorder, may be read in evidence without further proof of execution.

(c) Neither the certificate of acknowledgment nor the probate of any such deed or instrument, nor the record or transcript thereof, shall be conclusive, but it may be rebutted.

Rev. Stat., ch. 31, §§ 26-28; C. & M. Dig., §§ 1530-1532; Pope’s Dig., §§ 1840-1842; A.S.A. 1947, §§ 28-919 — 28-921.

Title 18. Property.

Subtitle 2. Real Property

Chapter 12. Conveyances.

Subchapter 6. Miscellaneous Conveyances

18-12-601. After-acquired title.

If any person shall convey any real estate by deed purporting to convey it in fee simple absolute, or any less estate, and shall not at the time of the conveyance have the legal estate in the lands, but shall afterwards acquire it, then the legal or equitable estate afterwards acquired shall immediately pass to the grantee and the conveyance shall be as valid as if the legal or equitable estate had been in the grantor at the time of the conveyance.

Rev. Stat., ch. 31, § 4; C. & M. Dig., § 1498; Pope’s Dig., § 1798; A.S.A. 1947, § 50-404.

Title 18. Property.

Subtitle 2. Real Property

Chapter 12. Conveyances.

Subchapter 6. Miscellaneous Conveyances

18-12-602. Land in adverse possession.

Any person claiming title to any real estate, notwithstanding there may be an adverse possession thereof, may sell and convey his or her interest in the same manner and with like effect as if he or she were in the actual possession of the real estate.

Rev. Stat., ch. 31, § 6; C. & M. Dig., § 1500; Pope’s Dig., § 1809; A.S.A. 1947, § 50-408

Title 18. Property.

Subtitle 2. Real Property

Chapter 12. Conveyances.

Subchapter 6. Miscellaneous Conveyances

18-12-603. Grants to two or more as tenancy in common.

Every interest in real estate granted or devised to two (2) or more persons, other than executors and trustees as such, shall be in tenancy in common unless expressly declared in the grant or devise to be a joint tenancy.

Rev. Stat., ch. 31, § 9; C. & M. Dig., § 1503; Pope’s Dig., § 1812; A.S.A. 1947, § 50-411.

Title 18. Property.

Subtitle 2. Real Property

Chapter 12. Conveyances.

Subchapter 6. Miscellaneous Conveyances

18-12-604. Deed to trustee or agent.

(a) (1) The appearance of the words “trustee”, “as trustee”, or “agent” following the names of the grantee in any deed of conveyance of land executed, without other language showing a trust, shall not be deemed to give notice to, or put on inquiry, any person dealing with the land that a trust or agency exists or that there are other beneficiaries of the conveyance except the grantee named therein.

(2) The conveyance shall vest the title to the land in the grantee.

(b) A conveyance of land by the grantee, whether followed by the words “trustee”, “as trustee”, or “agent” or not, shall vest title in his or her grantee free from any claims of all persons or corporations.

Acts 1919, No. 444, § 1; C. & M. Dig., § 1504; Pope’s Dig., § 1813; A.S.A. 1947, § 50-412.

Title 18. Property.

Subtitle 2. Real Property

Chapter 12. Conveyances.

Subchapter 6. Miscellaneous Conveyances

18-12-605. Deeds of administrators, executors, guardians, commissioners, and sheriffs.

(a) (1) All deeds of conveyance made by an administrator, an executor, a guardian, or a commissioner, deeds of real estate sold under an execution made and executed by a sheriff, and deeds made and executed by a trustee or an attorney pursuant to a foreclosure of a deed of trust or mortgage, duly made and executed, acknowledged, and recorded, as now required by law and purporting to convey real estate, shall vest in the grantee and his or her heirs and assigns a good and valid title, both in law and in equity.

(2) (A) The deeds shall be evidence of the facts recited in the deeds and of the legality and regularity of the sale of the real estate so conveyed.

(B) However, the deeds do not warrant title to a subsequent grantee, and any subsequent grantee may not assert or claim any warranty of title deriving from the deeds.

(b) Nothing in this section shall prohibit a deed made under subdivision (a)(1) of this section from warranting title by express use of warranty language.

(c) Every deed so made, executed, acknowledged, and recorded, or a certified copy of the deed, under the seal of the recorder of the proper county shall be received in evidence in any court in this state without further proof of its execution.

Acts 1853, §§ 1, 2, p. 207; C. & M. Dig., §§ 1534, 1535; Pope’s Dig., §§ 1844, 1845; A.S.A. 1947, §§ 50-419, 50-420; Acts 2005, No. 1884, § 1.

Title 18. Property.

Subtitle 2. Real Property

Chapter 12. Conveyances.

Subchapter 6. Miscellaneous Conveyances

18-12-608. Beneficiary deeds — Terms — Recording required. (Amended March 9, 2007 by Act 243)

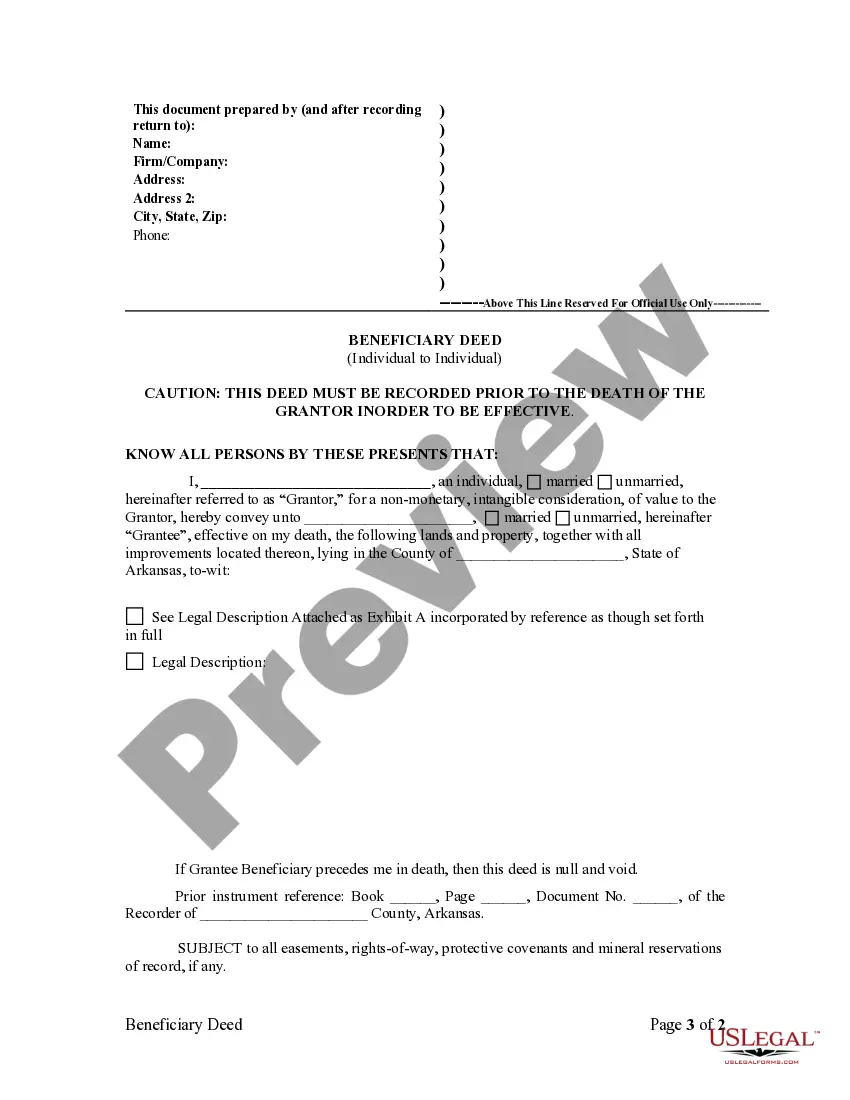

(a) (1) (A) A beneficiary deed is a deed without current tangible consideration that conveys upon the death of the owner an ownership interest in real property other than a leasehold or lien interest to a grantee designated by the owner and that expressly states that the deed is not to take effect until the death of the owner.

(B) (i) A beneficiary deed transfers the interest to the designated grantee effective upon the death of the owner, subject to:

(a) All conveyances, assignments, contracts, leases, mortgages, deeds of trust, liens, security pledges, oil, gas, or mineral leases, and other encumbrances made by the owner or to which the real property was subject at the time of the owner’s death, whether or not the conveyance or encumbrance was created before or after the execution of the beneficiary deed; and

(b) A claim for reimbursement of federal or state benefits by the Department of Human Services from the estate of the grantor or the interest acquired by a grantee of the beneficiary deed under § 20-76-436.

(ii) No legal or equitable interest shall vest in the grantee until the death of the owner prior to revocation of the beneficiary deed.

(2) (A) The owner may designate multiple grantees under a beneficiary deed.

(B) Multiple grantees may be joint tenants with right of survivorship, tenants in common, holders of a tenancy by the entirety, or any other tenancy that is otherwise valid under the laws of this state.

(3) (A) The owner may designate one (1) or more successor grantees, including one (1) or more unnamed heirs of the original grantee or grantees, under a beneficiary deed.

(B) The condition upon which the interest of a successor grantee vests, such as the failure of the original grantee to survive the grantor, shall be included in the beneficiary deed.

(b) (1) If real property is owned as a tenancy by the entirety or as a joint tenancy with the right of survivorship, a beneficiary deed that conveys an interest in the real property to a grantee designated by all of the then surviving owners and that expressly states the beneficiary deed is not to take effect until the death of the last surviving owner transfers the interest to the designated grantee effective upon the death of the last surviving owner.

(2) (A) If a beneficiary deed is executed by fewer than all of the owners of real property owned as a tenancy by the entirety or as joint tenants with right of survivorship, the beneficiary deed is valid if the last surviving owner is a person who executed the beneficiary deed.

(B) If the last surviving owner did not execute the beneficiary deed, the beneficiary deed is invalid.

(c) (1) A beneficiary deed is valid only if the beneficiary deed is recorded before the death of the owner or the last surviving owner as provided by law in the office of the county recorder of the county in which the real property is located.

(2) A beneficiary deed may be used to transfer an interest in real property to a trustee of a trust estate even if the trust is revocable and may include one (1) or more unnamed successor trustees as successor grantees.

(d) (1) A beneficiary deed may be revoked at any time by the owner or, if there is more than one (1) owner, by any of the owners who executed the beneficiary deed.

(2) To be effective, the revocation shall be:

(A) Executed before the death of the owner who executes the revocation; and

(B) Recorded in the office of the county recorder of the county in which the real property is located before the death of the owner as provided by law.

(3) If the revocation is not executed by all the owners, the revocation is not effective unless executed by the last surviving owner and recorded before the death of the last surviving owner.

(4) A beneficiary deed that complies with this section may not be revoked, altered, or amended by the provisions of the owner’s will.

(e) If an owner executes more than one (1) beneficiary deed concerning the same real property, the recorded beneficiary deed that is last signed before the owner’s death is the effective beneficiary deed, regardless of the sequence of recording.

(f) (1) This section does not prohibit other methods of conveying real property that are permitted by law and that have the effect of postponing enjoyment of an interest in real property until the death of the owner.

(2) This section does not invalidate any deed otherwise effective by law to convey title to the interests and estates provided in the deed that is not recorded until after the death of the owner.

(g) A beneficiary deed is sufficient if it complies with other applicable laws and if it is in substantially the following form:

“Beneficiary Deed

(h) The instrument of revocation shall be sufficient if it complies with other applicable laws and is in substantially the following form:

Revocation of Beneficiary Deed

Acts 2005, No. 1918, § 1; 2007, No. 243, § 1.

Arkansas Case Law

Arkansas courts have ruled in Ashworth v. Hankins, 452 S.W.2d 838 (Ark. Sup.Ct. 1970); Held vendor may waive his right to forfeiture under a contract for deed, but may thereafter reinstate it with proper notice. Case shows Arkansas interpretation of contract for deed forfeiture clauses. Forfeiture provisions are normally held to be valid and timely enforced.

Contract for Deed - General - Arkansas

(3) An acknowledgment in any of these forms shall be sufficient to entitle the instrument to be recorded and to be read in evidence.

(b) The acknowledgment of a married person, both as to the disposition of his or her own property and as to the relinquishment of dower, curtesy, and homestead in the property of a spouse, may be made in the same form as if that person were sole and without any examination separate and apart from a spouse, and without necessity for a specific reference therein to the interest so conveyed or relinquished.

Acts 1937, No. 44, § 1; Pope’s Dig., § 1831; Acts 1981, No. 714, § 3; A.S.A. 1947, § 49-201.

Title 18. Property.

Subtitle 2. Real Property

Chapter 12. Conveyances.

Subchapter 2. Acknowledgment And Proof Of Instruments

18-12-203. Officers authorized to take proof or acknowledgment of real estate conveyances.

(a) The proof or acknowledgment of every deed or instrument of writing for the conveyance of any real estate shall be taken by one (1) of the following courts or officers:

(1) When acknowledged or proved within this state, before the Supreme Court, the circuit court, or any justices or judges thereof, the clerk of any court of record, any county judge, or before any notary public;

(2) When acknowledged or proved outside this state, and within the United States or its territories, or in any of the colonies or possessions or dependencies of the United States, before any court of the United States, or any state or territory, or colony or possession or dependency of the United States, having a seal, or a clerk of any such court, or before any notary public, or before the mayor of any incorporated city or town, or the chief officer of any city or town having a seal, or before a commissioner appointed by the Governor; and

(3) When acknowledged or proved outside the United States, before any:

(A) Court of any state, kingdom, or empire having a seal;

(B) Mayor or chief officer of any city or town having an official seal; or

(C) Officer of any foreign country who by the laws of that country is authorized to take probate of the conveyance of real estate of his or her own country if the officer has, by law, an official seal.

(b) The acknowledgment of any deed or mortgage, when taken outside the United States, may be taken and certified by a United States consul.

Rev. Stat., ch. 31, § 13; Acts 1874, No. 13, § 1, p. 58; 1887, No. 91, § 1, p. 142; 1897, No. 26, § 1, p. 33; 1899, No. 150, § 1, p. 276; C. & M. Dig., § 1516; Acts 1921, No. 233, § 1; 1923, No. 464, §§ 1, 2; Pope’s Dig., § 1825; A.S.A. 1947, §§ 49-202, 49-203; Acts 2003, No. 1185, § 252.

Title 18. Property.

Subtitle 2. Real Property

Chapter 12. Conveyances.

Subchapter 2. Acknowledgment And Proof Of Instruments

18-12-206. Manner of making acknowledgment – Proof of deed or instrument – Proof of identity of grantor or witness.

(a) The acknowledgment of deeds and instruments of writing for the conveyance of real estate, or whereby such real estate is to be affected in law or equity, shall be by the grantor appearing in person before a court or officer having the authority by law to take the acknowledgment and stating that he or she had executed the deed or instrument for the consideration and purposes therein mentioned and set forth.

(b) When a deed or instrument referred to in subsection (a) of this section is to be proved, it shall be done by one (1) or more of the subscribing witnesses personally appearing before the proper court or officer and stating on oath that he or she saw the grantor subscribe the deed or instrument of writing or that the grantor acknowledged in his or her presence that he or she had subscribed and executed the deed or instrument for the purposes and consideration therein mentioned, and that he or she had subscribed the deed or instrument as a witness at the request of the grantor.

(c) If any grantor has not acknowledged the execution of a deed or instrument referred to in subsection (a) of this section and the subscribing witnesses are dead or cannot be had, then the deed or instrument may be proved by the evidence of the handwriting of the grantor and of at least one (1) of the subscribing witnesses. This evidence shall consist of the deposition of two (2) or more disinterested persons, swearing to each signature.

(d) (1) When any grantor in any deed or instrument that conveys real estate or whereby any real estate may be affected in law or equity, or any witness to any like instrument, shall present himself or herself before any court or other officer for the purpose of acknowledging or proving the execution of the deed or instrument, if the grantor or witness shall be personally unknown to the court or officer, his or her identity and his or her being the person he or she purports to be on the face of such instrument of writing shall be proved to the court or officer.

(2) Proof may be made by witnesses known to the court or officer or by the affidavit of the grantor or witness if the court or officer shall be satisfied therewith. The proof or affidavit shall also be endorsed on the deed or instrument of writing.

Rev. Stat., ch. 31, §§ 17-20; C. & M. Dig., §§ 1520-1523; Pope’s Dig., §§ 1829, 1830, 1832, 1833; A.S.A. 1947, §§ 49-207 — 49-210.

Title 18. Property.

Subtitle 2. Real Property

Chapter 12. Conveyances.

Subchapter 2. Acknowledgment And Proof Of Instruments

18-12-208. Defects.

(a) All deeds, conveyances, deeds of trust, mortgages, marriage contracts, and other instruments in writing affecting or purporting to affect the title to any real estate or personal property situated in this state, which have been recorded and which are defective or ineffectual because:

(1) Of failure to comply with § 18-12-403;

(2) The officer who certified the acknowledgment or acknowledgments to such instruments omitted any words required by law to be in the certificate or acknowledgments;

(3) The officer failed or omitted to attach his or her seal to the certificate;

(4) The officer attached to any such certificate a seal not bearing the words and devices required by law;

(5) The officer was a mayor of a city or an incorporated town in the State of Arkansas and as such was not authorized to certify to executions and acknowledgments to such instruments, or was the deputy of an official duly authorized by law to take acknowledgments but whose deputy was not so authorized;

(6) The notary public failed to state the date of the expiration of his or her commission on the certificate of acknowledgment, or incorrectly stated it thereon;

(7) The officer incorrectly dated the certificate of acknowledgment or failed to state the county wherein the acknowledgment was taken; or

(8) The acknowledgment was certified in any county of the State of Arkansas by any person holding an unexpired commission as notary public under the laws of the state who had, at the time of the certification, ceased to be a resident of the county within and for which he or she was commissioned, shall be as binding and effectual as though the certificate of acknowledgment or proof of execution was in due form, bore the proper seal, and was certified to by a duly authorized officer.

(b) A deed, conveyance, deed of trust, mortgage, marriage contract, and other instrument in writing, affecting or purporting to affect the title to any real estate or personal property situated in this state, which is executed after August 13, 1993, shall not be deemed defective or ineffectual because:

(1) The officer failed or omitted to attach his or her seal to the certificate;

(2) The officer attached to any such certificate a seal not bearing the words and devices required by law;

(3) The notary public failed to state the date of the expiration of his or her commission on the certificate of acknowledgment, or incorrectly stated it thereon;

(4) The officer incorrectly dated the certificate of acknowledgment or failed to state the county wherein the acknowledgment was taken; or

(5) The acknowledgment was certified in any county of the State of Arkansas by any person holding an unexpired commission as notary public under the laws of the state who had, at the time of the certification, ceased to be a resident of the county within and for which he or she was commissioned.

(c) A deed, conveyance, deed of trust, mortgage, marriage contract, and any other instrument in writing, affecting or purporting to affect the title to any real estate or personal property situated in this state, whether executed before, on, or after the effective date of this subsection, shall not be found insufficient to satisfy the requirements of § 18-12-202:

(1) Because the acknowledgment thereof does not strictly comply with the form contained in § 16-47-107 or omits the words “for the consideration, uses, and purposes therein mentioned or set forth” or uses similar words;

(2) Because the gender listed in the acknowledgment thereof does not match the gender of the person acknowledging the instrument;

(3) Because the acknowledgment thereof does not identify the title or position of the person acknowledging the instrument on behalf of a corporation, partnership, company, trust, association, or other entity; or

(4) Where a good faith attempt at material compliance with § 16-47-107(a), (b), or (c), as applicable, has been made and there is no factual dispute as to the authenticity of the signature of the person making acknowledgement thereof.

(d) Notwithstanding an acknowledgment to a deed or other instrument which may contain one (1) or more of the defects set forth in this section, if a deed or other instrument is recorded, it shall:

(1) Provide constructive notice thereafter to all parties of the matters contained in the deed or other instrument; and

(2) Be treated as any other deed or instrument in writing under § 16-47-110, and may be read into evidence in any court in this state without further proof of execution.

(e) A valid jurat may act as a substitute for a certificate of acknowledgment for instruments recorded on or after the effective date of this subsection.

Acts 1955, No. 101, § 1; A.S.A. 1947, § 49-213; Acts 1993, No. 1081, §§ 1, 2; 2013, No. 999, § 4.

18-12-209. Recorded deed or written instrument affecting real estate.

(a) Every deed or instrument in writing which conveys or affects real estate and which is acknowledged or proved and certified as prescribed by this act may, together with the certificate of acknowledgment, proof, or relinquishment of dower, be recorded by the recorder of the county where such land to be conveyed or affected thereby is located, and when so recorded may be read in evidence in any court in this state without further proof of execution.

(b) If it appears at any time that any deed or instrument duly acknowledged or proved and recorded as prescribed by this act is lost or not within the power and control of the party wishing to use the deed or instrument, the record thereof, or a transcript of the record certified by the recorder, may be read in evidence without further proof of execution.

(c) Neither the certificate of acknowledgment nor the probate of any such deed or instrument, nor the record or transcript thereof, shall be conclusive, but it may be rebutted.

Rev. Stat., ch. 31, §§ 26-28; C. & M. Dig., §§ 1530-1532; Pope’s Dig., §§ 1840-1842; A.S.A. 1947, §§ 28-919 — 28-921.

Title 18. Property.

Subtitle 2. Real Property

Chapter 12. Conveyances.

Subchapter 6. Miscellaneous Conveyances

18-12-601. After-acquired title.

If any person shall convey any real estate by deed purporting to convey it in fee simple absolute, or any less estate, and shall not at the time of the conveyance have the legal estate in the lands, but shall afterwards acquire it, then the legal or equitable estate afterwards acquired shall immediately pass to the grantee and the conveyance shall be as valid as if the legal or equitable estate had been in the grantor at the time of the conveyance.

Rev. Stat., ch. 31, § 4; C. & M. Dig., § 1498; Pope’s Dig., § 1798; A.S.A. 1947, § 50-404.

Title 18. Property.

Subtitle 2. Real Property

Chapter 12. Conveyances.

Subchapter 6. Miscellaneous Conveyances

18-12-602. Land in adverse possession.

Any person claiming title to any real estate, notwithstanding there may be an adverse possession thereof, may sell and convey his or her interest in the same manner and with like effect as if he or she were in the actual possession of the real estate.

Rev. Stat., ch. 31, § 6; C. & M. Dig., § 1500; Pope’s Dig., § 1809; A.S.A. 1947, § 50-408

Title 18. Property.

Subtitle 2. Real Property

Chapter 12. Conveyances.

Subchapter 6. Miscellaneous Conveyances

18-12-603. Grants to two or more as tenancy in common.

Every interest in real estate granted or devised to two (2) or more persons, other than executors and trustees as such, shall be in tenancy in common unless expressly declared in the grant or devise to be a joint tenancy.

Rev. Stat., ch. 31, § 9; C. & M. Dig., § 1503; Pope’s Dig., § 1812; A.S.A. 1947, § 50-411.

Title 18. Property.

Subtitle 2. Real Property

Chapter 12. Conveyances.

Subchapter 6. Miscellaneous Conveyances

18-12-604. Deed to trustee or agent.

(a) (1) The appearance of the words “trustee”, “as trustee”, or “agent” following the names of the grantee in any deed of conveyance of land executed, without other language showing a trust, shall not be deemed to give notice to, or put on inquiry, any person dealing with the land that a trust or agency exists or that there are other beneficiaries of the conveyance except the grantee named therein.

(2) The conveyance shall vest the title to the land in the grantee.

(b) A conveyance of land by the grantee, whether followed by the words “trustee”, “as trustee”, or “agent” or not, shall vest title in his or her grantee free from any claims of all persons or corporations.

Acts 1919, No. 444, § 1; C. & M. Dig., § 1504; Pope’s Dig., § 1813; A.S.A. 1947, § 50-412.

Title 18. Property.

Subtitle 2. Real Property

Chapter 12. Conveyances.

Subchapter 6. Miscellaneous Conveyances

18-12-605. Deeds of administrators, executors, guardians, commissioners, and sheriffs.

(a) (1) All deeds of conveyance made by an administrator, an executor, a guardian, or a commissioner, deeds of real estate sold under an execution made and executed by a sheriff, and deeds made and executed by a trustee or an attorney pursuant to a foreclosure of a deed of trust or mortgage, duly made and executed, acknowledged, and recorded, as now required by law and purporting to convey real estate, shall vest in the grantee and his or her heirs and assigns a good and valid title, both in law and in equity.

(2) (A) The deeds shall be evidence of the facts recited in the deeds and of the legality and regularity of the sale of the real estate so conveyed.

(B) However, the deeds do not warrant title to a subsequent grantee, and any subsequent grantee may not assert or claim any warranty of title deriving from the deeds.

(b) Nothing in this section shall prohibit a deed made under subdivision (a)(1) of this section from warranting title by express use of warranty language.

(c) Every deed so made, executed, acknowledged, and recorded, or a certified copy of the deed, under the seal of the recorder of the proper county shall be received in evidence in any court in this state without further proof of its execution.

Acts 1853, §§ 1, 2, p. 207; C. & M. Dig., §§ 1534, 1535; Pope’s Dig., §§ 1844, 1845; A.S.A. 1947, §§ 50-419, 50-420; Acts 2005, No. 1884, § 1.

Title 18. Property.

Subtitle 2. Real Property

Chapter 12. Conveyances.

Subchapter 6. Miscellaneous Conveyances

18-12-608. Beneficiary deeds — Terms — Recording required. (Amended March 9, 2007 by Act 243)

(a) (1) (A) A beneficiary deed is a deed without current tangible consideration that conveys upon the death of the owner an ownership interest in real property other than a leasehold or lien interest to a grantee designated by the owner and that expressly states that the deed is not to take effect until the death of the owner.

(B) (i) A beneficiary deed transfers the interest to the designated grantee effective upon the death of the owner, subject to:

(a) All conveyances, assignments, contracts, leases, mortgages, deeds of trust, liens, security pledges, oil, gas, or mineral leases, and other encumbrances made by the owner or to which the real property was subject at the time of the owner’s death, whether or not the conveyance or encumbrance was created before or after the execution of the beneficiary deed; and

(b) A claim for reimbursement of federal or state benefits by the Department of Human Services from the estate of the grantor or the interest acquired by a grantee of the beneficiary deed under § 20-76-436.

(ii) No legal or equitable interest shall vest in the grantee until the death of the owner prior to revocation of the beneficiary deed.

(2) (A) The owner may designate multiple grantees under a beneficiary deed.

(B) Multiple grantees may be joint tenants with right of survivorship, tenants in common, holders of a tenancy by the entirety, or any other tenancy that is otherwise valid under the laws of this state.

(3) (A) The owner may designate one (1) or more successor grantees, including one (1) or more unnamed heirs of the original grantee or grantees, under a beneficiary deed.

(B) The condition upon which the interest of a successor grantee vests, such as the failure of the original grantee to survive the grantor, shall be included in the beneficiary deed.

(b) (1) If real property is owned as a tenancy by the entirety or as a joint tenancy with the right of survivorship, a beneficiary deed that conveys an interest in the real property to a grantee designated by all of the then surviving owners and that expressly states the beneficiary deed is not to take effect until the death of the last surviving owner transfers the interest to the designated grantee effective upon the death of the last surviving owner.

(2) (A) If a beneficiary deed is executed by fewer than all of the owners of real property owned as a tenancy by the entirety or as joint tenants with right of survivorship, the beneficiary deed is valid if the last surviving owner is a person who executed the beneficiary deed.

(B) If the last surviving owner did not execute the beneficiary deed, the beneficiary deed is invalid.

(c) (1) A beneficiary deed is valid only if the beneficiary deed is recorded before the death of the owner or the last surviving owner as provided by law in the office of the county recorder of the county in which the real property is located.

(2) A beneficiary deed may be used to transfer an interest in real property to a trustee of a trust estate even if the trust is revocable and may include one (1) or more unnamed successor trustees as successor grantees.

(d) (1) A beneficiary deed may be revoked at any time by the owner or, if there is more than one (1) owner, by any of the owners who executed the beneficiary deed.

(2) To be effective, the revocation shall be:

(A) Executed before the death of the owner who executes the revocation; and

(B) Recorded in the office of the county recorder of the county in which the real property is located before the death of the owner as provided by law.

(3) If the revocation is not executed by all the owners, the revocation is not effective unless executed by the last surviving owner and recorded before the death of the last surviving owner.

(4) A beneficiary deed that complies with this section may not be revoked, altered, or amended by the provisions of the owner’s will.

(e) If an owner executes more than one (1) beneficiary deed concerning the same real property, the recorded beneficiary deed that is last signed before the owner’s death is the effective beneficiary deed, regardless of the sequence of recording.

(f) (1) This section does not prohibit other methods of conveying real property that are permitted by law and that have the effect of postponing enjoyment of an interest in real property until the death of the owner.

(2) This section does not invalidate any deed otherwise effective by law to convey title to the interests and estates provided in the deed that is not recorded until after the death of the owner.

(g) A beneficiary deed is sufficient if it complies with other applicable laws and if it is in substantially the following form:

“Beneficiary Deed

(h) The instrument of revocation shall be sufficient if it complies with other applicable laws and is in substantially the following form:

Revocation of Beneficiary Deed

Acts 2005, No. 1918, § 1; 2007, No. 243, § 1.

Arkansas Case Law

Arkansas courts have ruled in Ashworth v. Hankins, 452 S.W.2d 838 (Ark. Sup.Ct. 1970); Held vendor may waive his right to forfeiture under a contract for deed, but may thereafter reinstate it with proper notice. Case shows Arkansas interpretation of contract for deed forfeiture clauses. Forfeiture provisions are normally held to be valid and timely enforced.