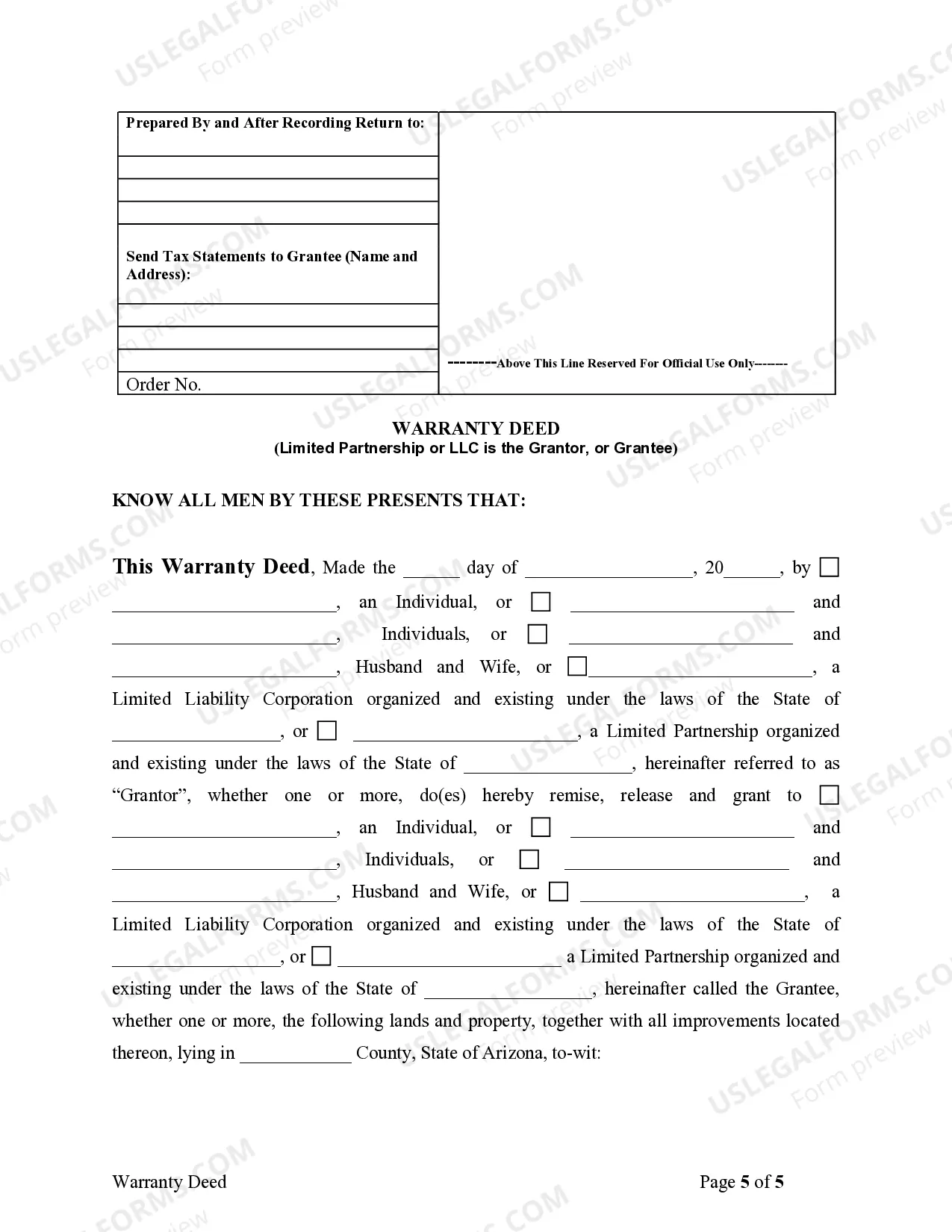

This form is a Warranty Deed where the grantor and/or grantee could be a limited partnership or LLC.

Limited Liability Partnership For Buy To Let

Category:

State:

Arizona

Control #:

AZ-SDEED-7

Format:

Word;

Rich Text

Instant download

Description Warranty Deed Llc

Free preview Limited Liability Partnership