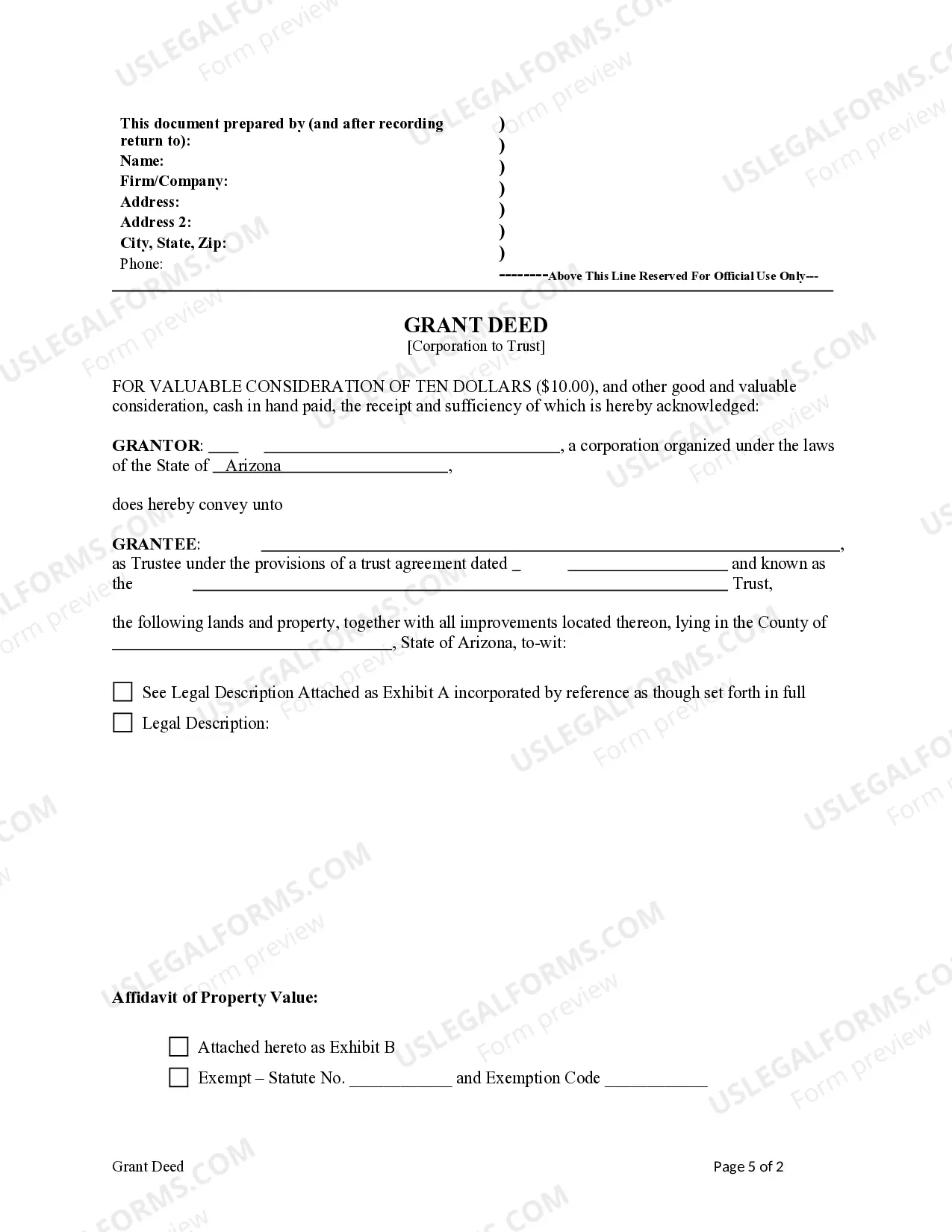

This form is a Warranty Deed where the Grantor is a limited liability company (LLC) and the Grantee is Trust. Grantor conveys and warrants the described property to the Grantee. This deed complies with all state statutory laws.

Corporation Grant Deed With Plan

Description

How to fill out Corporation Grant Deed With Plan?

When you are required to submit a Corporation Grant Deed With Plan that adheres to your local state's rules, there may be multiple options to choose from.

There’s no need to review every document to ensure it meets all the legal requirements if you are a subscriber to US Legal Forms.

It is a reliable service that can assist you in obtaining a reusable and current template on any topic.

Utilizing US Legal Forms makes obtaining professionally crafted legal documents effortless. Moreover, Premium users can also take advantage of advanced integrated tools for online document editing and signing. Give it a try today!

- US Legal Forms is the most comprehensive online directory with a collection of over 85k ready-to-use documents for business and personal legal needs.

- All templates are confirmed to conform to each state's regulations.

- Thus, when downloading Corporation Grant Deed With Plan from our platform, you can rest assured that you possess a valid and current document.

- Acquiring the necessary template from our platform is extremely simple.

- If you already have an account, simply Log In to the system, ensure your subscription is active, and save the chosen file.

- Later, you can access the My documents tab in your profile and have access to the Corporation Grant Deed With Plan at any time.

- If it's your first time using our website, please adhere to the guidelines below.

- Browse through the proposed page and verify it for alignment with your criteria.

Form popularity

FAQ

To fill out a quitclaim deed in California, start by providing the grantor and grantee's complete names and addresses. Next, include a detailed description of the property being transferred, ensuring clarity about the interest being conveyed. Adopting a Corporation grant deed with plan can help enhance the accuracy of the information and reduce future disputes.

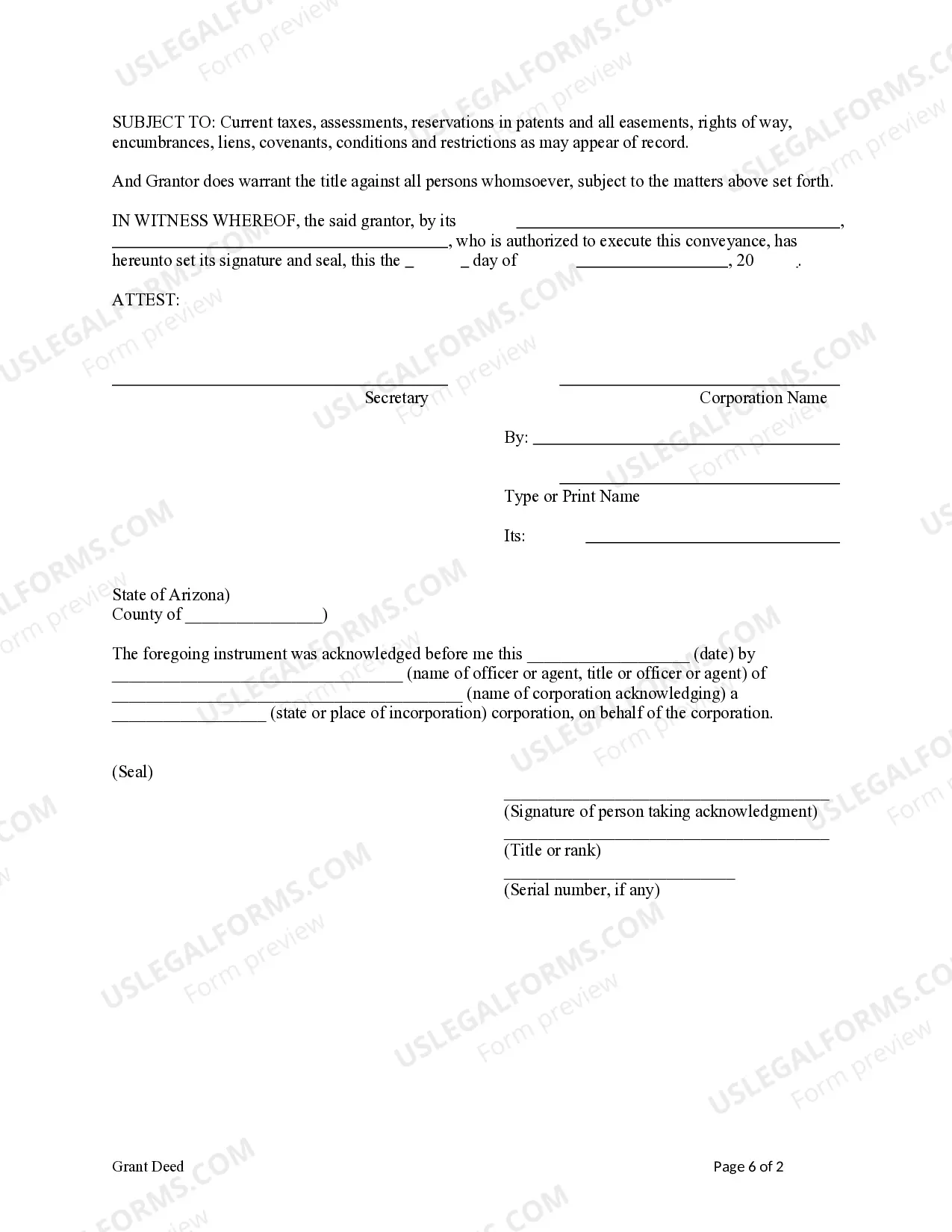

To execute a deed, the grantor must sign the document in the presence of a notary public, who then notarizes the signature. This process ensures the authenticity of the transaction and its legality. By following the steps related to a Corporation grant deed with plan, you can secure a smoother execution process.

In California, anyone can prepare a quitclaim deed, provided they understand the legal terminology involved. However, it is highly recommended to have a real estate attorney or a qualified professional to prepare this document to avoid potential pitfalls. When considering a Corporation grant deed with plan, engaging a professional can ensure all necessary legal requirements are met.

If a quitclaim deed is not recorded in California, the transfer of property ownership may remain unprotected against claims from third parties. This means previous owners can potentially claim rights to the property, leading to disputes. Thus, utilizing the Corporation grant deed with plan is a prudent choice to ensure clarity and authority in property ownership.

The least desirable deed is often the quitclaim deed, as it offers no guarantees about the property title. This lack of assurance can expose the recipient to significant risks. For better security in property transactions, consider utilizing a corporation grant deed with plan, which provides enhanced buyer protections and clearer title assurances.

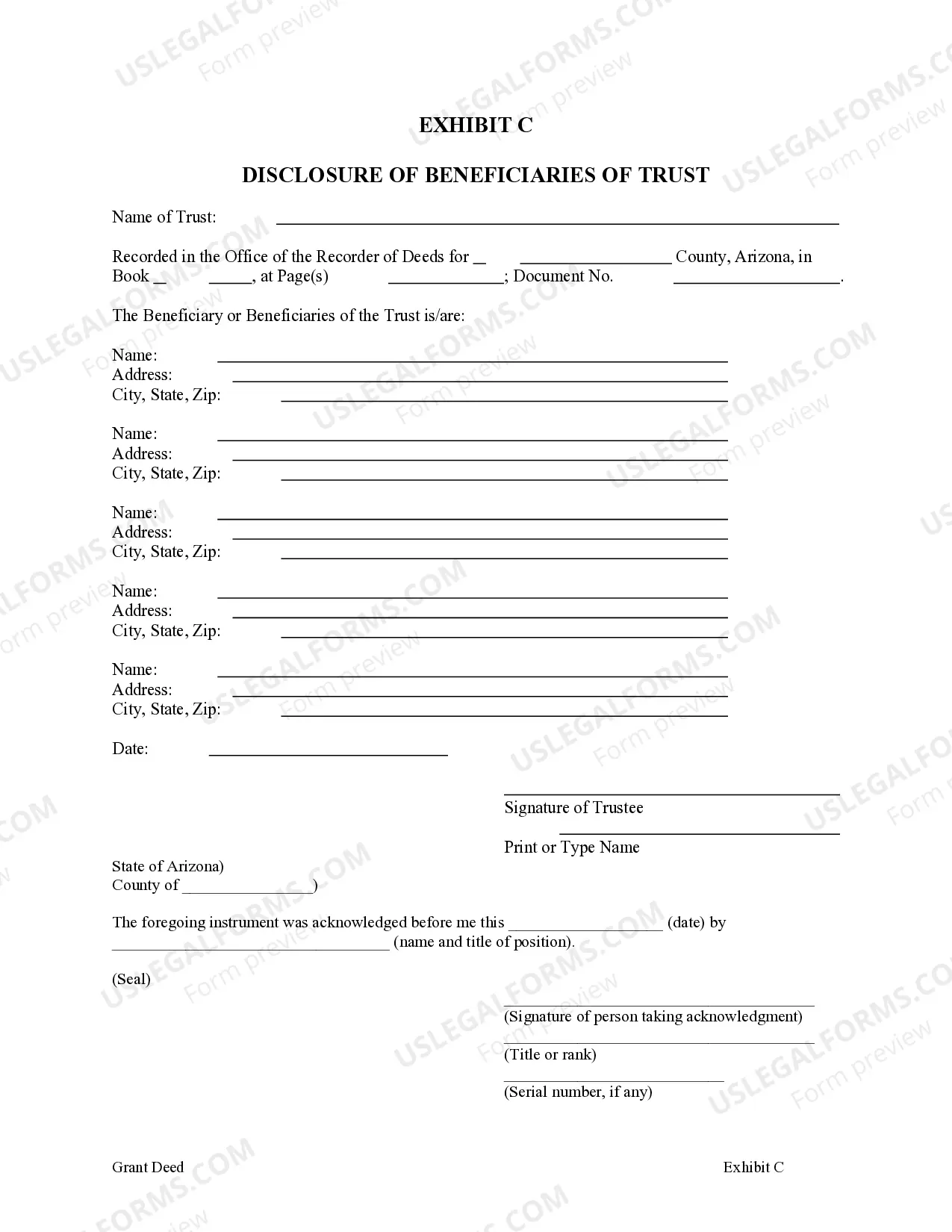

A deed plan outlines the specifications of property ownership transfers. It details the parties involved and any conditions related to the transfer of interest. Implementing a corporation grant deed with plan simplifies property transactions by providing structure and clarity in property rights and obligations.

The weakest deed is generally considered to be the quitclaim deed. Unlike warranty deeds, it does not provide any assurances regarding the title. A quitclaim deed merely transfers whatever interest the grantor has, which may be minimal or non-existent. For strong legal standing, consider a corporation grant deed with plan when securing property transactions.

In divorce situations, a quitclaim deed is commonly used. This deed allows one spouse to relinquish any claim to the property without conveying warranties. However, it is crucial to approach this process with care; utilizing a corporation grant deed with plan could offer a more detailed framework for property divisions.

The weakest form of deed is the quitclaim deed. This deed transfers whatever interest the grantor has in the property, without any guarantees or warranties. This means that if there are any issues with the title, the buyer has no legal recourse against the seller. It's essential to understand how a corporation grant deed with plan offers more robust protections in legal transactions.

The most common type of deed used in real estate transactions is the grant deed. This deed is often preferred because it provides some level of protection to the buyer regarding the title. When creating a corporation grant deed with plan, it’s important to ensure that you are adhering to relevant regulations to safeguard your investment.