Waiver Of Accounting Form For Divorce

Description

Form popularity

FAQ

Yes, in Florida, an executor must provide an accounting of the estate's assets and liabilities to the beneficiaries. This ensures transparency and keeps all parties informed throughout the probate process. If you have utilized a Waiver of accounting form for divorce, this can streamline your executor's responsibilities, making the process smoother for all involved.

Many assets can bypass probate in Florida, including joint bank accounts, life insurance policies with named beneficiaries, and certain types of trusts. Additionally, properties held in joint tenancy may also avoid the probate process. Using a Waiver of accounting form for divorce can help manage and identify which assets are exempt, providing clarity during difficult times.

In Florida, bank accounts can be subject to probate if they are solely in the deceased person's name. However, if a bank account has a designated beneficiary or is jointly owned, it may pass directly to the beneficiary without going through probate. To avoid complications, consider using a Waiver of accounting form for divorce, as it can simplify asset distribution.

A waiver in payment indicates that one party agrees to forgo receiving payment for a service or obligation. This concept often appears in legal agreements where parties might opt not to enforce payment to expedite other processes. In divorce scenarios, using a waiver of accounting form provides clarity about financial exchanges, aiding in swift resolutions.

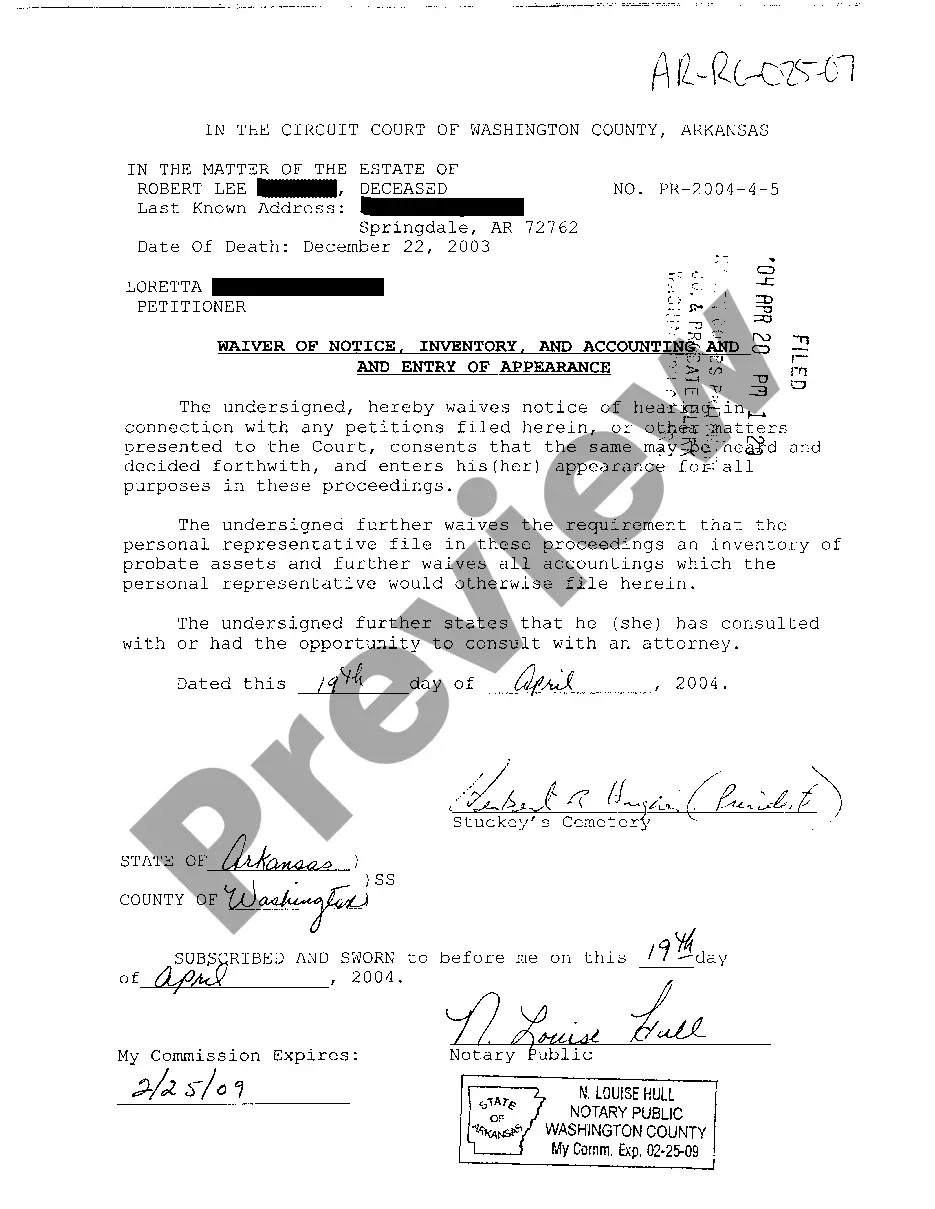

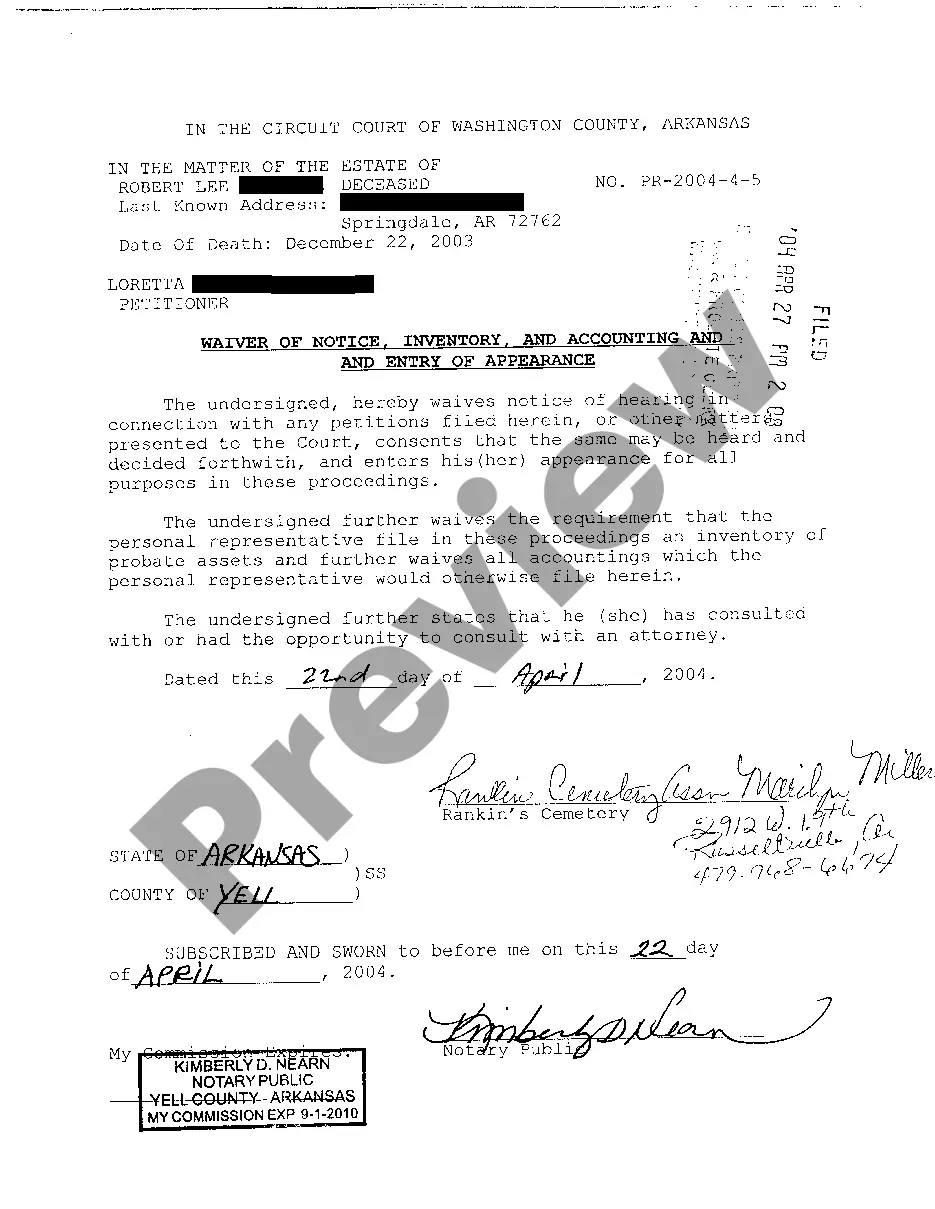

In Florida probate, a waiver of accounting permits an executor or administrator to bypass formal financial accounting requirements. This legal tool helps streamline the settling of an estate. For those dealing with divorce and estates, a waiver of accounting form for divorce can be a beneficial option, clarifying financial responsibilities without added complexities.

The primary purpose of a waiver is to allow individuals to relax or omit certain legal requirements. By signing a waiver, parties can expedite legal proceedings and avoid lengthy disputes. In divorce cases, a waiver of accounting form can simplify the process, allowing for a smoother transition as couples resolve their marital issues.

The term 'waiver' denotes the voluntary relinquishing of a known right. When individuals choose to waive a right, they formally acknowledge their decision not to exercise that right. For example, signing a waiver of accounting form for divorce signifies that a spouse gives up their demande for financial disclosures in the divorce proceedings.

A waiver of accounting refers to a legal document where a party agrees to waive their entitlement to a detailed accounting of financial transactions. In the realm of divorce, this means one spouse may choose to not receive a full report of the other spouse's financial activities, simplifying the process. Utilizing a waiver of accounting form for divorce can help expedite the settlement process.

A waiver is a formal declaration where a party relinquishes a right or privilege. For instance, in the context of a waiver of accounting form for divorce, one spouse may sign a waiver to forgo the requirement for detailed financial disclosures during the divorce process. This helps streamline the divorce proceedings, allowing both parties to move forward more easily.

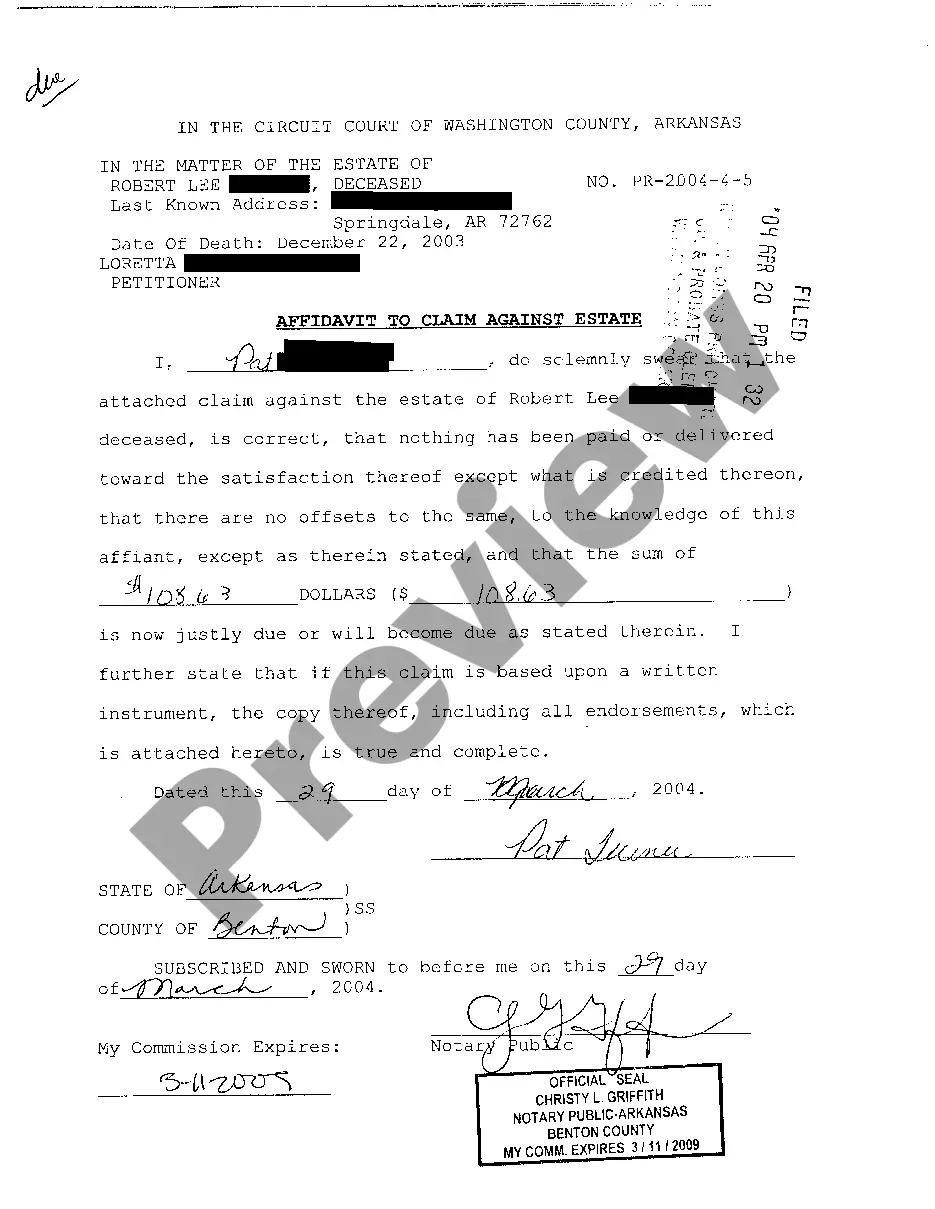

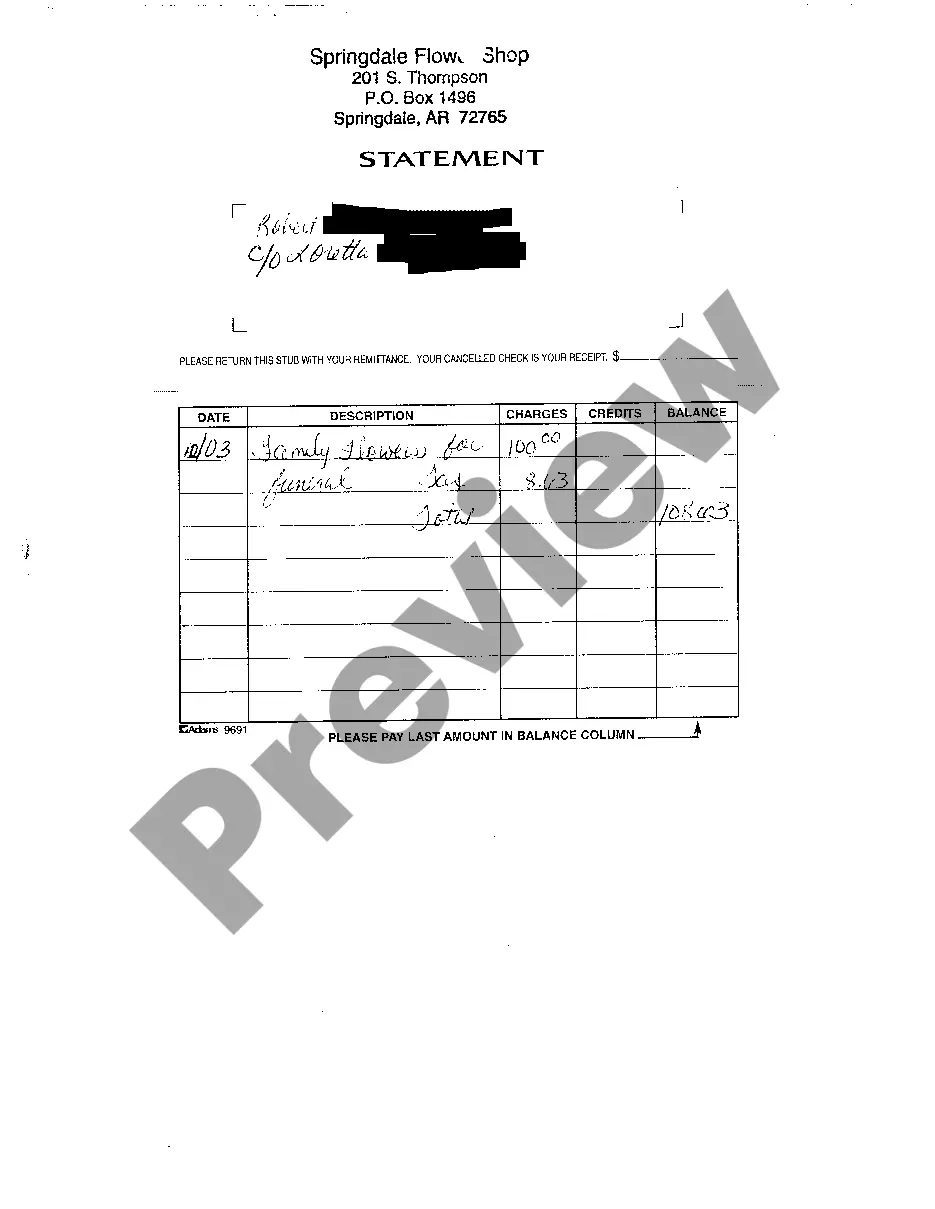

Filling out a waiver of accounting form for divorce is straightforward. Begin by gathering the necessary personal information, such as your name, your spouse's name, and the case number. Carefully follow the instructions on the form, ensuring that each section is completed accurately. Once finished, review your entries for any errors, sign the form, and keep a copy for your records.