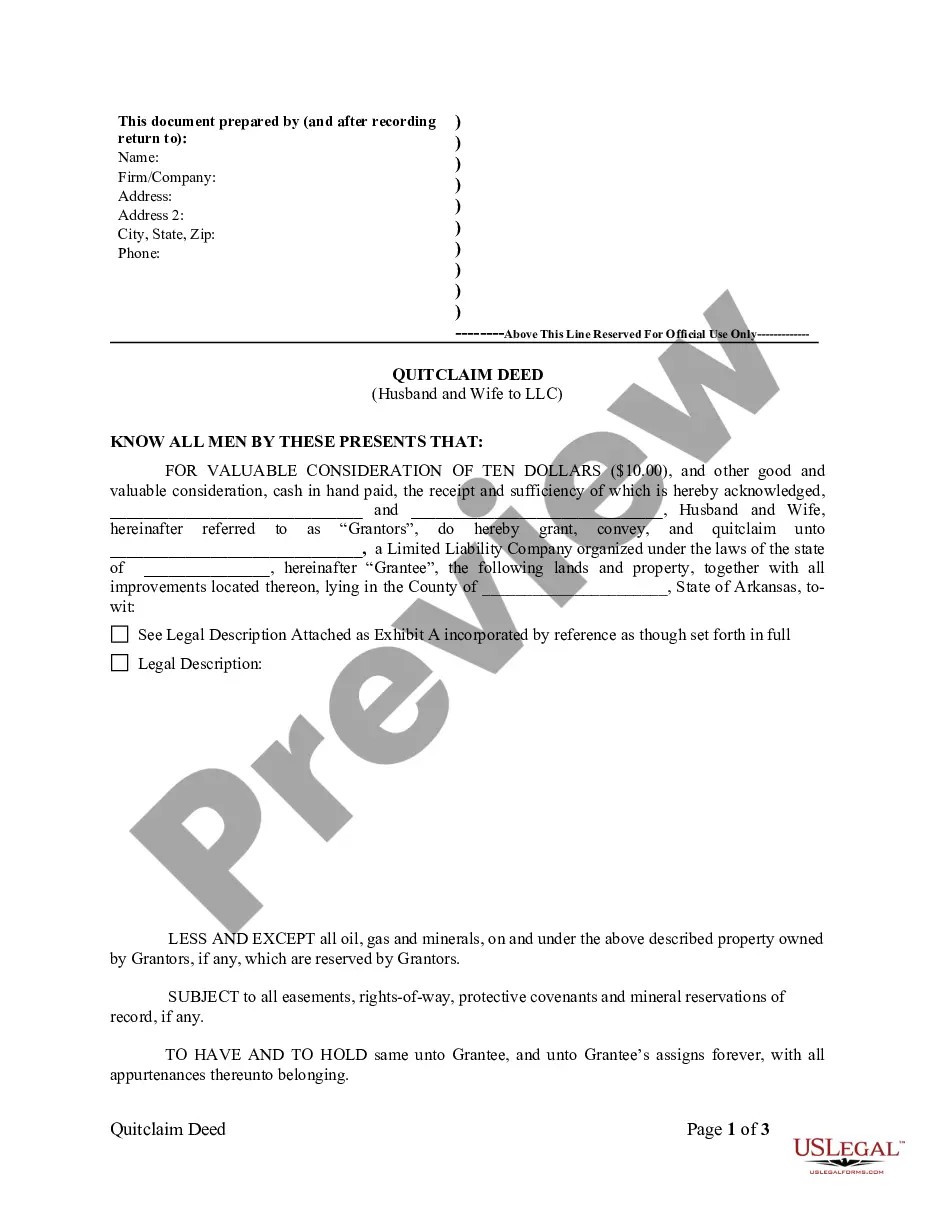

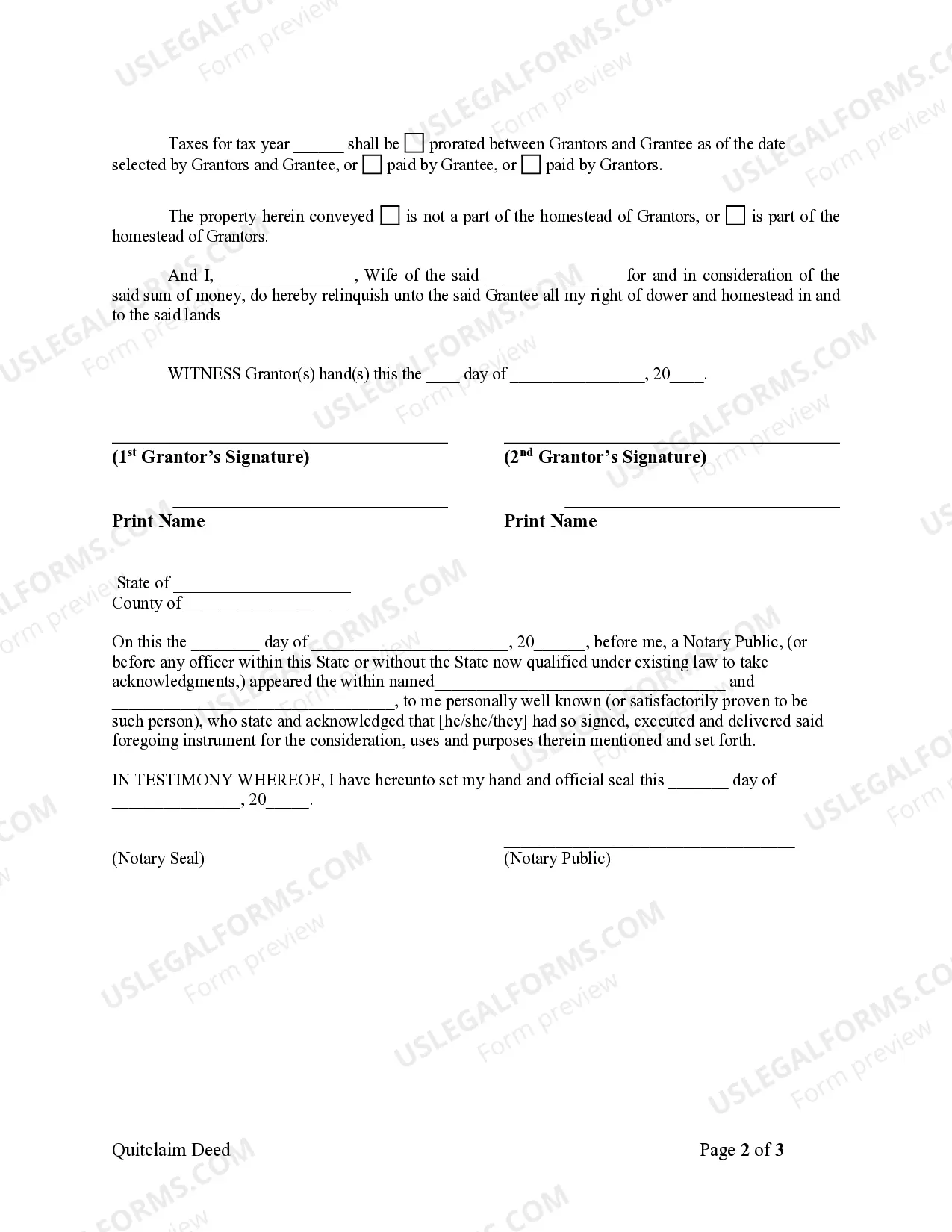

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

Operating Agreement For Husband And Wife Llc

Description

How to fill out Arkansas Quitclaim Deed From Husband And Wife To LLC?

Maneuvering through the red tape of official documents and samples can be challenging, particularly for those who do not engage in such tasks professionally.

Even selecting the appropriate template for a Partnership Agreement For Married Couples LLC can be labor-intensive, as it needs to be valid and accurate to the last detail.

However, you will significantly reduce the time spent locating a fitting template from a reliable resource.

Obtain the correct form in a few simple steps: Enter the document title in the search field. Locate the suitable Partnership Agreement For Married Couples LLC within the search results. Review the sample description or view its preview. If the template meets your criteria, click Buy Now. Continue by selecting your subscription plan. Utilize your email and create a password to register at US Legal Forms. Choose a credit card or PayPal as your payment method. Save the document on your device in your preferred format. US Legal Forms can save you time and effort in verifying if the form you discovered online aligns with your requirements. Create an account for unlimited access to all necessary templates.

- US Legal Forms is a service that streamlines the task of finding the correct documents online.

- US Legal Forms serves as a one-stop shop for the latest examples of forms, consultation on their application, and downloading these documents for completion.

- It houses a collection of over 85K forms applicable across various fields.

- When seeking a Partnership Agreement For Married Couples LLC, you will not need to doubt its validity, as all forms are verified.

- Having an account with US Legal Forms guarantees you access to all necessary samples readily available.

- You can store them in your history or add them to the My documents catalog.

- Your saved documents can be accessed from any device by clicking Log In on the library site.

- If you have not yet established an account, you can always search for the template you require.

Form popularity

FAQ

The LLC is wholly owned by the husband and wife as community property under state law. no one else would be considered an owner for federal tax purposes, and. the business is not otherwise treated as a corporation under federal law.

The straightforward answer is no: You are not required to name your spouse anywhere in the LLC documents, especially if they aren't directly involved in the business. However, there are some occasions where it may be helpful or necessary to include your spouse.

If your LLC has one owner, you're a single member limited liability company (SMLLC). If you are married, you and your spouse are considered one owner and can elect to be treated as an SMLLC.

If an LLC is owned by a husband and wife in a non-community property state the LLC should file as a partnership. However, in community property states you can have your multi-member (husband and wife owners) and that LLC can get treated as a SMLLC for tax purposes.

A business jointly owned and operated by a married couple is a partnership (and should file Form 1065, U.S. Return of Partnership Income) unless the spouses qualify and elect to have the business be treated as a qualified joint venture, or they operate their business in one of the nine community property states.