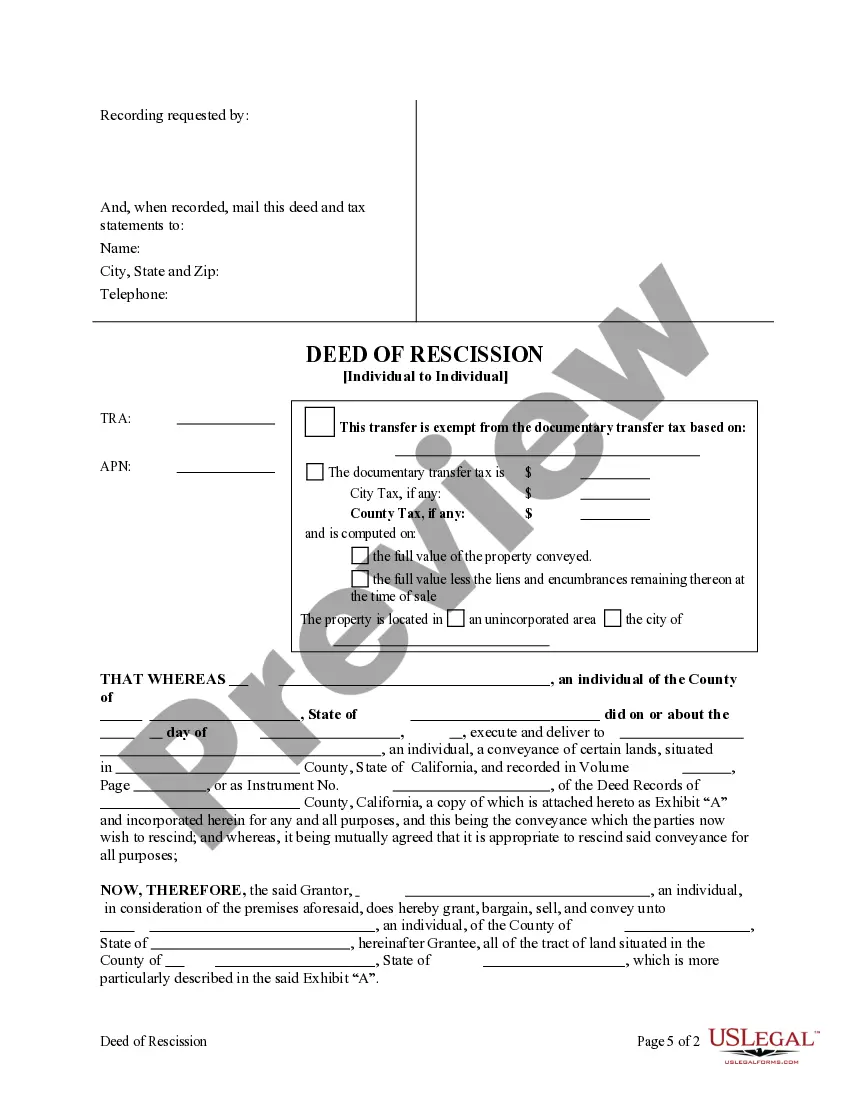

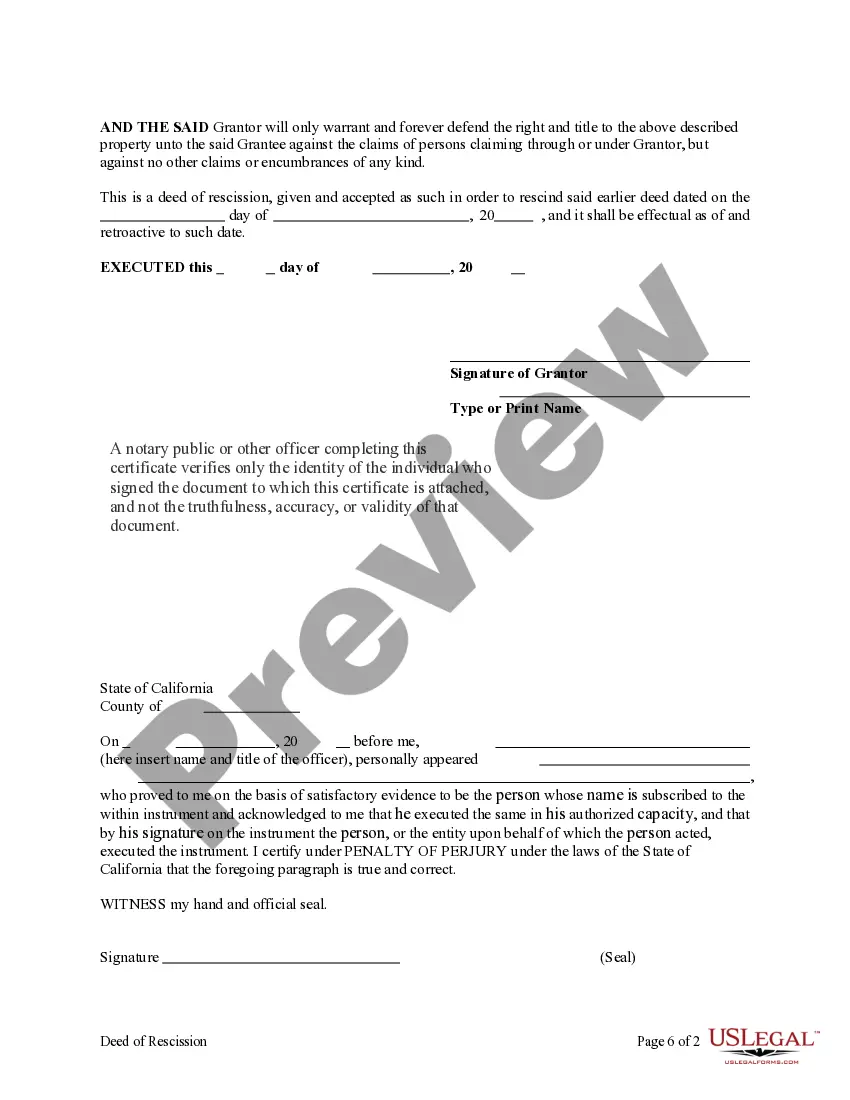

This form is a Deed of Rescission where the Grantor is an individual and the Grantee is an individual. The parties are rescinding or unwinding a prior transfer of the subject property. Grantor conveys and grants the described property to the Grantee. Grantor will defend and warrant the property only as to those claiming by through and under him and not otherwise. This deed complies with all state statutory laws.

A Deed of Rescission is a legal document used to formally cancel or undo a previous agreement or contract. It is often used when both parties involved in the original agreement wish to terminate it and return to their original positions as if the agreement never existed. This can occur due to various reasons such as a breach of contract, mutual consent, or a change in circumstances. One essential aspect of a Deed of Rescission is the payment of stamp duty, which refers to the tax imposed on certain legal documents. The stamp duty is usually calculated based on the value of the agreement being rescinded and varies depending on the jurisdiction and the type of rescission involved. It is important to understand the specific stamp duty requirements related to the particular type of Deed of Rescission being executed to ensure compliance with the law. There are different types of Deed of Rescission stamp duty, each catering to specific situations and agreements. Some common types include: 1. Real Estate Rescission: This type of rescission is often related to property transactions, where the Deed of Rescission is used to nullify an existing real estate agreement, such as a purchase or lease contract. Stamp duty is levied on the value of the property being released from the agreement. 2. Business Agreement Rescission: In the case of business agreements, a Deed of Rescission may be used to terminate contracts related to partnerships, joint ventures, or sales of businesses. The stamp duty for this rescission is typically calculated based on the value of the business assets involved. 3. Financial Rescission: Financial agreements, such as loan contracts or investment agreements, can be rescinded through a Deed of Rescission. The stamp duty applicable in these situations is determined by the financial amount being released or returned. It is important to consult with a legal professional or seek guidance from the relevant government authorities to understand the specific stamp duty requirements for executing a Deed of Rescission in the respective jurisdiction. Failure to comply with stamp duty obligations can result in legal consequences and financial penalties.A Deed of Rescission is a legal document used to formally cancel or undo a previous agreement or contract. It is often used when both parties involved in the original agreement wish to terminate it and return to their original positions as if the agreement never existed. This can occur due to various reasons such as a breach of contract, mutual consent, or a change in circumstances. One essential aspect of a Deed of Rescission is the payment of stamp duty, which refers to the tax imposed on certain legal documents. The stamp duty is usually calculated based on the value of the agreement being rescinded and varies depending on the jurisdiction and the type of rescission involved. It is important to understand the specific stamp duty requirements related to the particular type of Deed of Rescission being executed to ensure compliance with the law. There are different types of Deed of Rescission stamp duty, each catering to specific situations and agreements. Some common types include: 1. Real Estate Rescission: This type of rescission is often related to property transactions, where the Deed of Rescission is used to nullify an existing real estate agreement, such as a purchase or lease contract. Stamp duty is levied on the value of the property being released from the agreement. 2. Business Agreement Rescission: In the case of business agreements, a Deed of Rescission may be used to terminate contracts related to partnerships, joint ventures, or sales of businesses. The stamp duty for this rescission is typically calculated based on the value of the business assets involved. 3. Financial Rescission: Financial agreements, such as loan contracts or investment agreements, can be rescinded through a Deed of Rescission. The stamp duty applicable in these situations is determined by the financial amount being released or returned. It is important to consult with a legal professional or seek guidance from the relevant government authorities to understand the specific stamp duty requirements for executing a Deed of Rescission in the respective jurisdiction. Failure to comply with stamp duty obligations can result in legal consequences and financial penalties.