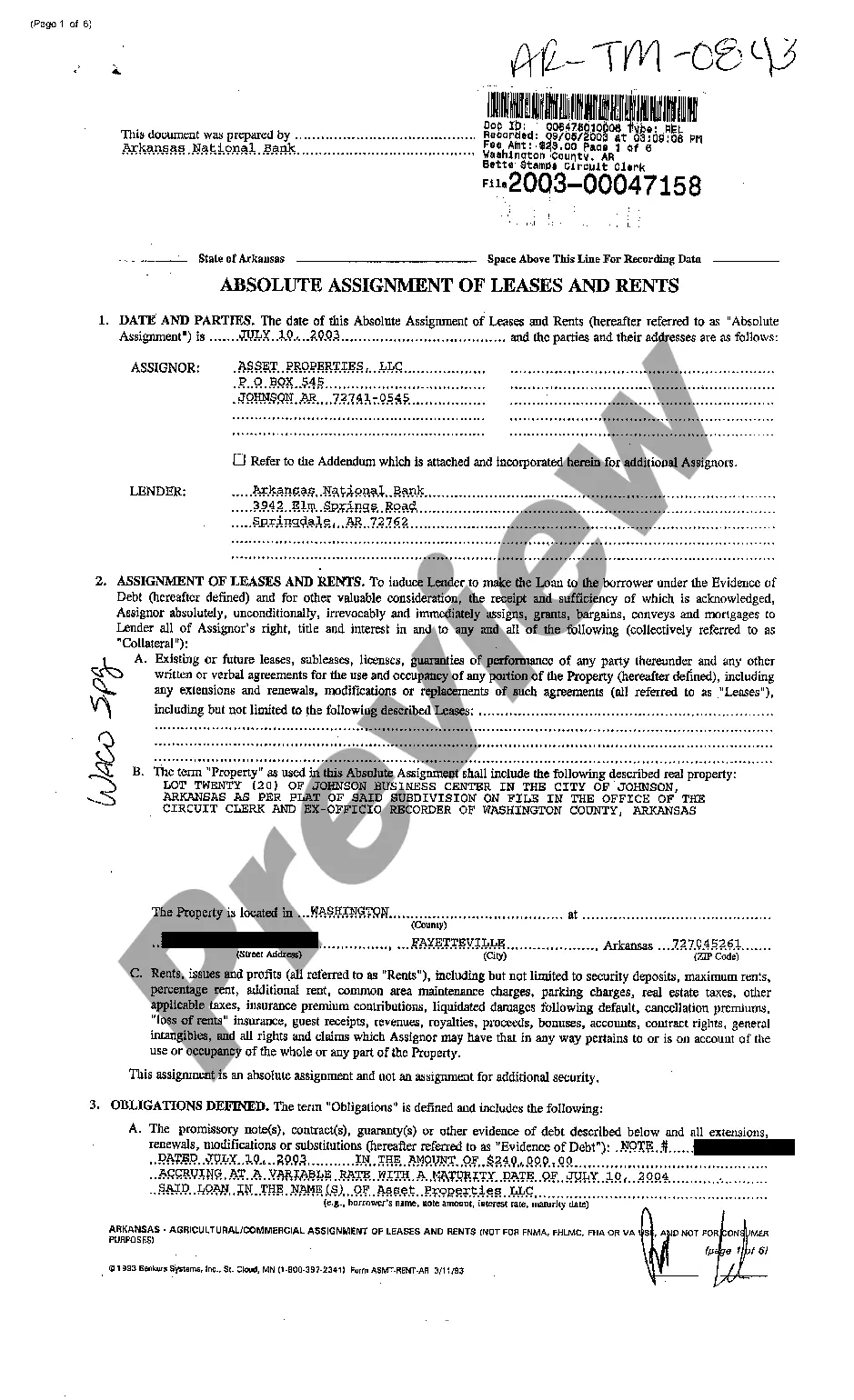

Absolute Assignment Of Debt

Description

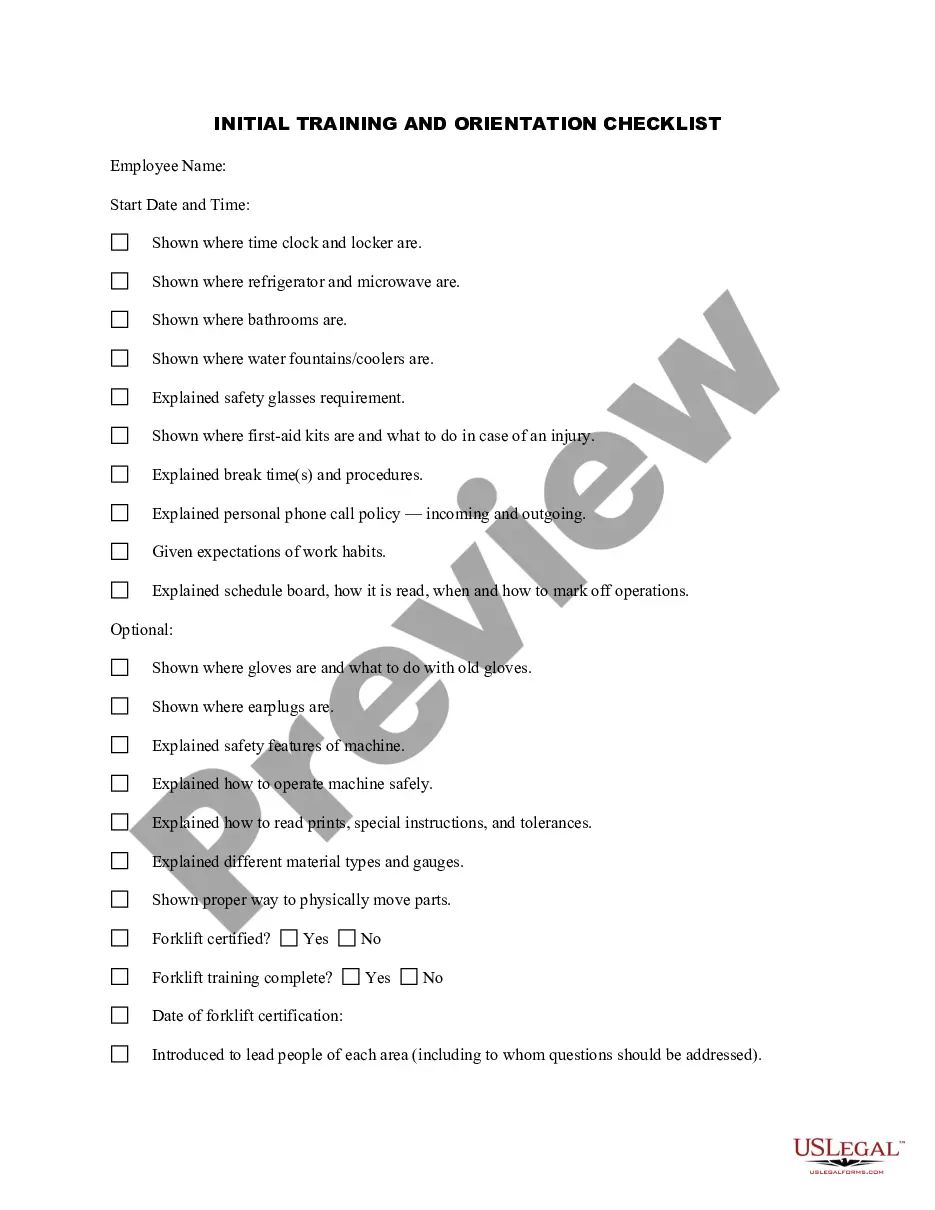

How to fill out Arkansas Absolute Assignment Of Lease And Rents?

How to acquire professional legal documents that comply with your state's regulations and create the Absolute Assignment Of Debt without consulting an attorney.

Numerous services online provide templates to address different legal matters and formalities.

However, it may require time to determine which of the accessible examples meet both your needs and legal standards.

If you do not have an account with US Legal Forms, follow the steps outlined below.

- US Legal Forms is a reliable service that assists you in finding official documents created in line with the latest state law revisions and economizing on legal help.

- US Legal Forms is not a conventional web library; it is a repository of over 85,000 verified templates for various business and personal scenarios.

- All documents are categorized by industry and state to expedite your search process.

- Additionally, it features advanced solutions for PDF editing and electronic signing, allowing users with a Premium subscription to efficiently finalize their paperwork online.

- It requires minimal time and effort to obtain the necessary documents.

- If you currently possess an account, Log In and verify that your subscription is current.

- Download the Absolute Assignment Of Debt using the related button next to the file title.

Form popularity

FAQ

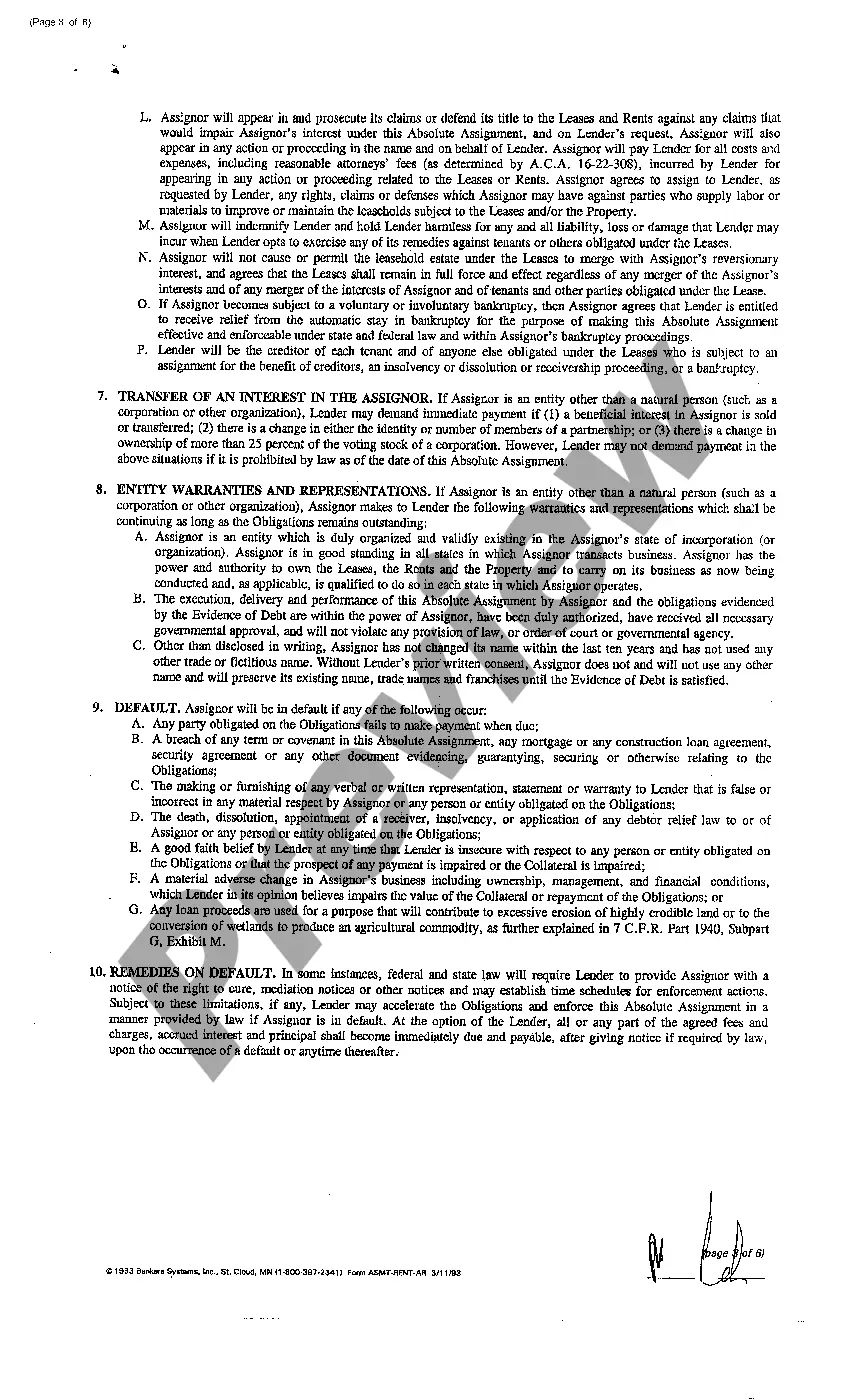

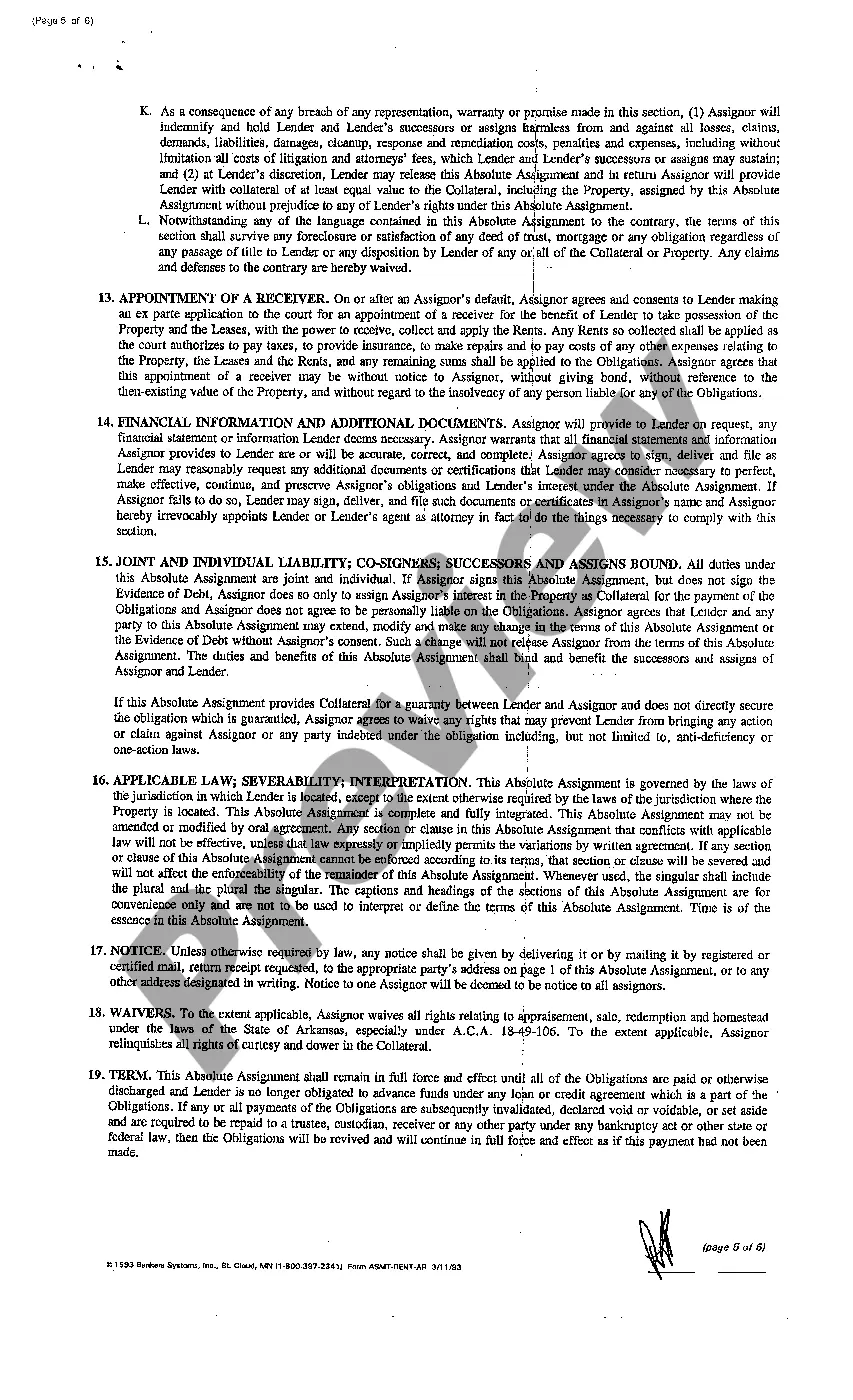

Acknowledgement of debt requires a written agreement where the debtor confirms their liability for the amount owed. It must typically include essential details, such as the creditor's information, the sum due, and the debtor's signature. In circumstances involving absolute assignment of debt, this acknowledgment can be crucial in establishing a legal foundation for the debt collection process.

To assign debt, you need to create a written document that clearly states the transfer of the debt from one party to another. This document, often known as an absolute assignment of debt, should detail the original creditor, the debtor, and any relevant terms. For anyone navigating debt issues, using a reliable platform like US Legal Forms can simplify this process by providing templates and guidance.

The 777 rule refers to the practice where debt collectors must provide certain information before they can legally pursue payment. They must show evidence of the collection timeline, the amount owed, and your contact details. This rule aims to ensure transparency and accountability, allowing you to understand your obligations, especially in situations involving absolute assignment of debt.

Qualifying proof of debt includes items such as a copy of the original agreement, billing statements, or contracts showing the amount owed. Also, it may involve an account history that details all transactions leading to the current balance. When dealing with an absolute assignment of debt, this proof is vital for validating the claims of the debt collector and protecting your rights.

Debt collectors must prove three essential elements: first, they need to verify the existence of the debt; second, they must establish that you owe the debt; and third, they need to demonstrate that they have the right to collect it. This verification is crucial, especially in cases of absolute assignment of debt, where the chain of responsibility can be complex. Ensure you request documentation if a debt collector cannot provide this information.

Debt collection agencies cannot harass or threaten you. They also cannot contact you at inconvenient times, such as early mornings or late at night, unless you have given them permission. Additionally, they cannot discuss your debt with others without your consent, especially if it puts your private information at risk. Understanding these limitations can help you navigate your obligations under an absolute assignment of debt.

To get a debt collector to prove your debt, you can request documentation that demonstrates their right to collect through an absolute assignment of debt. When contacting them, ask for the original creditor's details, account statements, and any signed agreements. If the debt collector cannot provide adequate proof, they may not have the legal right to pursue you further. For additional support, consider using platforms like US Legal Forms to access templates that can guide you in drafting effective requests.

Proof of debt assignment refers to the documents that verify a change in the ownership of a debt, typically through an absolute assignment of debt. This assignment legally shifts the right to collect the debt from the original creditor to a new creditor. To verify this assignment, you should receive documentation outlining the terms and the evidence that the debt has been officially transferred. Understanding this process is crucial if you are dealing with debt collectors.

Three major examples of debt commonly held by individuals include credit card debt, mortgage debt, and student loans. Each type presents unique challenges and obligations, making it crucial for borrowers to understand their rights and responsibilities. With the absolute assignment of debt, individuals can navigate these debts more effectively, ensuring that any transfers or assignments are properly managed.

Proof of assignment of debt is a document that verifies the transfer of debt from the original creditor to a new creditor. This documentation may include a signed agreement indicating the details of the debt, such as the amount and parties involved. It is essential for ensuring clarity and transparency in the absolute assignment of debt process, protecting the rights of the new creditor.