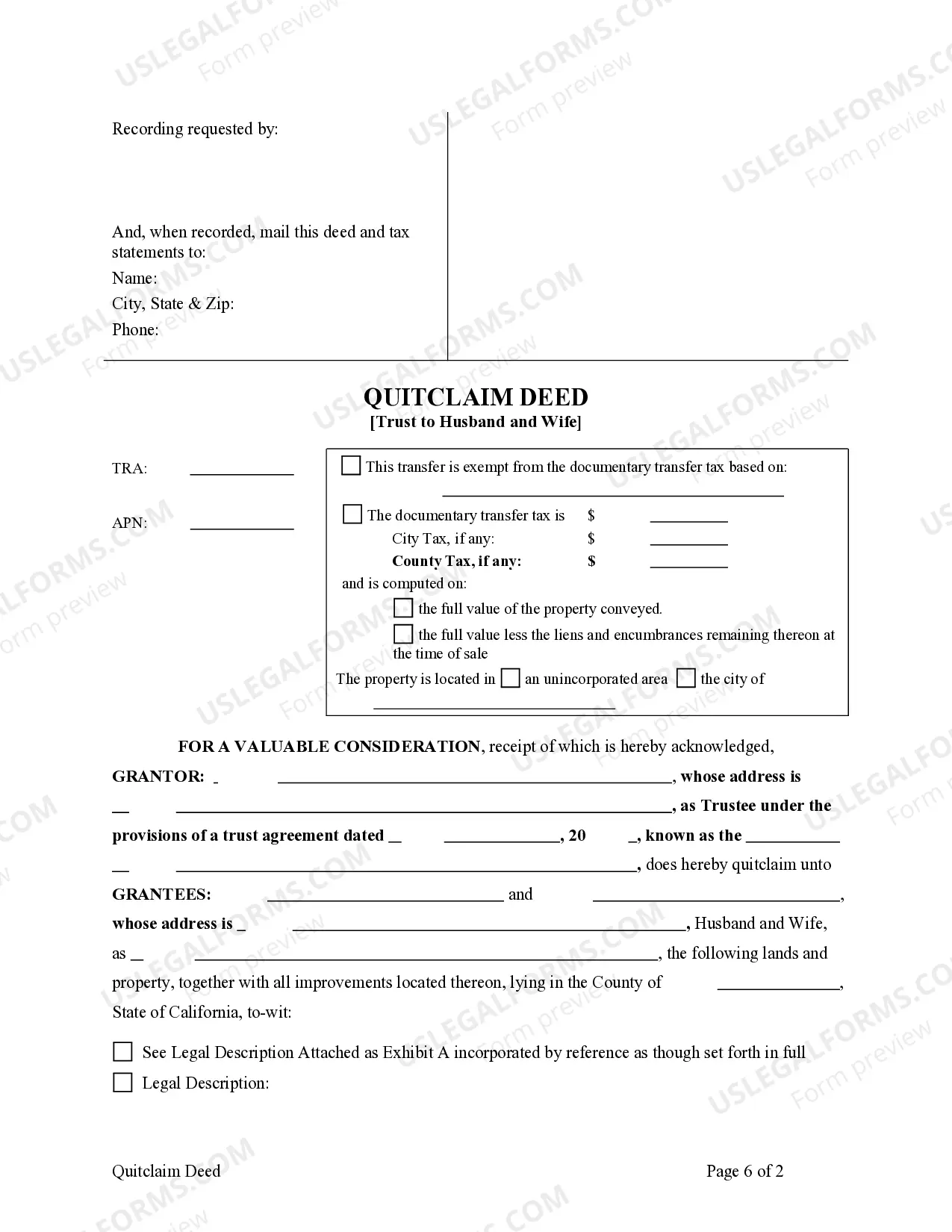

This form is a Quitclaim Deed where the grantor is a trust and the grantees are husband and wife. Grantor conveys and quitclaims the described property to grantees. Grantees take the property as community property with the right of survivorship, community property, joint tenants with the right of survivorship, or tenants in common. This deed complies with all state statutory laws.

Quitclaim Deed For Trust

Description

How to fill out Quitclaim Deed For Trust?

There’s no longer a necessity to spend hours searching for legal documents to comply with your local state laws. US Legal Forms has assembled all of them in one location and made them easier to access.

Our platform offers over 85,000 templates for various business and personal legal matters categorized by state and usage area. All forms are correctly composed and confirmed for legitimacy, so you can be confident in acquiring an updated Quitclaim Deed For Trust.

If you are acquainted with our service and already possess an account, ensure your subscription is active before obtaining any templates. Log In to your account, select the document, and click Download. You can also revisit all saved documents anytime by accessing the My documents section in your profile.

Print your form to fill it out by hand or upload the template if you prefer to utilize an online editor. Preparing legal documents in compliance with federal and state laws and regulations is fast and straightforward with our platform. Try US Legal Forms today to keep your paperwork organized!

- If you have never used our service before, the process will involve a few more steps to complete. Here’s how new users can find the Quitclaim Deed For Trust in our catalog.

- Examine the page content carefully to ensure it contains the sample you require.

- To assist, use the form description and preview options, if available.

- Utilize the Search field above to find another sample if the current one doesn't meet your needs.

- Click Buy Now next to the template title when you discover the appropriate one.

- Choose the most fitting subscription plan and create an account or Log In.

- Make payment for your subscription using a card or PayPal to proceed.

- Select the file format for your Quitclaim Deed For Trust and download it to your device.

Form popularity

FAQ

The disadvantages of a quitclaim deed include the lack of warranty regarding the property title, which means the grantee may inherit unresolved claims or tax liabilities. Additionally, if the grantor has a flawed title, the recipient assumes that risk without legal recourse. Therefore, while a quitclaim deed for trust can be beneficial, it is essential to consider the potential risks associated with it.

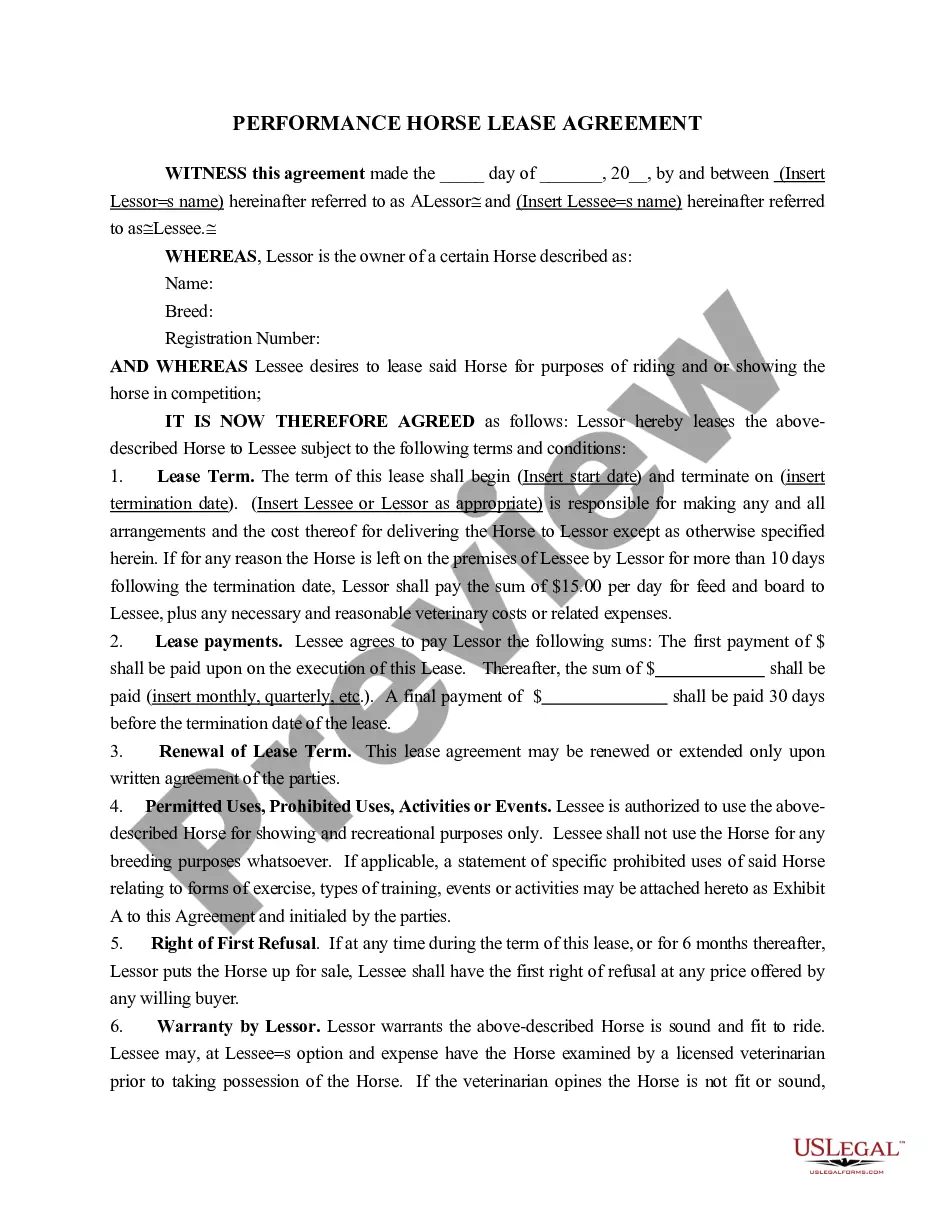

The usual reason for using a quitclaim deed is to expedite the transfer of property ownership among known parties, typically without the need for a lengthy and costly title search. This might arise during family transactions or in situations like parent-to-child property transfers. Thus, a quitclaim deed for trust simplifies the process, making it accessible and efficient.

A quitclaim deed is commonly used to convey the grantor's interest in a property to another party, without any warranties. For example, it is often utilized in situations like divorce settlements, where one spouse transfers their interest to the other. This simple transfer mechanism is particularly useful in cases where the parties involved have a mutual understanding, reinforcing the significance of a quitclaim deed for trust.

Quitclaim deeds are most often used to transfer property interest without guaranteeing the title's validity. This method is commonly applied among family members, where trust and familiarity exist. Essentially, a quitclaim deed for trust facilitates straightforward property transfers, making it a practical choice for estate planning or resolving ownership disputes.

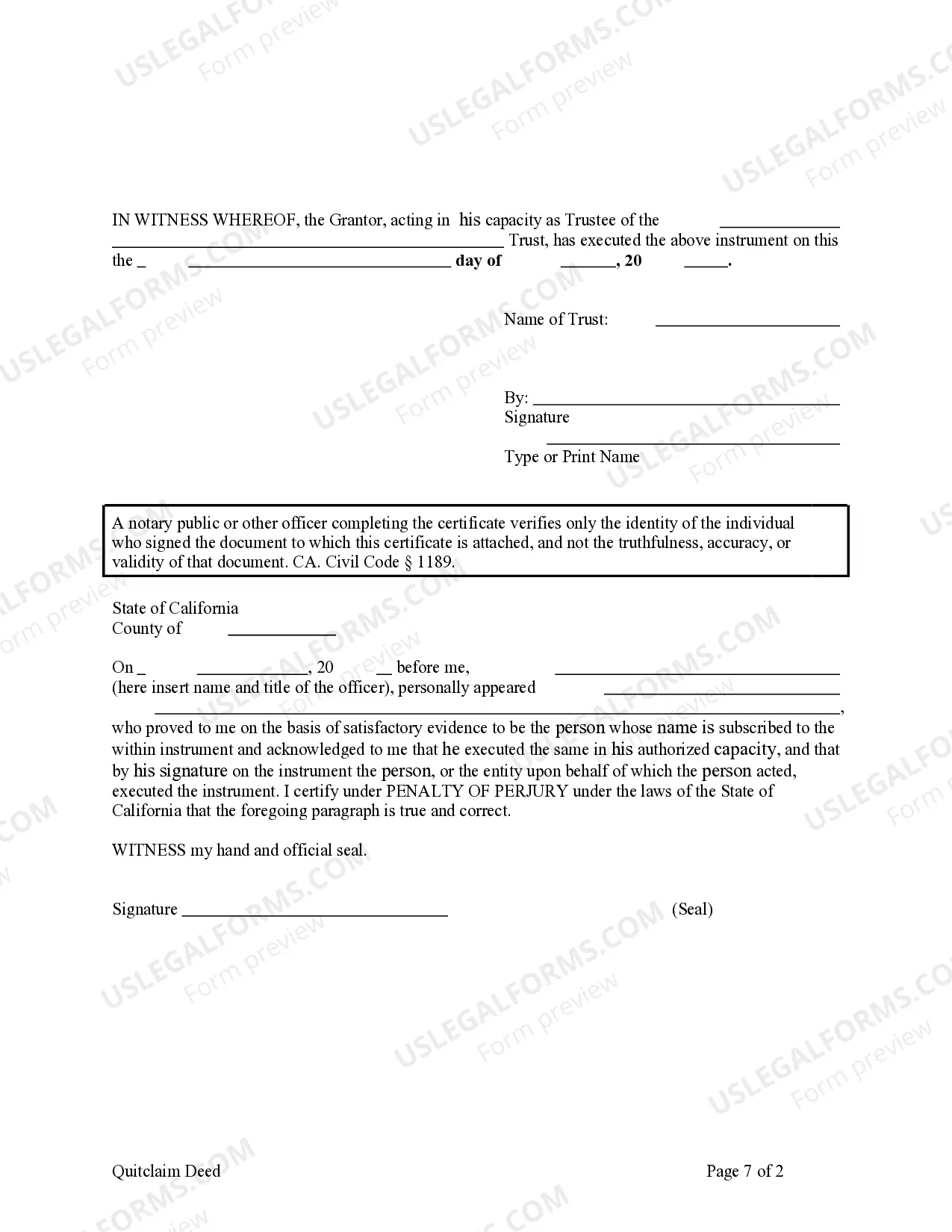

To execute a quitclaim deed for trust, start by obtaining the specific form that suits your needs. Fill out the deed with accurate details about the property and the trust. Once completed, you need to have the deed notarized to affirm authenticity. Finally, record the deed with your local county clerk's office to ensure it's legally documented, protecting your interests and the trust's future.

Individuals transferring property to a trust benefit significantly from a quitclaim deed for trust. This process simplifies the transfer of assets and helps ensure that the property is managed according to the trust's terms. Additionally, it's ideal for family members or friends who wish to pass on property without complicated legal hurdles. By using a quitclaim deed, you can streamline the transfer process and benefit from peace of mind.

Many individuals have utilized a quitclaim deed for trust to transfer property ownership efficiently. It serves as a straightforward method for transferring interest in real estate, eliminating the complexities often associated with other deed types. When executed correctly, this deed can help you avoid probate and simplify estate planning. For those considering this option, UsLegalForms provides essential templates and guidance to ensure a smooth process.

The individual or entity that wishes to transfer ownership of a property initiates a quitclaim deed. Usually, this is the current owner or the trustee when dealing with a trust. If you are involved in a quitclaim deed for trust, ensure that the trustee follows the proper legal procedures to enact the transfer. Clear initiation prevents future disputes and streamlines the transfer process.

Yes, you can execute a quitclaim deed from a trust to transfer property ownership to a beneficiary. This process typically involves preparing a quitclaim deed for trust that specifies the trust as the grantor and the beneficiary as the grantee. It is advisable to consult an attorney to ensure legal compliance and clarity in the transfer. Properly executed, this method preserves the integrity of the trust and facilitates smooth asset transfer.