Arkansas Child Support Chart Bi-Weekly Withholding: A Comprehensive Guide When it comes to determining child support in the state of Arkansas, the Arkansas child support chart bi-weekly withholding plays a crucial role. This detailed description aims to provide a comprehensive understanding of the concept, its significance, and any variations that may exist in the calculation process. In essence, the Arkansas child support chart bi-weekly withholding serves as a guideline to determine the appropriate amount of support a non-custodial parent should contribute towards their child's financial needs every two weeks. This chart takes into account several factors, including the number of children, the combined gross income of both parents, and certain deductions. The calculations are based on the child support guidelines set by the Arkansas Supreme Court and are designed to ensure fairness and consistency in support payments. These guidelines provide a framework to determine an equitable sharing of child-rearing expenses between parents. It is important to note that different variations of the Arkansas child support chart bi-weekly withholding may exist. These can include: 1. Standard Bi-Weekly Withholding: This chart is applicable to most cases and follows the established guidelines for calculating child support payments. It considers the number of children and the combined gross income. 2. Deviation from Standard Chart: In some cases, the court may deviate from the standard chart based on certain factors, such as substantial earnings of either parent, medical expenses, or other extraordinary circumstances. These deviations require a detailed assessment of the specific case to ensure a fair outcome. To calculate child support using the Arkansas child support chart bi-weekly withholding, it is essential to gather the necessary information, such as the number of children, each parent's gross income, and any applicable deductions. Once these figures are determined, they are plugged into the chart to find the corresponding child support amount. It is vital to understand that the Arkansas child support chart bi-weekly withholding is not set in stone and may be subject to modification as circumstances change. Situations such as an increase or decrease in income, changes in custody arrangements, or significant changes in the child's needs may warrant a review of the support calculations. In conclusion, the Arkansas child support chart bi-weekly withholding is a vital tool used in determining child support payments in the state. It ensures a fair and consistent approach by considering various factors and the unique circumstances of each case. By following the guidelines set by the Arkansas Supreme Court, parents can contribute to their child's financial well-being and provide the necessary support for their upbringing.

Arkansas Child Support Chart Bi Weekly Withholding

Description

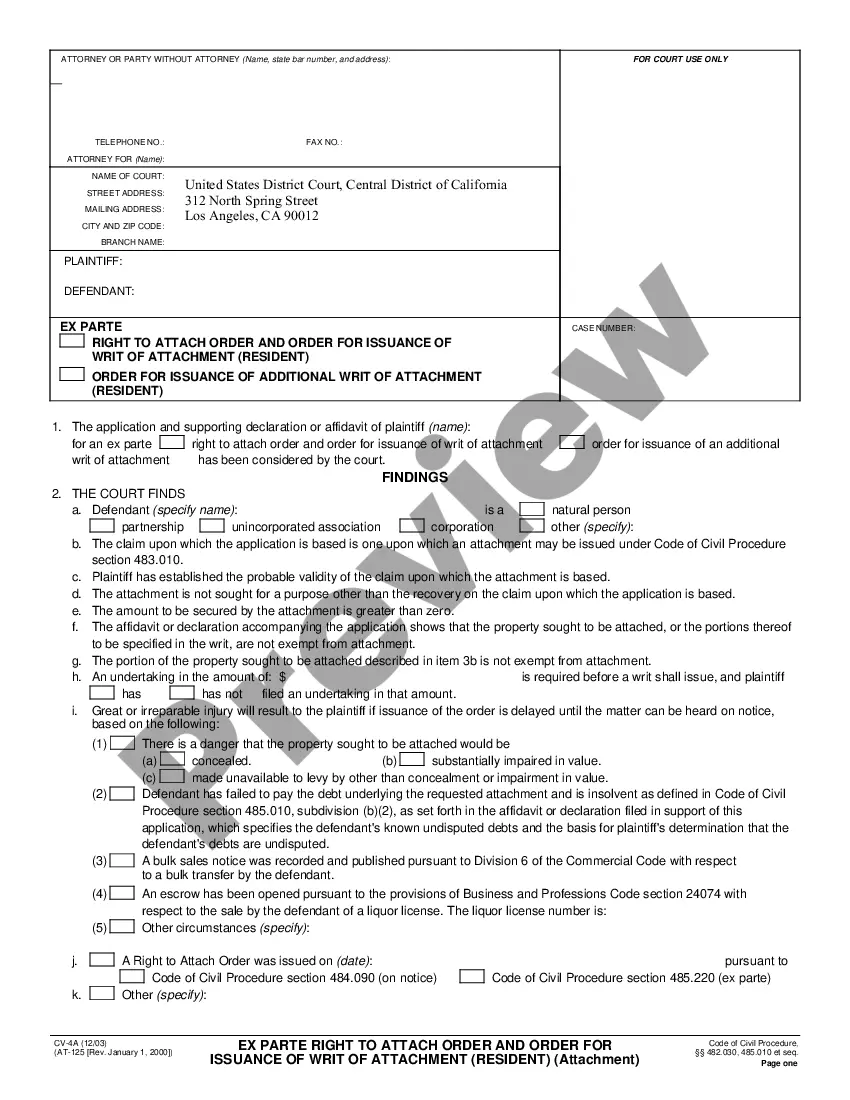

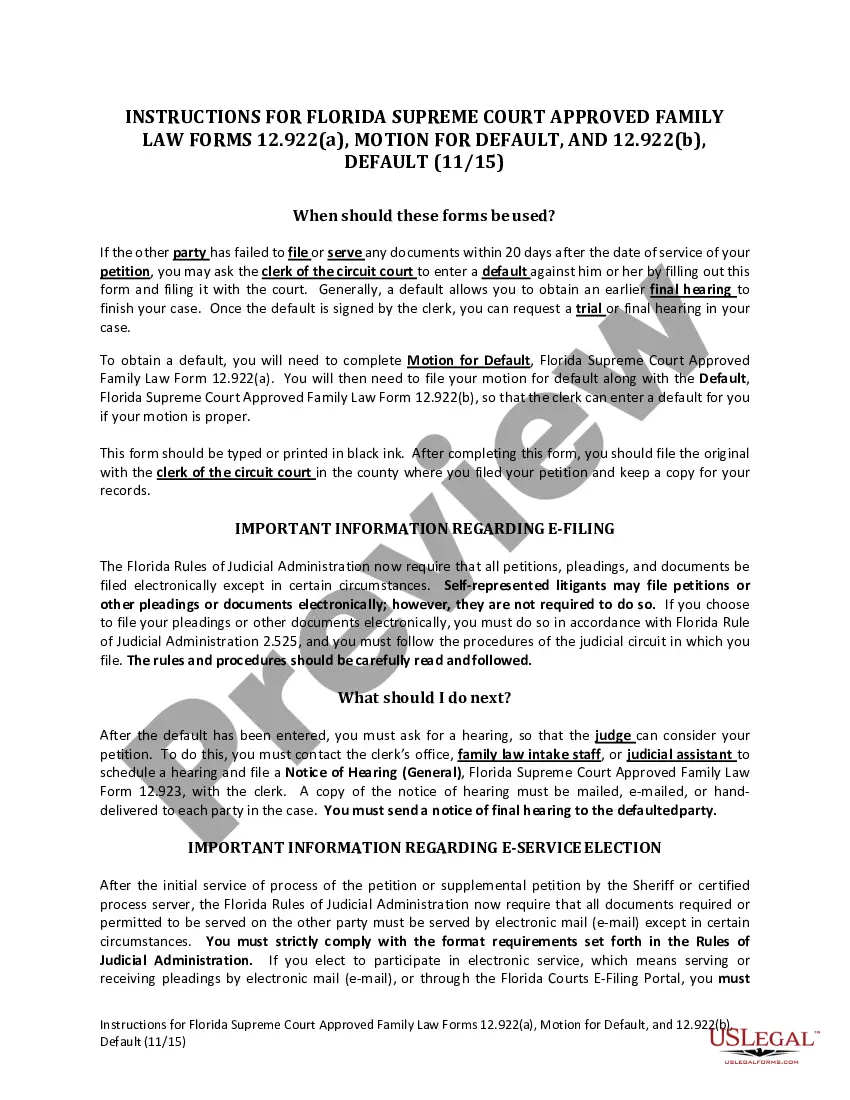

How to fill out Arkansas Child Support Chart Bi Weekly Withholding?

Finding a go-to place to take the most current and relevant legal samples is half the struggle of dealing with bureaucracy. Discovering the right legal papers demands precision and attention to detail, which is why it is crucial to take samples of Arkansas Child Support Chart Bi Weekly Withholding only from reputable sources, like US Legal Forms. An improper template will waste your time and hold off the situation you are in. With US Legal Forms, you have little to be concerned about. You can access and check all the information concerning the document’s use and relevance for your circumstances and in your state or county.

Consider the following steps to finish your Arkansas Child Support Chart Bi Weekly Withholding:

- Use the library navigation or search field to locate your template.

- View the form’s description to check if it matches the requirements of your state and region.

- View the form preview, if there is one, to ensure the form is the one you are interested in.

- Go back to the search and find the right document if the Arkansas Child Support Chart Bi Weekly Withholding does not suit your requirements.

- If you are positive regarding the form’s relevance, download it.

- If you are an authorized customer, click Log in to authenticate and gain access to your picked templates in My Forms.

- If you do not have a profile yet, click Buy now to obtain the template.

- Pick the pricing plan that fits your preferences.

- Go on to the registration to finalize your purchase.

- Finalize your purchase by selecting a transaction method (bank card or PayPal).

- Pick the document format for downloading Arkansas Child Support Chart Bi Weekly Withholding.

- When you have the form on your gadget, you can modify it with the editor or print it and finish it manually.

Eliminate the inconvenience that comes with your legal paperwork. Explore the comprehensive US Legal Forms collection to find legal samples, examine their relevance to your circumstances, and download them immediately.

Form popularity

FAQ

Follow these five steps to start a Kentucky LLC and elect Kentucky S corp designation: Name Your Business. Choose a Registered Agent. File the Kentucky Articles of Organization. Create an Operating Agreement. File Form 2553 to Elect Kentucky S Corp Tax Designation.

The state of Kentucky has many strengths that make it a good place to start a business. Generally, it has a business-friendly environment. It also offers various incentives and programs that aim to help businesses. Ideal location ? Kentucky is in the middle of multiple states.

Who needs to register their business? In most cases, all businesses in Kentucky are required by law to register with the Office of the Secretary of the State, the Department of Revenue, the Office of Employment Training, the Internal Revenue Service and with local municipalities to obtain business licenses and permits.

To start an LLC in Kentucky, the state fee is $40 to file your LLC Articles of Organization online or in-person. Along with the fee you'll pay to the Secretary of State, you'll also have to pay $15 every year when you file your annual report.

How to Incorporate in Kentucky. To start a corporation in Kentucky, you'll need to do three things: appoint a registered agent, choose a name for your business, and file Articles of Incorporation with the Secretary of State. You can file this document online or by mail. The articles cost a minimum of $50 to file.

To register a foreign corporation in Kentucky, you must file a Kentucky Certificate of Authority with the Kentucky Secretary of State. You can submit this document by mail, online, or in person. The Certificate of Authority for a foreign Kentucky corporation costs $90 to file.

No. 86?272, a Kentucky Unitary Combined. Corporation Income Tax and LLET Return (Form 720U) must. be filed by every corporation doing business in this state. KRS.