Surviving Spouse On Deed

Description

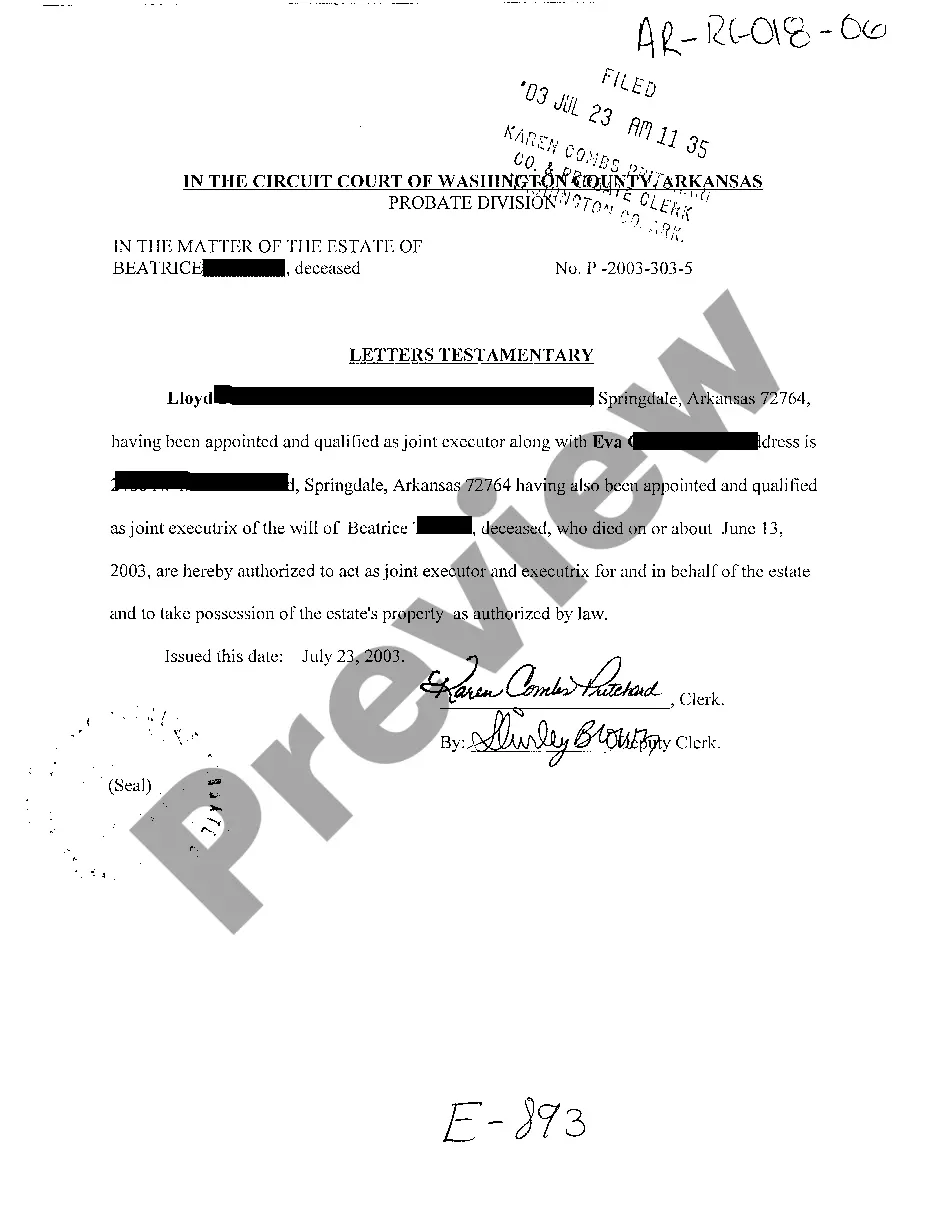

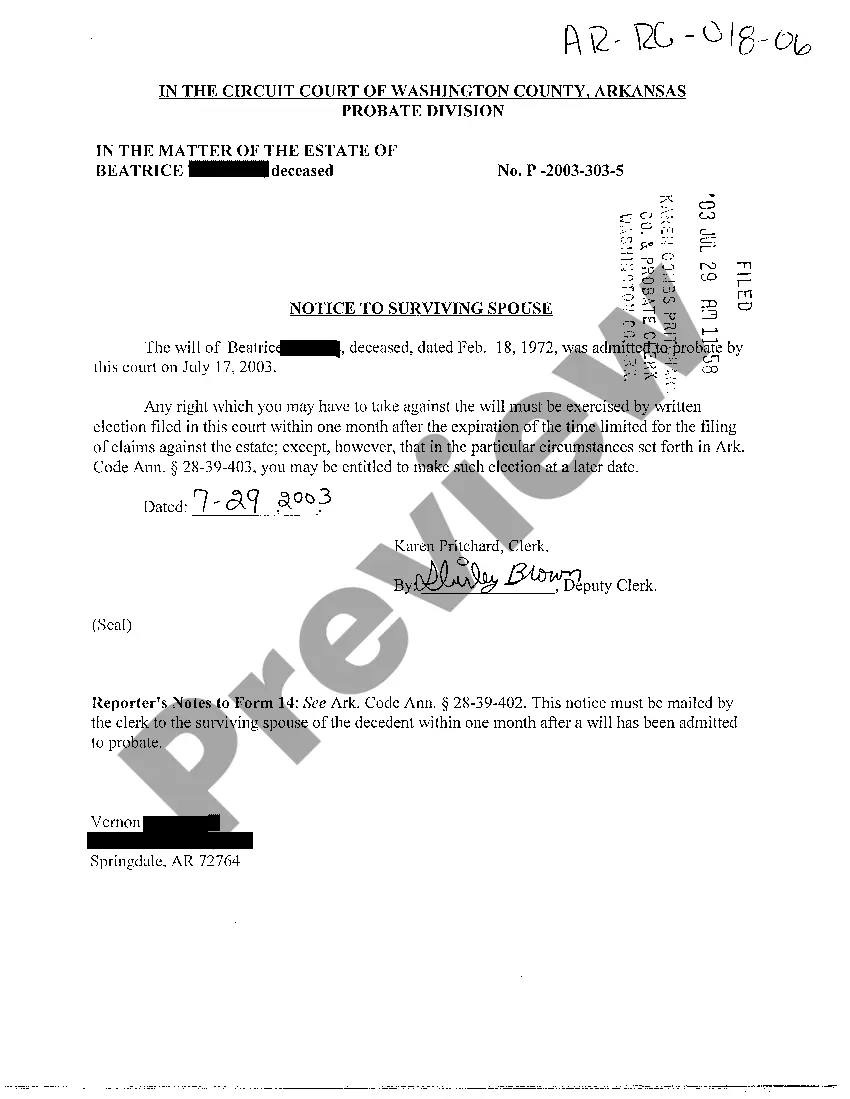

How to fill out Arkansas Notice To Surviving Spouse?

Red tape necessitates exactness and correctness.

If you do not manage completing forms like Surviving Spouse On Deed consistently, it might lead to some confusion.

Selecting the appropriate template from the beginning will ensure that your document submission proceeds effortlessly and avoid any complications of resubmitting a file or executing the same task entirely from the beginning.

Acquiring the correct and current samples for your documentation takes just a few moments with an account at US Legal Forms. Eliminate bureaucratic uncertainties and simplify your tasks with forms.

- Find the appropriate template using the search feature.

- Confirm the Surviving Spouse On Deed you've located is suitable for your state or region.

- Review the preview or examine the description detailing the usage of the template.

- If the result aligns with your search, click the Buy Now button.

- Choose the proper option among the proposed subscription plans.

- Log In to your account or establish a new one.

- Complete the purchase utilizing a credit card or PayPal payment method.

- Save the document in the format you prefer.

Form popularity

FAQ

Filing taxes for a deceased spouse involves completing a final tax return and using the appropriate IRS forms. You will need to report any income earned before their death and indicate the date of death on the tax forms. This process can seem overwhelming, but utilizing services like US Legal Forms can simplify your experience.

To file as a surviving spouse, you need to use the IRS Form 1040 and select the appropriate status. Ensure you gather all necessary documentation, including your spouse's death certificate and any dependent information. Using resources from US Legal Forms can help you navigate the filing process effectively.

The IRS offers specific rules for a surviving spouse, allowing them to file taxes as a married person for the two years following the death of their partner. This designation can provide beneficial tax rates and increased deductions. Understanding these rules can help you make the most of your financial situation during this challenging time.

Yes, Social Security notifies the IRS when someone dies, which helps ensure that tax records are updated accordingly. This notification is crucial, as it can affect any tax filings related to the deceased individual's estate. As a surviving spouse on deed, keeping track of these notifications can help you stay informed about your tax responsibilities.

To qualify for the surviving spouse filing status, you must meet specific criteria, including being married to the deceased at the time of death. Additionally, you must have a dependent child and have not remarried within the tax year. This designation can significantly affect your tax rates and deductions, making it beneficial to understand.

You don’t necessarily need an attorney for a transfer on a death deed, but having one can simplify the process. An attorney can help ensure that all legal requirements are met, and they can also guide you through the paperwork. Using a legal service platform like US Legal Forms can provide the necessary resources if you choose to handle it on your own.

When your spouse is grieving, avoid putting pressure on them to move on quickly or make decisions regarding the property. Offering support is vital, but skip conversations about transferring the deed or financial matters until they are ready. Allow them the time to process their emotions and seek legal advice when appropriate to protect your interests as a surviving spouse on deed.

A transfer on death deed may seem straightforward, but it comes with potential downsides. For instance, it does not address the creditor claims against the estate, and your interest as a surviving spouse on deed may not receive full protection. It's advisable to evaluate this option carefully and consider whether it meets your long-term goals.

Notifying your bank immediately after a death can complicate matters regarding joint accounts and assets. Banks may freeze accounts, which can hinder your access to funds as a surviving spouse on deed. It's often best to wait until you have clear guidance on how to proceed with estate matters before informing the bank.

When your spouse passes away, the first step is to gather essential documents, including the will and any property deeds. Understanding your position as a surviving spouse on deed is crucial in this process. You may want to secure legal advice to ensure that you handle matters related to the estate and property appropriately.