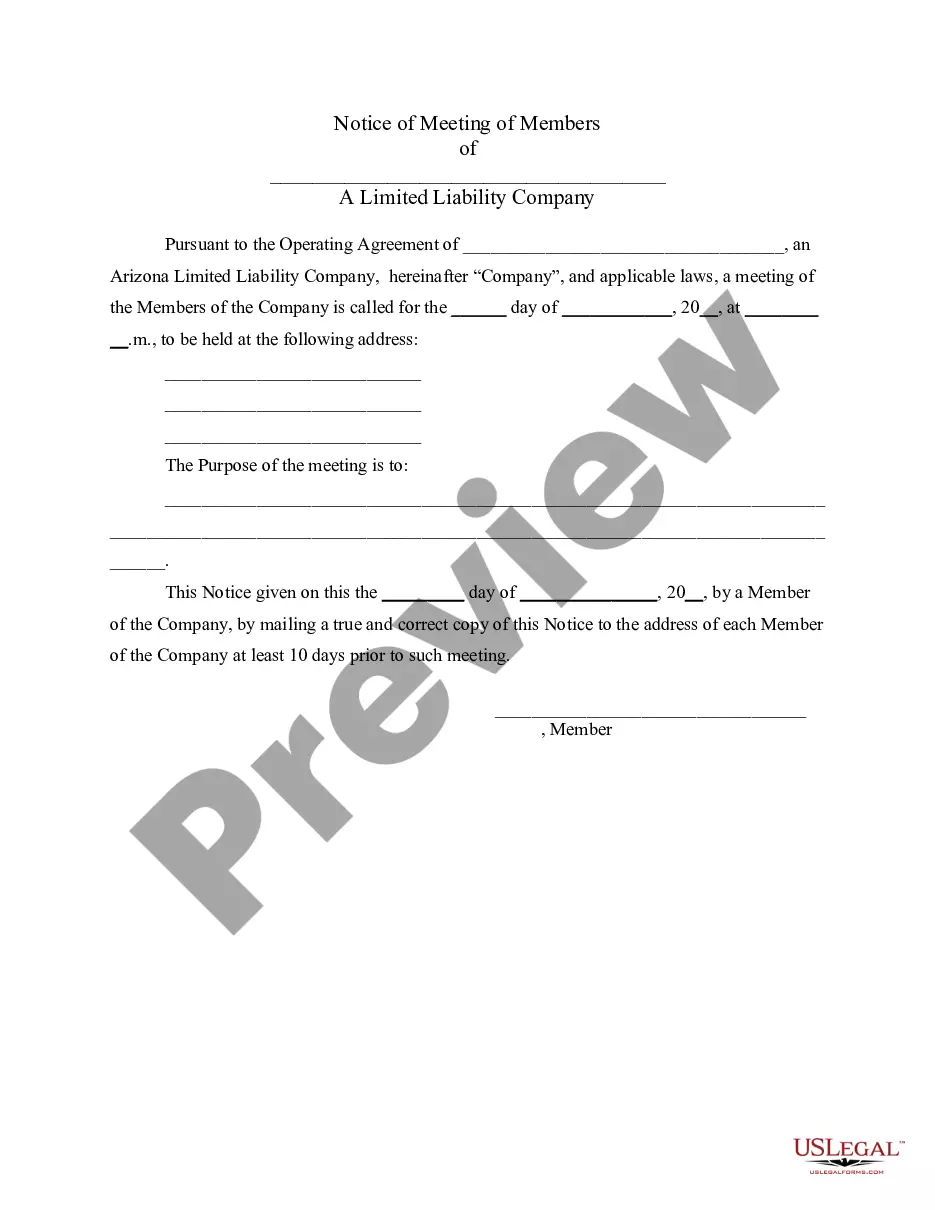

This LLC Notices, Resolutions and other Operations Forms Package contains over 15 forms for use in connection with the operation of a LLC, including the following: (1) Notice of Meeting for General Purpose, (2) Resolution of Meeting for General Purpose, (3) Notice of Meeting to Amend Articles of Organization, (4) Resolution to Amend Articles of Organization, (5) Notice of Meeting to Consider Dissolution, (6) Resolution Regarding Dissolution, (7) Notice to Admit New Members, (8) Resolution Concerning Admitting New Members, (9) Notice of Meeting Concerning Accepting Resignation of Manager, (10) Resolution Accepting Resignation of Manager, (11) Notice of Meeting to Remove Manager, (12) Resolution Concerning Removal of Manager, (13) Notice of Meeting to Consider Disbursements to Members, (14) Resolution Concerning Disbursements, (15) Assignment of Member Interest, (16) Demand for Indemnity by Member/Manager and (17) Application for Tax Identification Number.

An Arizona limited liability company with shares refers to a specific type of business entity in the state of Arizona that combines characteristics of both a corporation and a limited liability company (LLC). This type of company is commonly referred to as an "LLC with shares" or a "hybrid LLC." In Arizona, there are three main types of limited liability companies with shares: 1. Arizona "LLC — Corporation"— - An LLC - Corporation is a hybrid entity formed by filing Articles of Organization with the Arizona Corporation Commission (ACC). — The company must have at least one member, and the ownership is represented by shares, similar to a traditional corporation. — The owners of the company are referred to as "shareholders" or "members." — The LL— - Corporation provides limited liability protection to its owners, shielding their personal assets from the company's debts and obligations. — This type of company has the flexibility of an LLC, such as pass-through taxation, while also incorporating corporate formalities like the issuance of shares. 2. Arizona "Close LLC": — A Close LLC is a type of limited liability company with shares that restricts stock ownership typically to a small group of individuals or entities, such as family members or close business associates. — The primary purpose of a Close LLC is to maintain the close-knit ownership structure by restricting the transferability of shares. — ClosLCSCs often have stricter operating agreements governing the management, governance, and transfer of shares than standard LCS. 3. Arizona "Series LLC": — A Series LLC is a unique type of limited liability company with shares that allows for the creation of separate divisions or "series" within the company, with each series having its own assets, liabilities, and members. — The series functioindependentlOdomom one another, presenting a cost-effective way to segregate different business activities or assets. — Each series can have its own members or shareholders, directors, and management structure, allowing for greater flexibility in operations and asset protection. SerialistsCs require specific provisions in their operating agreement to establish and maintain individual series. In summary, an Arizona limited liability company with shares is a versatile business entity that combines the limited liability protection of an LLC with the share-based ownership structure of a corporation. The three types mentioned above — LLC - Corporation, Close LLC, and Series LLC — offer various options to fit the specific needs and goals of entrepreneurs and businesses operating in the state of Arizona.