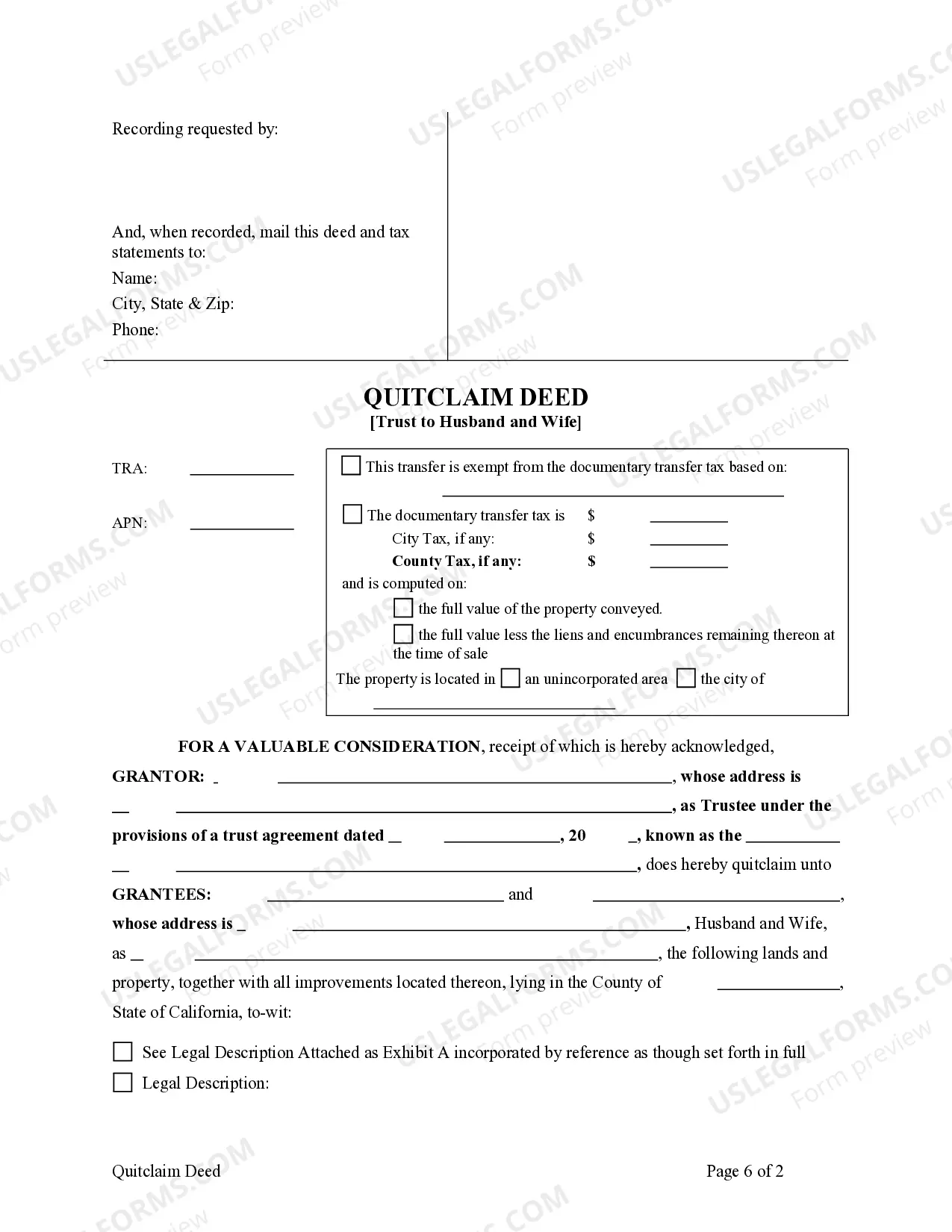

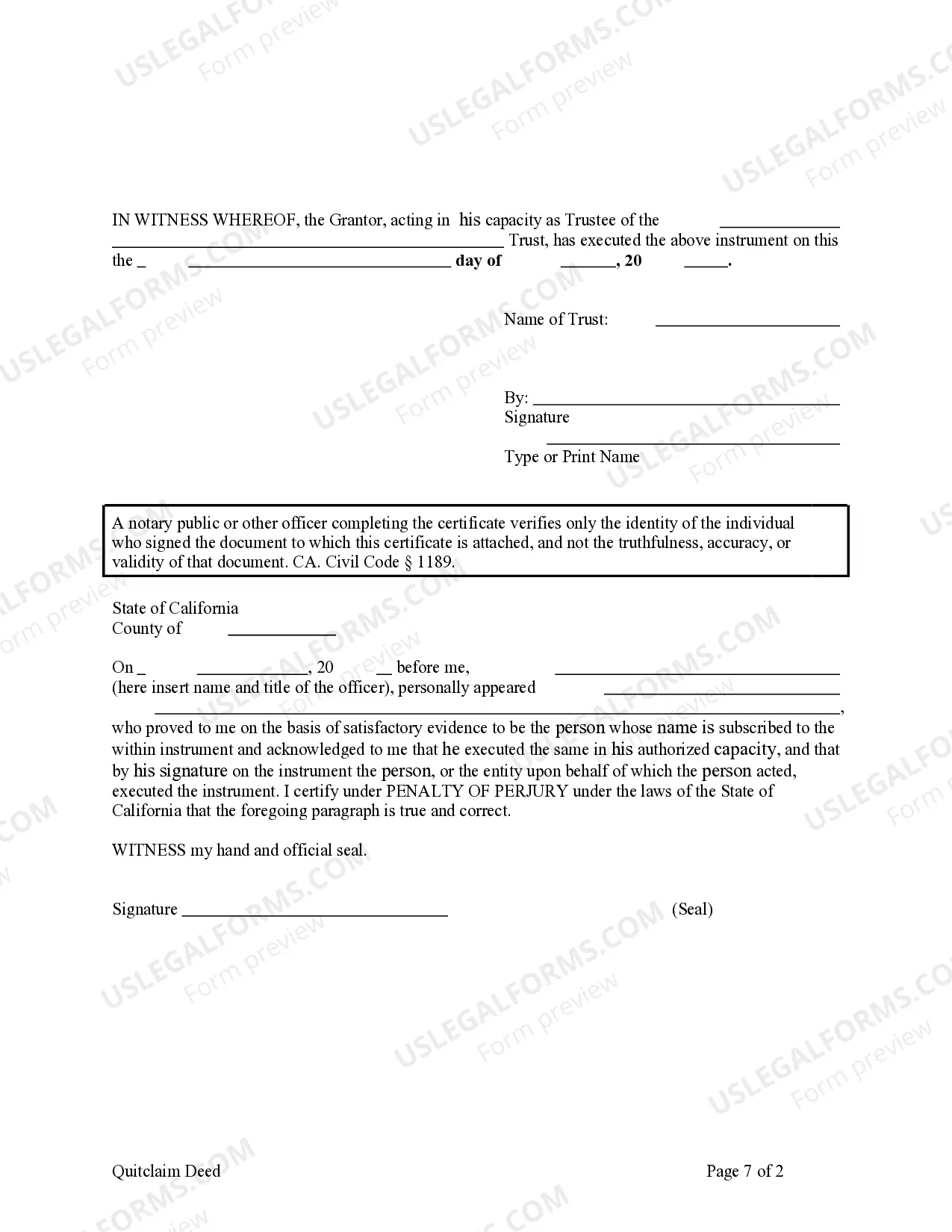

This form is a Quitclaim Deed where the grantor is a trust and the grantees are husband and wife. Grantor conveys and quitclaims the described property to grantees. Grantees take the property as community property with the right of survivorship, community property, joint tenants with the right of survivorship, or tenants in common. This deed complies with all state statutory laws.

Quitclaim Deed With Trust

Description

How to fill out Quitclaim Deed With Trust?

There's no longer a requirement to invest time searching for legal documents to adhere to your local state laws.

US Legal Forms has compiled all of them into a single location and streamlined their availability.

Our platform offers over 85,000 templates for any business and personal legal situations organized by state and area of utilization. All forms are properly drafted and verified for validity, allowing you to confidently obtain a current Quitclaim Deed With Trust.

Print your form to fill it out by hand or upload the template if you prefer to use an online editor. Completing legal documents in accordance with federal and state regulations is quick and hassle-free with our library. Try US Legal Forms today to keep your paperwork organized!

- If you are acquainted with our platform and already possess an account, ensure your subscription is active prior to acquiring any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all obtained documents at any time by accessing the My documents tab in your profile.

- If you are a new user to our platform, the process will require a few additional steps to complete.

- Here’s how new users can acquire the Quitclaim Deed With Trust from our collection.

- Carefully review the page content to verify it contains the sample you need.

- Utilize the form description and preview options if available.

- Use the Search field above to find another template if the current one does not meet your needs.

- Click Buy Now next to the template name once you identify the suitable one.

- Select the desired pricing plan and create an account or Log In.

- Complete your payment for your subscription with a card or via PayPal to proceed.

- Choose the file format for your Quitclaim Deed With Trust and download it to your device.

Form popularity

FAQ

To execute a quitclaim deed with trust, you typically need to start by drafting the deed, including the names of all parties involved and the legal description of the property. Once the deed is completed, it must be signed and notarized, then recorded in the appropriate county office. This process helps ensure that the transfer is legally binding and recognized. For a step-by-step guide and templates, you can visit uslegalforms, where their resources can assist you in ensuring accuracy and compliance.

It's not uncommon nor crazy to file your own quitclaim deed with trust, but it requires careful attention to detail. Many individuals have successfully navigated this process on their own, ensuring that all legal requirements are met. However, if you're unsure, consulting a legal professional can provide you with peace of mind. Platforms like uslegalforms offer helpful resources to assist you if you prefer to manage it independently.

Yes, many individuals have utilized a quitclaim deed with trust to facilitate property transfers. This approach allows for a straightforward transfer of interests, particularly when adding or removing individuals from a title. It's crucial to understand the implications and benefits of using a quitclaim deed, especially in estate planning. For comprehensive information and resources, consider exploring uslegalforms, where you can find templates and guidance tailored to your specific needs.

Certain assets, such as retirement accounts and life insurance policies, usually cannot be directly placed in a trust without specific planning. Additionally, assets that require direct owner management, like some business interests, can become complicated when placed in a trust. Understanding these limitations is essential for effective estate planning, so consider consulting experts on how to best utilize a quitclaim deed with trust.

One common mistake parents make is not properly funding the trust. It's critical to transfer assets, including real estate through a quitclaim deed with trust, and ensure that your trust holds the intended property. Neglecting this step can lead to delays and potential legal issues down the road.

Yes, you can execute a quitclaim deed from a trust. This process allows the trustee to transfer property out of the trust, making it possible to manage assets according to evolving needs. By doing so, you can adapt your estate plan while maintaining control over your property and minimizing complications.

One disadvantage of a quitclaim deed is that it provides no guarantees regarding the title — you might inherit unknown liens or claims. Additionally, a quitclaim deed with trust does not offer the same level of protection as warranties, which could leave you vulnerable. It’s crucial to understand these risks when considering this option for transferring property.

The best trust to put your house in often depends on your individual circumstances, including your estate planning goals. A revocable living trust is commonly used because it allows for flexibility and control while you are alive. Utilizing a quitclaim deed with trust to transfer your property can simplify the management of your assets and facilitate a smoother transition in the event of your passing.

Yes, a home with a mortgage can be transferred to a trust. However, it's important to check with your lender before making this move, as it may trigger a due-on-sale clause. By using a quitclaim deed with trust, you can effectively transfer property into a trust while ensuring that your new estate plans align with your mortgage obligations.