Arizona Foreign Llc Withdrawal

Instant download

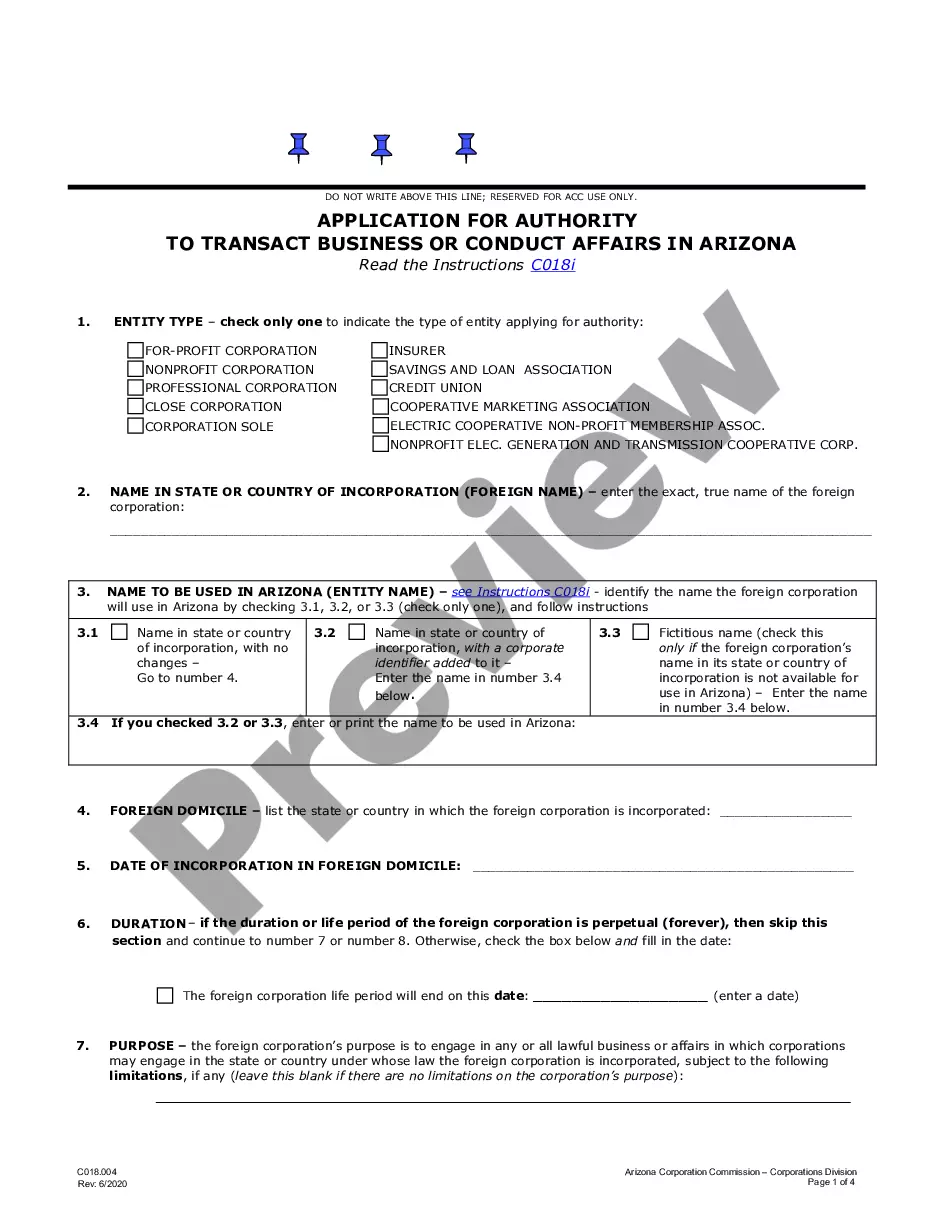

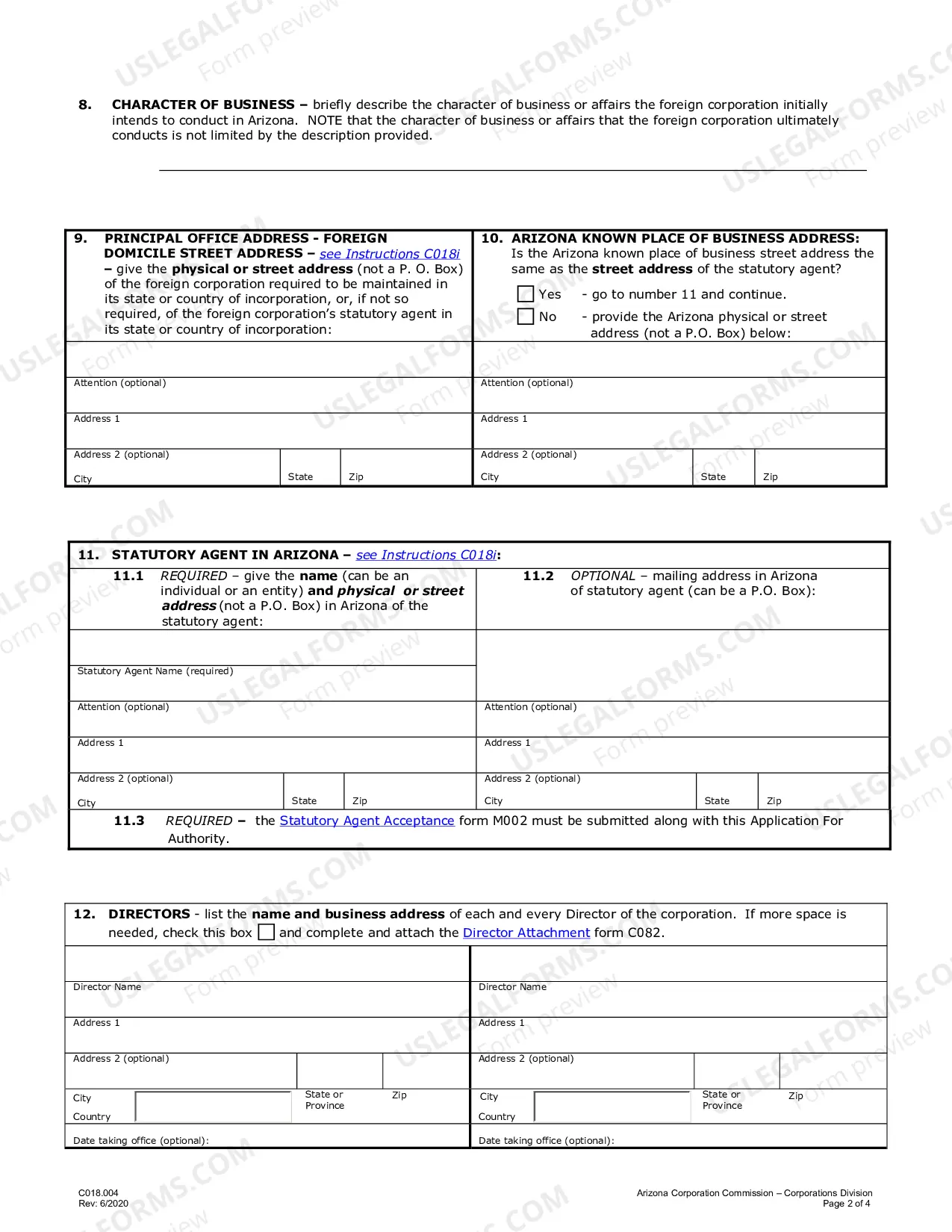

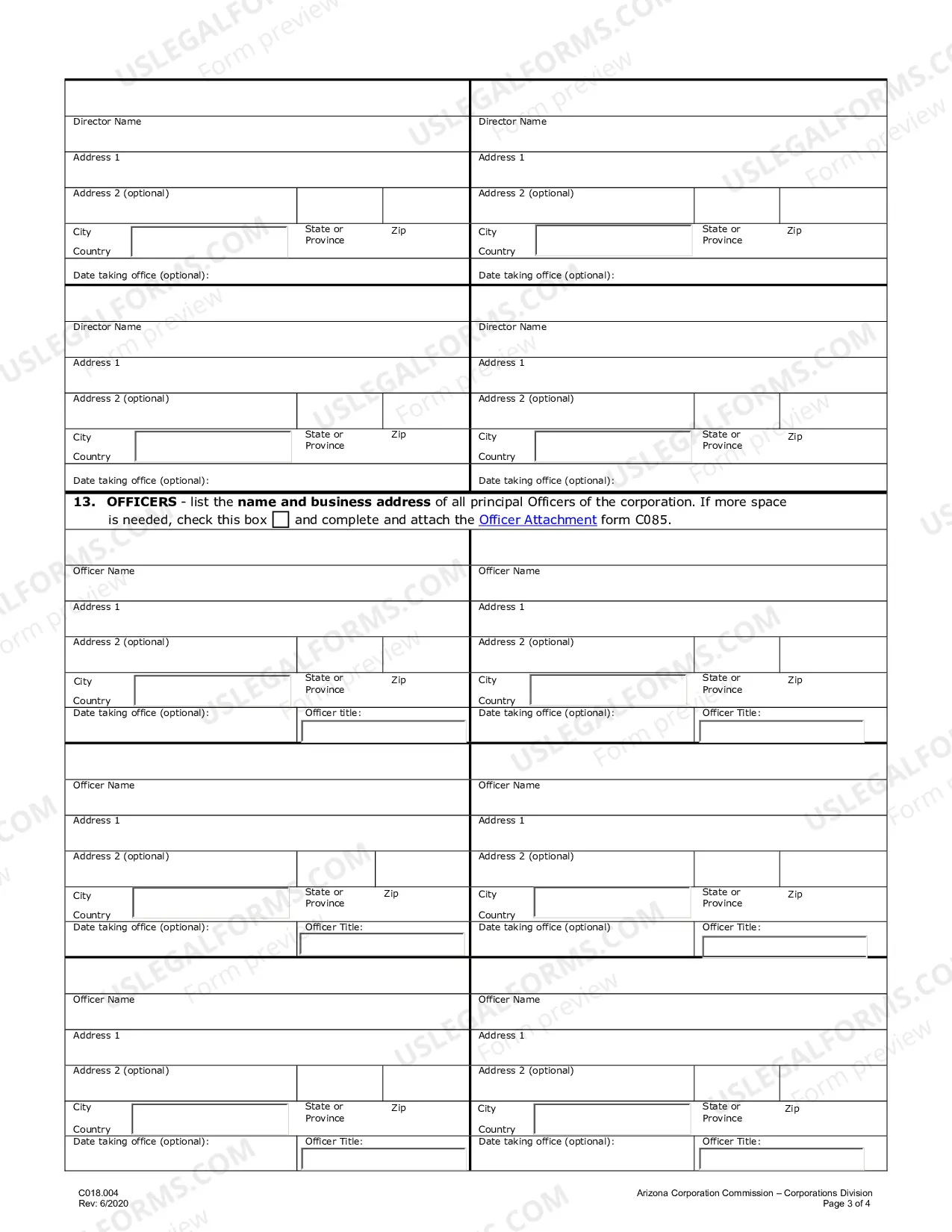

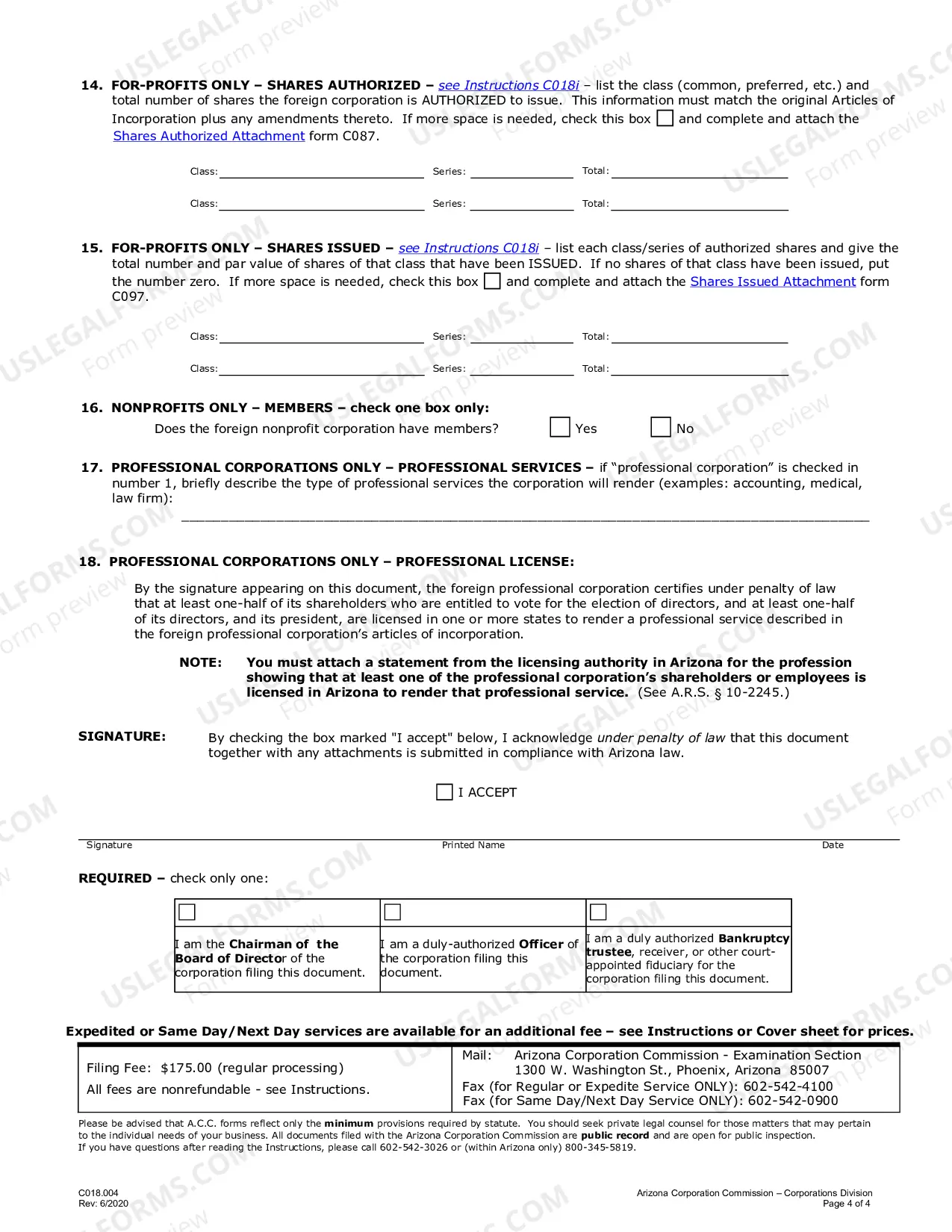

Description Arizona Foreign Corporation

Includes forms to register a foreign corporation or LLC in Arizona.

Free preview A Z Country Name