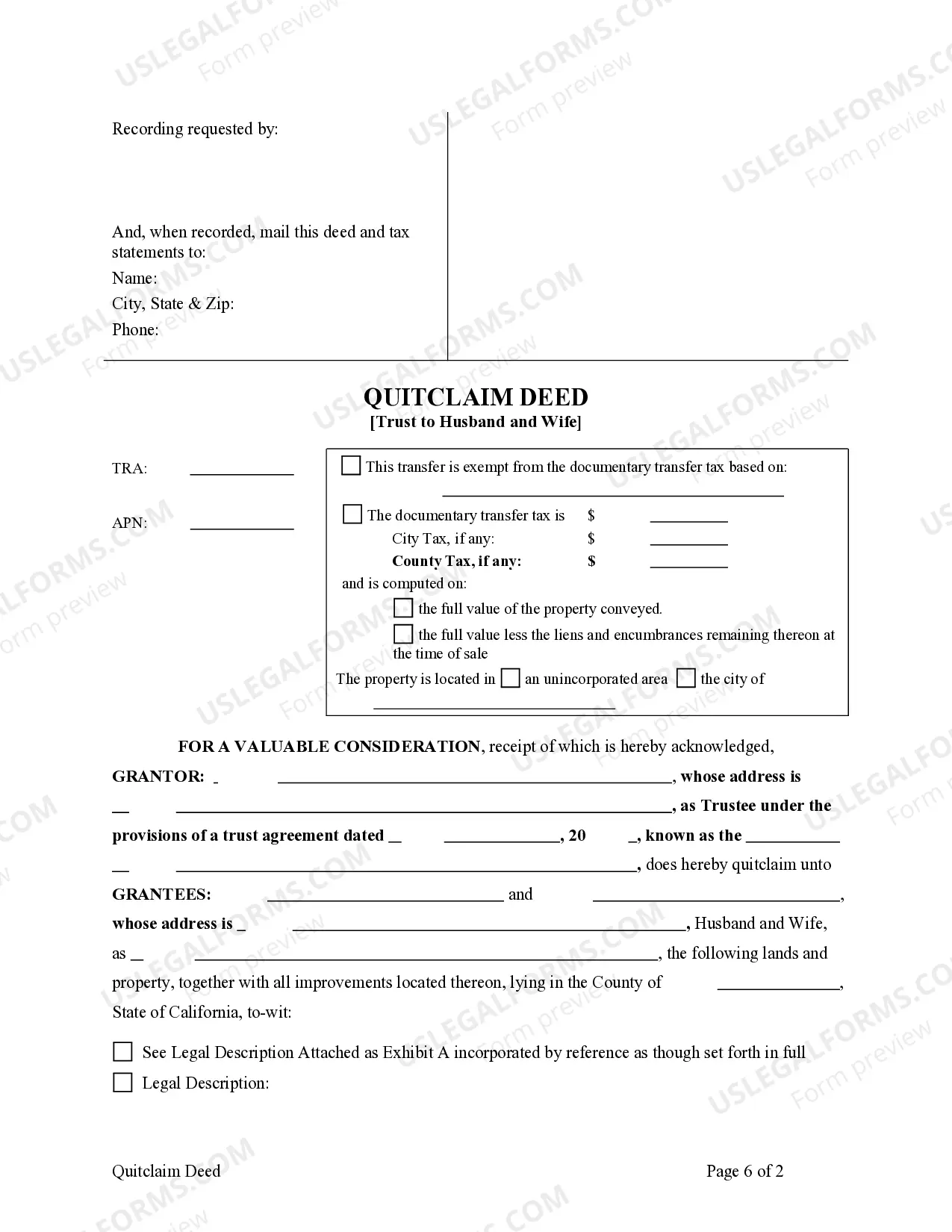

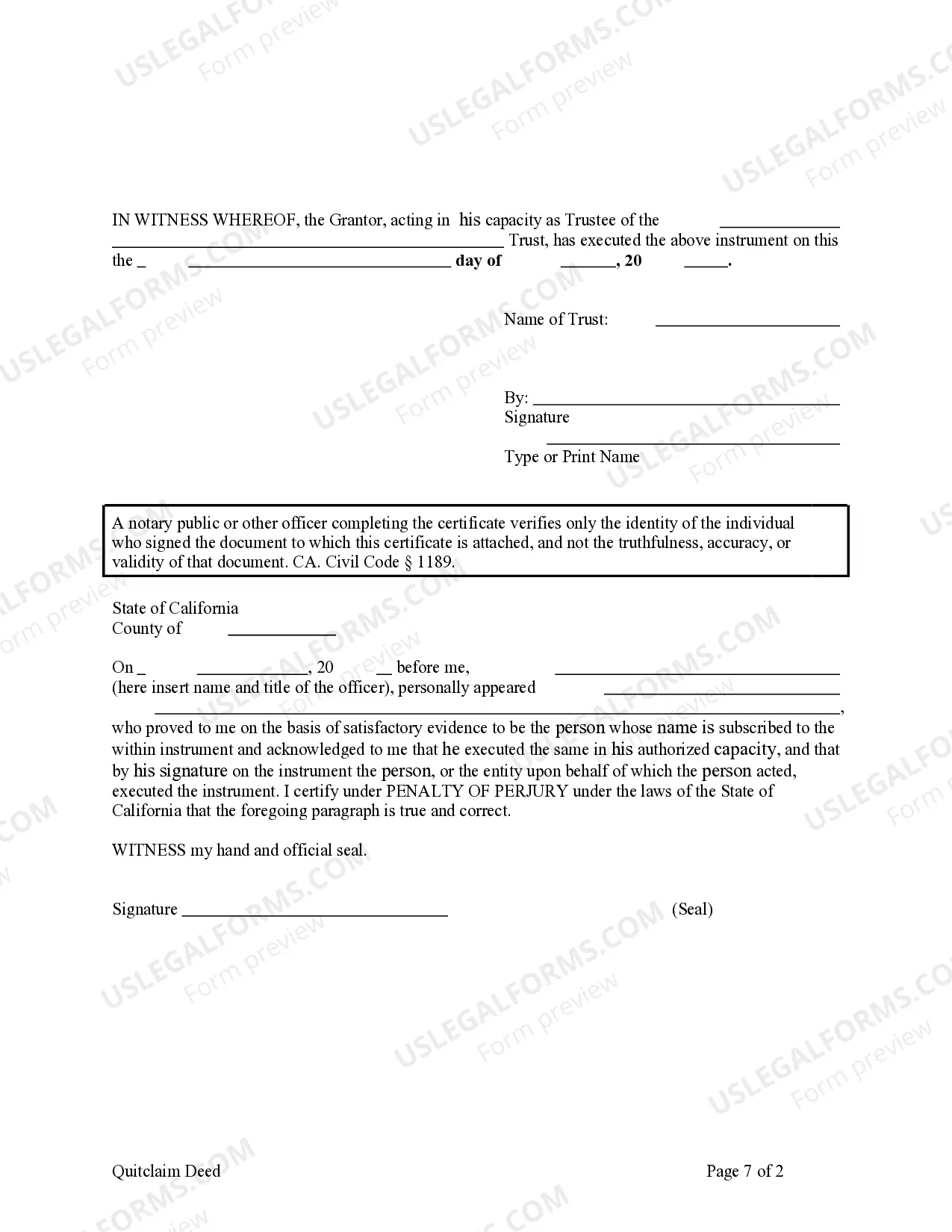

This form is a Quitclaim Deed where the grantor is a trust and the grantees are husband and wife. Grantor conveys and quitclaims the described property to grantees. Grantees take the property as community property with the right of survivorship, community property, joint tenants with the right of survivorship, or tenants in common. This deed complies with all state statutory laws.

Quitclaim Deed To Revocable Trust Form

Description

How to fill out Quitclaim Deed To Revocable Trust Form?

How to locate professional legal documents that conform to your state regulations and generate the Quitclaim Deed To Revocable Trust Form without consulting a lawyer.

Numerous online services provide templates to address various legal scenarios and requirements. However, it can be time-consuming to identify which of the available samples meet both functional and legal standards for your situation.

US Legal Forms is a trustworthy service that assists you in locating official documents created in compliance with the latest updates in state laws, helping you save on legal costs.

If you do not hold a US Legal Forms account, follow the steps outlined below: Review the webpage you have accessed and verify whether the form suits your requirements. To do this, utilize the form description and preview options if accessible. Search for another template in the header specifying your state if needed. Click the Buy Now button when you locate the appropriate document. Select the most suitable pricing plan, then Log In or create a new account. Choose your payment method (by credit card or via PayPal). Select the file format for your Quitclaim Deed To Revocable Trust Form and click Download. The files you acquire will remain in your possession: you can always revisit them in the My documents tab of your profile. Subscribe to our service and create legal documents independently like a seasoned legal professional!

- US Legal Forms is not an ordinary online directory.

- It features a compilation of over 85,000 verified templates for various business and personal needs.

- All documents are categorized by field and state to streamline your search process.

- It also integrates advanced tools for PDF editing and electronic signatures, enabling Premium subscribers to quickly finalize their documents online.

- It requires minimal effort and time to acquire the necessary paperwork.

- If you already possess an account, Log In and ensure your subscription is current.

- Download the Quitclaim Deed To Revocable Trust Form using the adjacent button next to the file name.

Form popularity

FAQ

The best type of trust largely depends on your unique financial situation and goals. Many people favor revocable trusts for their flexibility and ease of management. They allow you to retain control over your assets and provide clarity for beneficiaries after your passing. For optimal results, consider using a quitclaim deed to revocable trust form to facilitate the transfer of property into your trust.

In the UK, a revocable trust functions similarly to those in the US, allowing the creator to maintain control over their assets. This type of trust can be altered or canceled by the creator, offering flexibility in estate planning. However, it may have different legal implications and tax consequences compared to US trusts. Understanding these differences is crucial, and platforms like USLegalForms can guide you through creating a quitclaim deed to revocable trust form tailored to your needs.

A revocable trust is a legal document that allows you to manage your assets while you're alive and specify how they will be distributed after your death. You can change the trust terms or even dissolve it entirely at any time. This type of trust avoids probate, streamlining the process of asset distribution. Using a quitclaim deed to revocable trust form helps ensure a smooth transition of your property into the trust.

A trust is a legal arrangement where one party holds property for the benefit of another. A revocable trust, however, allows the creator to modify or revoke the trust during their lifetime. This flexibility provides you with control over your assets, making it easier to manage them. To transfer assets to a revocable trust, you can use a quitclaim deed to revocable trust form, simplifying the process.

In Wisconsin, the primary difference between a warranty deed and a quitclaim deed lies in the guarantees provided. A warranty deed assures the buyer of clear title and protection against future claims, whereas a quitclaim deed transfers whatever interest the seller has without warranties. For those dealing with estate planning, a quitclaim deed to revocable trust form may be preferable for its simplicity. It's critical to understand these differences to choose the best option for your needs.

Filing your own quitclaim deed to revocable trust form is entirely possible, and many people successfully do it. However, it's wise to understand the legal implications and ensure the form is completed correctly. Mistakes can lead to issues down the line, so consider using a trusted platform like US Legal Forms for guidance and resources. Taking the right steps now can save you headaches in the future.

Individuals looking to transfer property without complications often benefit the most from a quitclaim deed. This simple form allows property owners to transfer rights quickly, making it ideal for family members and close friends. Using a quitclaim deed to revocable trust form can be especially useful in estate planning, helping to avoid probate. It's a straightforward solution for those seeking an efficient means of property transfer.