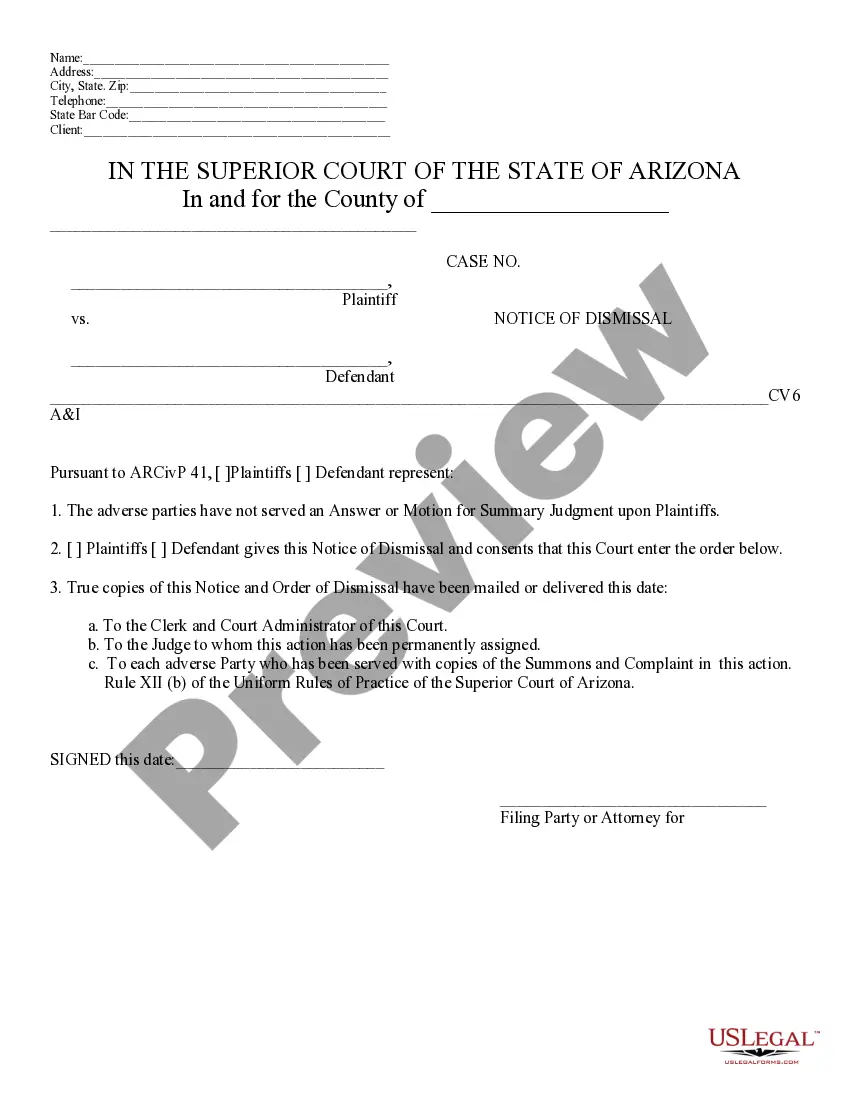

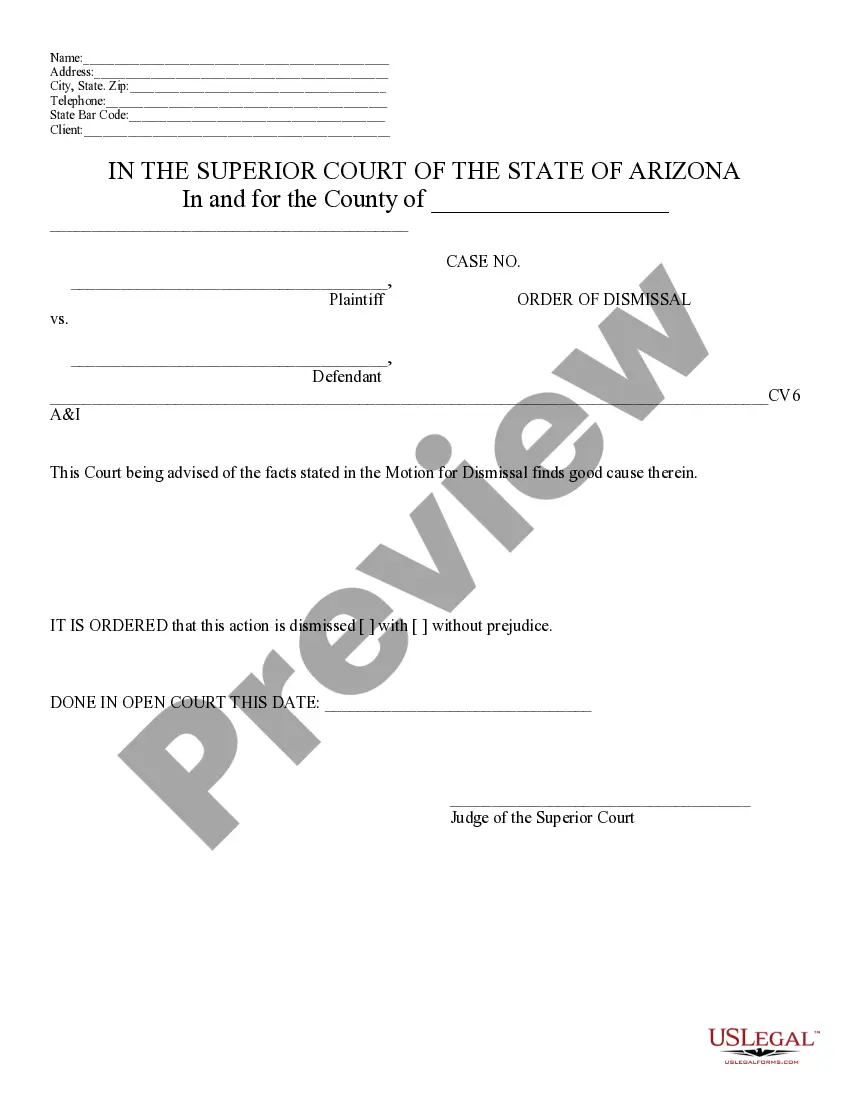

Motion for Dismissal: This is a motion which asks the court to dismiss a particular cause of action. The document must include the reasoning behind wanting the dismissal, as well be signed in front of a Notary Public. Also included, is a sample Order Granting Dismissal. This would be signed by the Judge and filed with the clerk's office. This form is available in both Word and Rich Text formats.

AZ motion Superior Court Arizona withholding refers to the legal process in Arizona that involves withholding certain assets or funds as a means of enforcing court orders or judgments. The Superior Court of Arizona has the authority to issue withholding orders in various situations, ensuring compliance with legal obligations. One type of AZ motion Superior Court Arizona withholding is wage withholding, also known as wage garnishment. This typically occurs when an individual fails to meet financial obligations, such as child support or spousal maintenance payments. Upon receiving a court order, the employer is required to deduct a specified amount from the employee's wages and remit it to the designated recipient. Another type of AZ motion Superior Court Arizona withholding is bank account garnishment. If an individual owes money to a creditor, the court may order that funds from their bank account be frozen or seized to satisfy the debt. This type of withholding is an effective method of ensuring payment is made, as it directly impacts the debtor's access to their finances. Additionally, tax refund withholding is another form of AZ motion Superior Court Arizona withholding. When an individual owes money to a governmental agency, such as unpaid taxes or fines, the court may order the interception of their state or federal tax refunds. This process prevents the debtor from receiving their tax refund until the specified debt is satisfied. It is important to note that AZ motion Superior Court Arizona withholding can also extend to other assets and properties, such as real estate or vehicles. In such cases, the court may issue a lien or order the seizure of the assets to enforce a judgment. This ensures that the debtor's assets are held until the debt is paid or alternative arrangements are made. Overall, AZ motion Superior Court Arizona withholding entails various methods to enforce court orders and judgments, such as wage withholding, bank account garnishment, and tax refund withholding. These processes are crucial in ensuring compliance with legal obligations and protecting the rights of creditors and beneficiaries.