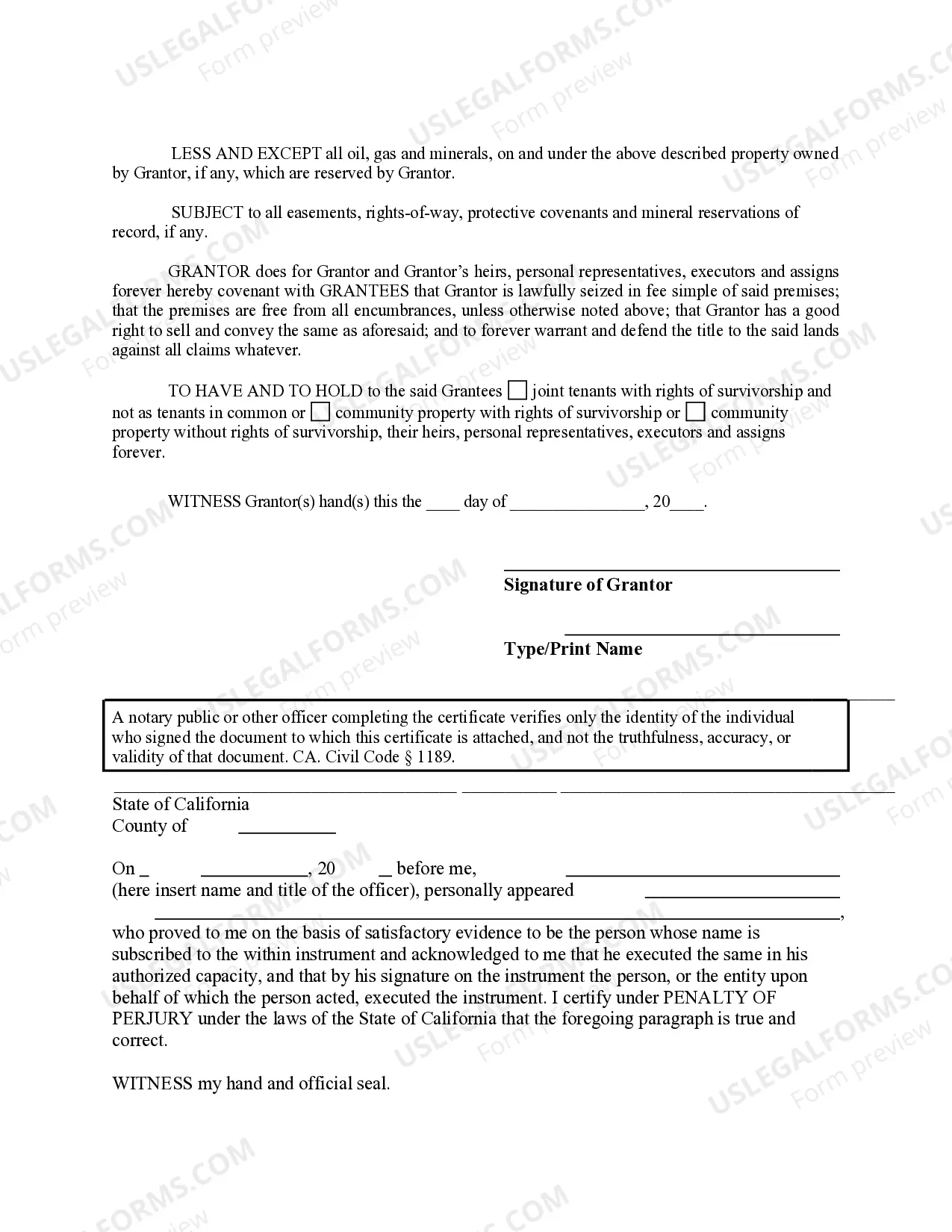

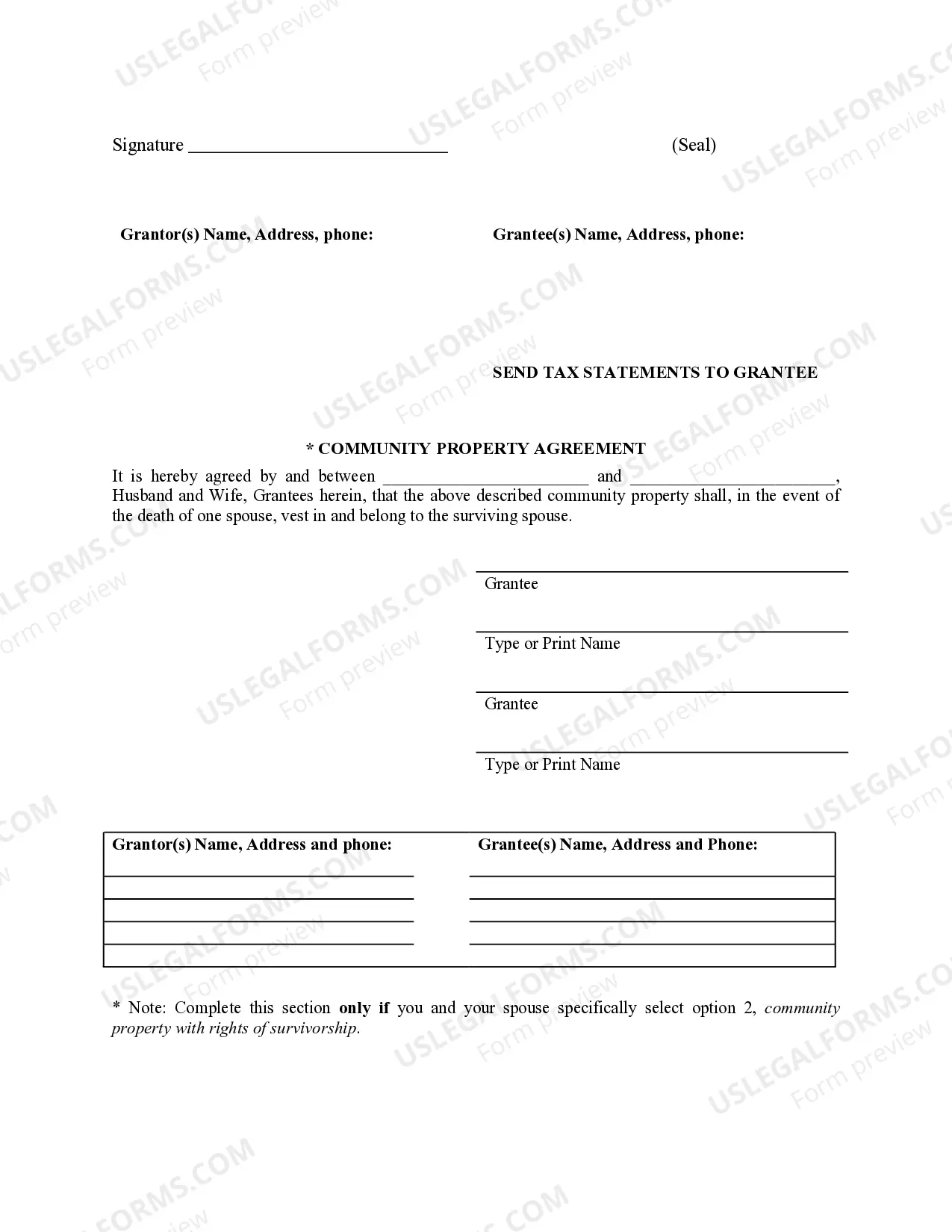

This Warranty Deed from Individual to Husband and Wife form is a Warranty Deed where the Grantor is an individual and the Grantees are husband and wife. Grantor conveys and warrants the described property to Grantees less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all applicable state statutory laws.

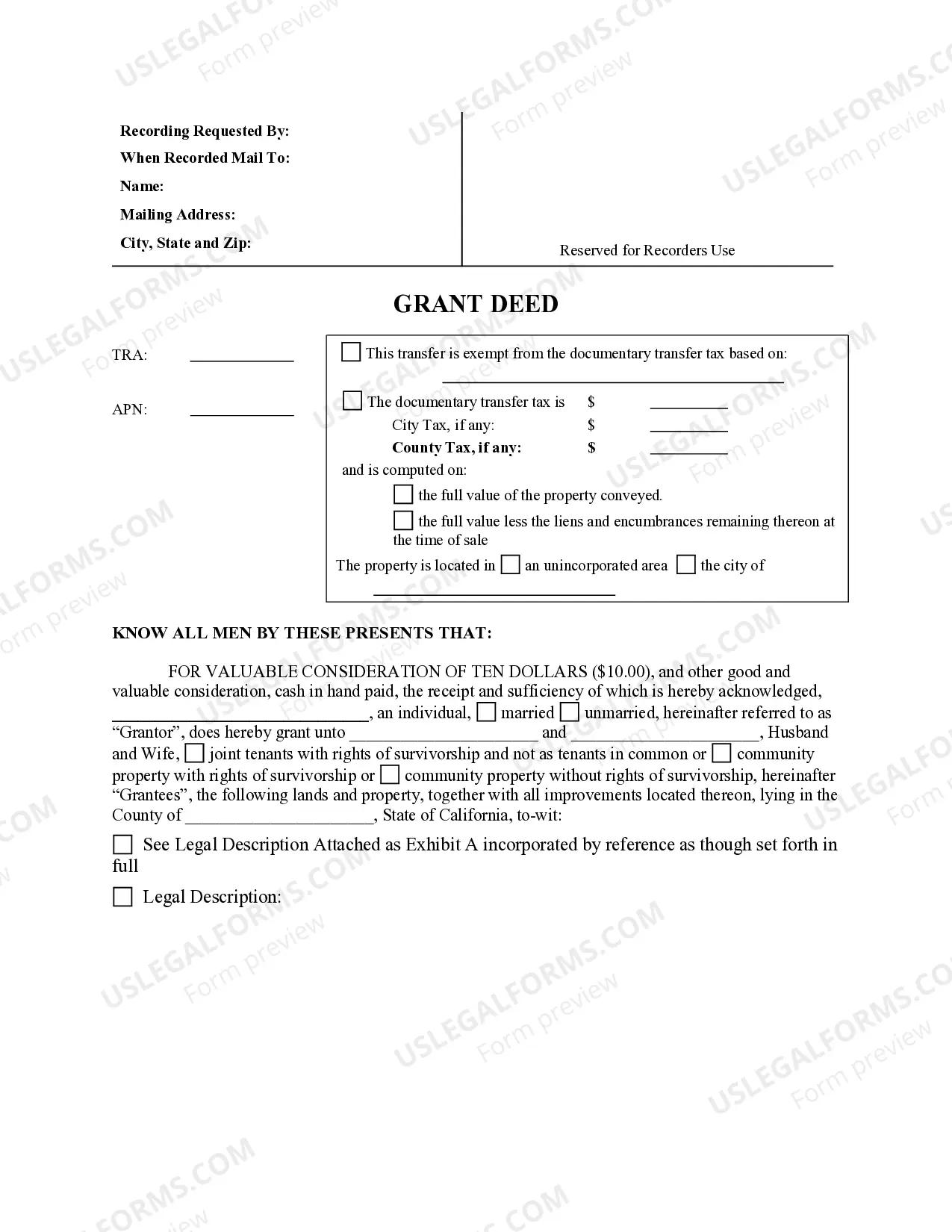

Grant Deed Form With Pcor

Description

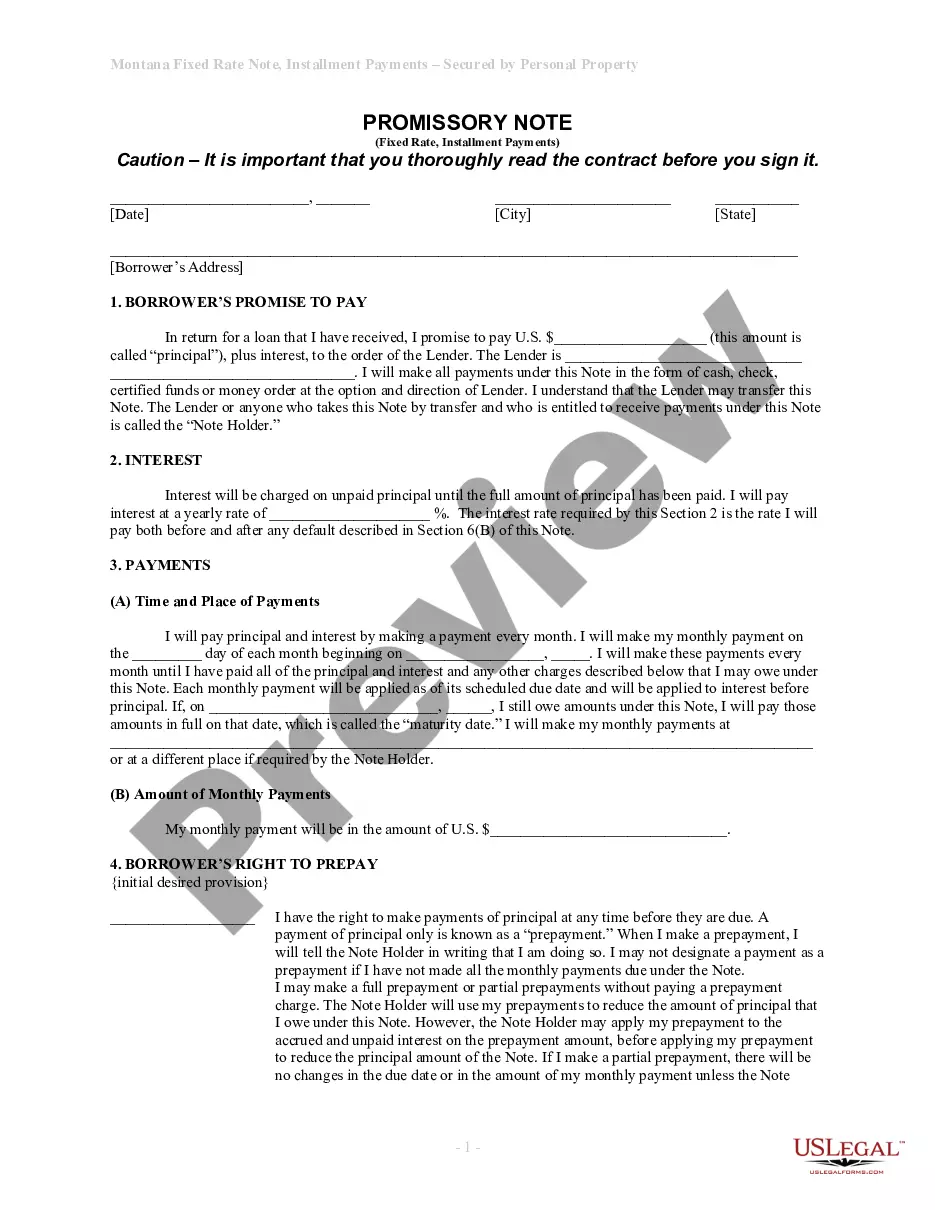

How to fill out Grant Deed Form With Pcor?

Red tape necessitates exactness and correctness.

If you do not engage in completing documentation like Grant Deed Form With Pcor regularly, it may lead to some confusions.

Selecting the appropriate sample from the outset will ensure that your document submission proceeds smoothly and avoid any hassles of resending a document or starting the same task from the beginning.

If you are not a registered user, finding the required sample will take a few additional steps.

- You can always locate the suitable sample for your documentation in US Legal Forms.

- US Legal Forms is the largest digital forms repository that provides over 85 thousand templates for various fields.

- You can acquire the latest and most pertinent version of the Grant Deed Form With Pcor by simply searching it on the platform.

- Find, save, and download templates in your account or refer to the description to confirm you have the correct one available.

- With an account at US Legal Forms, it is simple to secure, keep in one place, and browse through the templates you save for easy access.

- While on the website, click the Log In/">Log In button to authenticate.

- Then, navigate to the My documents page, where your document list is stored.

- Examine the forms' descriptions and download those you need at any time.

Form popularity

FAQ

The weakest form of deed is typically considered to be a quitclaim deed. This deed transfers whatever interest the grantor has in the property without any warranties or guarantees. Thus, it does not assure the buyer about the property's title or any encumbrances. If you're looking for more secure options, consider using a grant deed form with PCOR, which provides added protections during property transfer.

In California, a grant deed provides basic assurances about the title of the property. This type of deed confirms that the seller has not sold the property to someone else and that there are no undisclosed encumbrances. In contrast, a warranty deed offers more extensive protections, guaranteeing the property’s title against future claims. Understanding these distinctions is crucial when preparing a grant deed form with PCOR.

PCOR, or Preliminary Change of Ownership Report, plays a critical role in property transactions in California. This form helps assess any changes in ownership and is necessary when filing a grant deed form with PCOR. By accurately reporting ownership changes, PCOR ensures that property tax records reflect current ownership status. Utilizing the PCOR form along with your grant deed can streamline the property transfer process.

To obtain a copy of a grant deed in Orange County, CA, you can visit the local recorder's office or check their official website. They often provide online access to recorded deeds. For convenience, consider using services like USLegalForms which can guide you in obtaining the necessary documents, including the grant deed form with pcor.

To fill out a grant deed in California, start by identifying the current owner and the new owner of the property. Include the legal description of the property and any important information required by local law. Using a grant deed form with pcor will help ensure all essential components are included, making the process straightforward.

Correcting a grant deed in California typically involves filing a new deed that clarifies the intent or corrects the mistake. You may need to prepare an amended grant deed form with pcor that outlines the necessary corrections clearly. Utilizing platforms like USLegalForms can help you easily create the correct documentation needed for this process.

If a quitclaim deed is not recorded in California, it can lead to serious complications regarding property ownership. Failure to record the deed means that your rights may not be recognized against third parties. To protect your interests, it's wise to ensure that your grant deed form with pcor is properly recorded with the county.

Filling out a quitclaim deed in California involves several key steps. You should start by providing the name of the seller and buyer, along with a clear description of the property in question. To facilitate the process, you can use a template for a grant deed form with pcor, which will guide you through the necessary information to include.

In California, anyone can prepare a quitclaim deed, but it is advisable to seek assistance from a qualified professional. According to California law, individuals involved in the property transfer can create the grant deed form with pcor without formal training. However, using a service like USLegalForms can simplify the process and ensure that all legal requirements are met.

An unrecorded grant deed is legally valid in California, but it may lack the necessary protections. Recording the grant deed form with PCOR provides legal visibility, preventing disputes over ownership. Consider recording your deed to ensure your rights are protected if challenges arise.