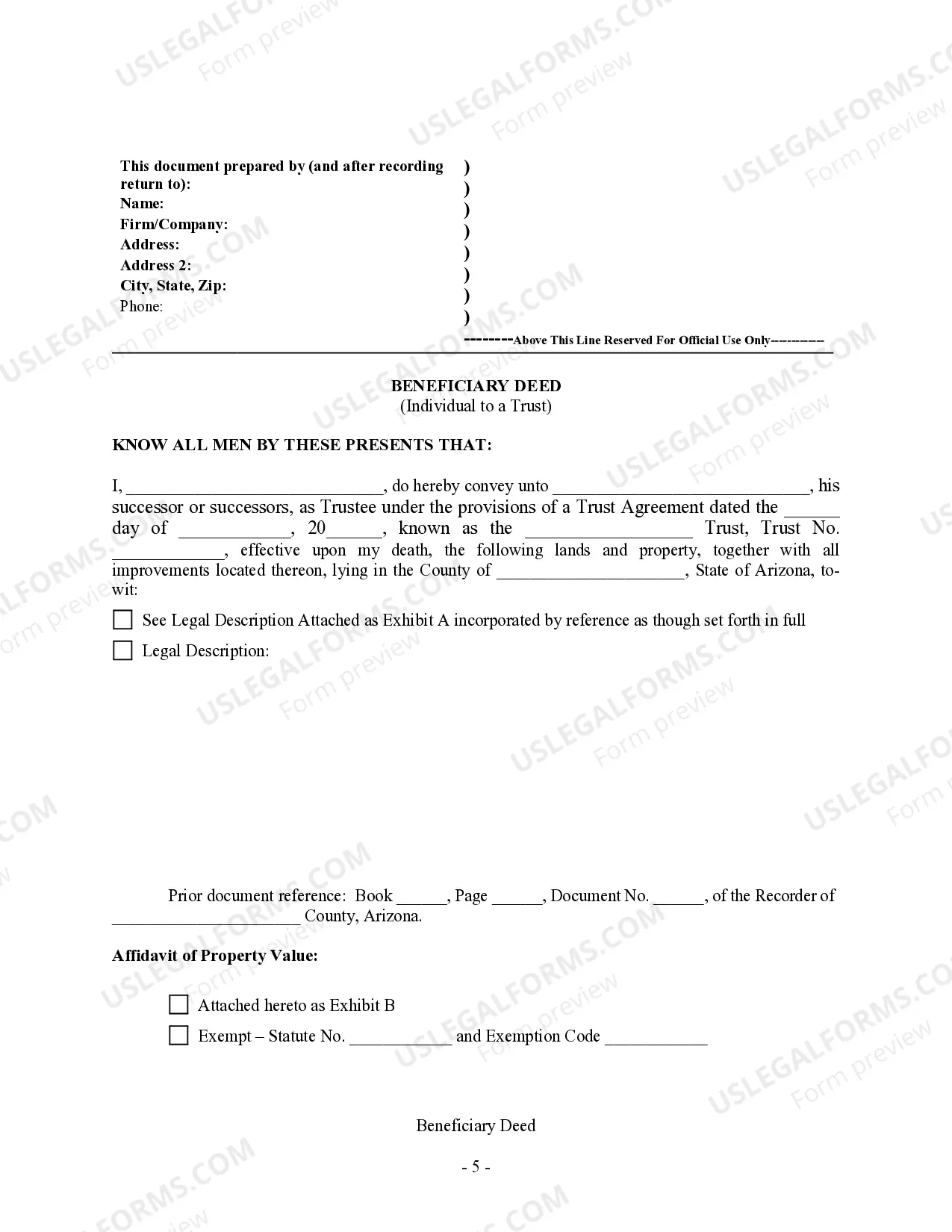

This form is a Beneficiary or Transfer on Death Deed where the grantor is an individual and the grantee is a trustee acting on behalf of the trust. This transfer is revocable until grantor's death and effective only upon the death of the grantor. This deed complies with all state statutory laws.

The Arizona deed of trust form for California is a legal document that outlines the terms and conditions of a loan secured by real estate located in California. It is specifically designed for borrowers and lenders who reside or have property in Arizona, but are involved in financial transactions related to California properties. This Arizona deed of trust form is crucial in outlining the obligations and rights of both parties. It serves as a legal safeguard to protect the lender's interests by transferring the legal title of the property to a trustee until the borrower repays the loan in full. In case of default, the trustee can initiate the foreclosure process on behalf of the lender. There are various types of Arizona deed of trust forms for California that cater to different situations and requirements. Some common variations include: 1. General Arizona Deed of Trust Form for California: This is the standard form used in most loan transactions. It outlines the basic terms of the loan, such as the principal amount, interest rate, repayment terms, and the rights and responsibilities of the borrower and lender. 2. Wraparound Arizona Deed of Trust Form for California: This type of deed of trust is used when the borrower wants to secure a new loan without paying off the existing loan. It enables the borrower to obtain additional financing while keeping the existing loan intact. 3. Adjustable-Rate Arizona Deed of Trust Form for California: This form is used when the loan carries an adjustable interest rate. It allows for changes in the interest rate over the loan term, usually based on an index such as the LIBOR or Treasury rates. 4. Balloon Payment Arizona Deed of Trust Form for California: This type of deed of trust involves a large, final payment that is due at the end of the loan term. It typically offers lower monthly payments during the loan term, with the remainder of the loan amount due as a balloon payment. 5. Reverse Arizona Deed of Trust Form for California: This form is used in reverse mortgage transactions where the homeowner receives monthly payment installments or a lump sum from the lender, secured by the property. The loan is typically repaid when the homeowner moves out, sells the property, or passes away. These different Arizona deed of trust forms for California provide flexibility and legal protection for borrowers and lenders involved in real estate transactions. It is advised to consult with a qualified attorney or legal professional to ensure the appropriate form is selected and executed correctly based on the specific circumstances.