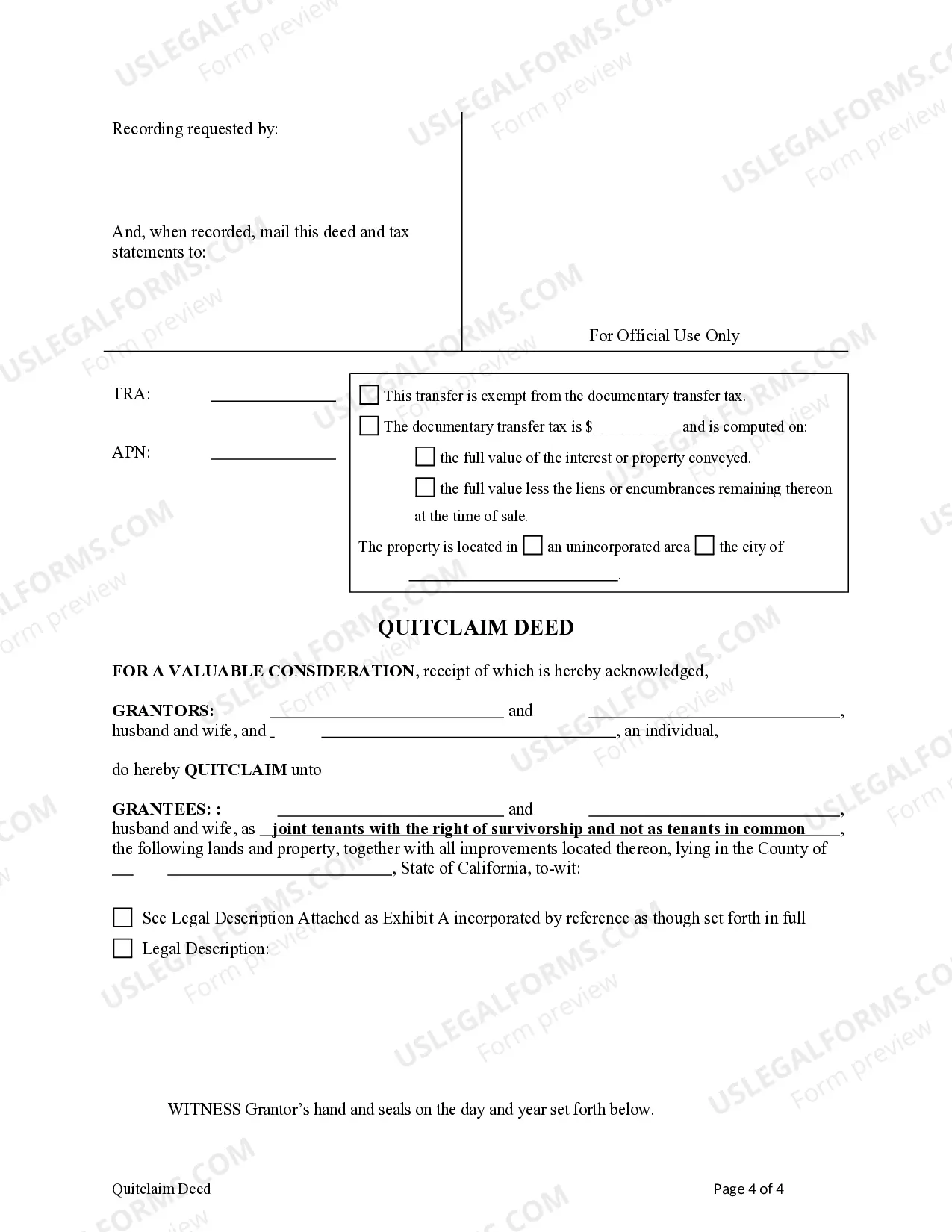

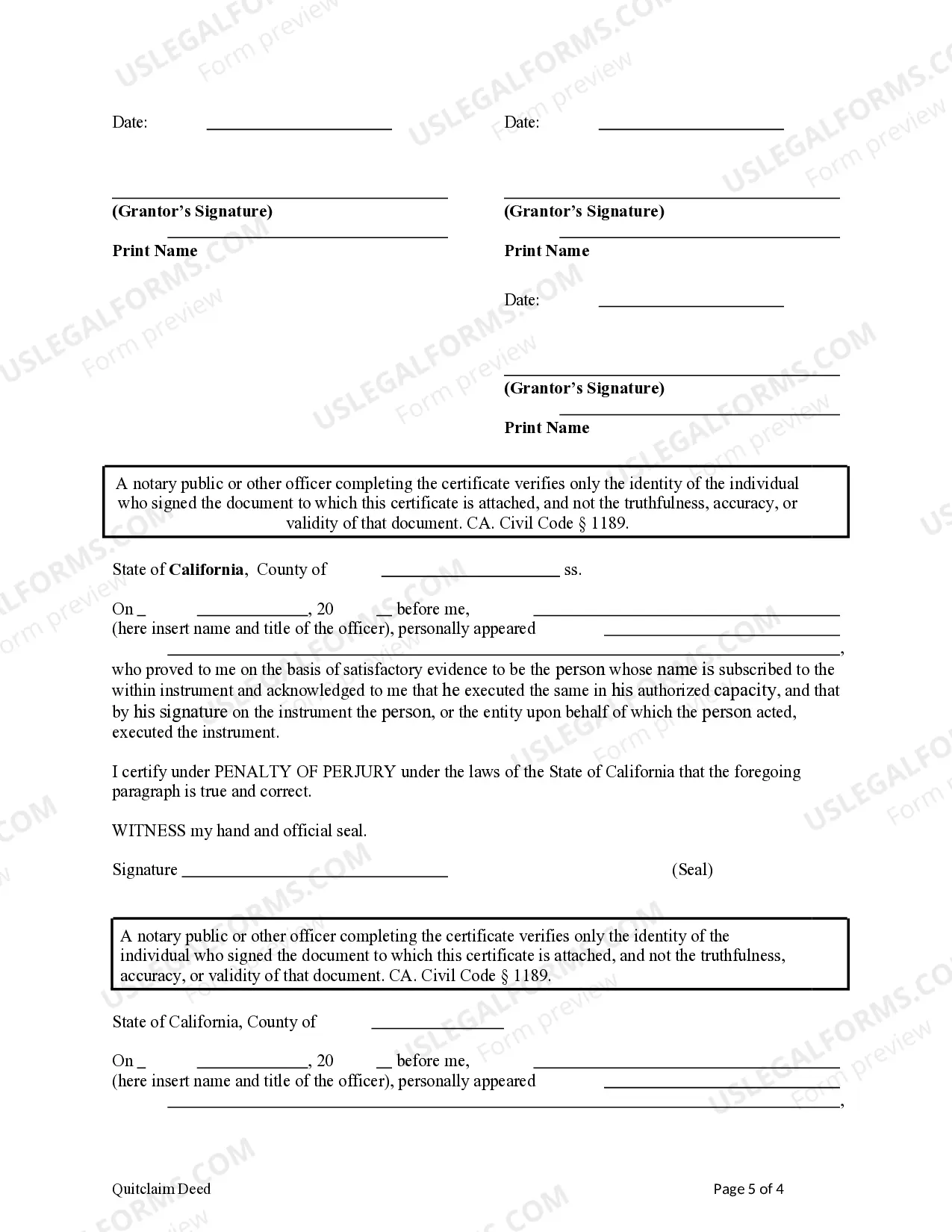

This form is a Quitclaim Deed where the Grantors are Husband, Wife and an Individual and the Grantees are Husband and Wife. Grantors convey and quitclaim the described property to Grantees. This deed complies with all state statutory laws.

California Quitclaim Deed Without Consideration

Description

How to fill out California Quitclaim Deed Without Consideration?

There is no longer a necessity to waste time searching for legal paperwork to adhere to your local state laws. US Legal Forms has gathered all of them in one place and enhanced their availability.

Our platform offers over 85k templates for various business and personal legal situations organized by state and usage area. All forms are expertly drafted and verified for legitimacy, so you can be assured of acquiring an up-to-date California Quitclaim Deed Without Consideration.

If you are acquainted with our service and already possess an account, ensure your subscription is active before acquiring any templates. Log In to your account, select the document, and click Download. You can also access all saved documents anytime needed by navigating to the My documents tab in your profile.

Print your form to complete it manually or upload the sample if you prefer to do it in an online editor. Preparing legal documents under federal and state statutes and regulations is quick and straightforward with our library. Try out US Legal Forms today to manage your documentation effectively!

- If you have never utilized our service prior, the process will require a few additional steps to complete. Here's how new users can find the California Quitclaim Deed Without Consideration in our catalog.

- Examine the page content carefully to confirm it includes the sample you need.

- To do this, make use of the form description and preview options if available.

- Employ the Search bar above to look for another template if the previous one did not suit your needs.

- Click Buy Now next to the template title once you discover the appropriate one.

- Select the most suitable subscription plan and either register for an account or Log In.

- Complete your subscription payment with a card or via PayPal to continue.

- Choose the file format for your California Quitclaim Deed Without Consideration and download it to your device.

Form popularity

FAQ

Yes, $0.00 is a valid consideration when filing a California quitclaim deed without consideration. This type of deed transfers property ownership without any payment, often used between family members or in certain legal circumstances. It is important to properly execute the quitclaim deed to ensure that it is legally binding and recognized by the state. If you need assistance with filing or understanding the process, consider using the services offered by uslegalforms for a seamless experience.

If a quitclaim deed is not recorded in California, the transfer of property may not be legally recognized against third parties. This can lead to disputes over ownership and may create issues when it comes to selling the property in the future. To avoid these complications, it is important to ensure that your California quitclaim deed without consideration is properly recorded with the county clerk's office.

The primary beneficiaries of a California quitclaim deed without consideration are usually family members or close friends. This type of deed allows for quick and smooth transfers, especially in situations such as inheritance or divorce. By eliminating the need for potentially costly processes, all parties involved can enjoy a straightforward approach to property transfer.

Quitclaim deeds are most often used in California for transferring property between family members, especially during divorce proceedings or estate settlements. They serve as a quick method to relinquish ownership without the complexities of a traditional sale. In many cases, a California quitclaim deed without consideration helps to avoid tax implications associated with property sales.

In California, anyone can prepare a quitclaim deed without consideration, as long as they provide accurate information. However, it is often advisable to consult a legal professional to ensure the document meets all state requirements and avoids potential pitfalls. Using a platform like US Legal Forms can simplify the preparation process, providing templates and guidance to help you create a valid quitclaim deed.

Yes, many individuals have used a California quitclaim deed without consideration to transfer ownership of property. This type of deed is often used among family members or friends to simplify the transfer process or to eliminate complications during property division. People appreciate the straightforwardness of a quitclaim deed, as it does not require a title search or warranty of ownership.

A warranty deed primarily benefits the buyer, or grantee, in a property transaction. This deed provides guarantees that the seller holds clear title to the property and has the right to transfer it. While a California quitclaim deed without consideration lacks these warranties, it can still be beneficial for the seller who wants to relinquish property rights quickly. Understanding the differences between deed types is essential for making informed decisions.

A no consideration deed refers to a property transfer that does not involve any payment in exchange for the property. Typically, this type of deed is used in situations like gifts between family members. It’s common to see a California quitclaim deed without consideration in these scenarios. Always consult a legal professional to understand any potential tax implications of such transfers.

Having no consideration in a deed means that the transfer of property occurs without a monetary exchange. In legal terms, consideration can be something of value, but with a California quitclaim deed without consideration, the transfer is a gift or done for other non-financial reasons. This can have implications for tax purposes and future ownership rights, which should be carefully considered.

An unrecorded quit claim deed is valid in California, but it may not be as effective as a recorded one. Recording provides public notice of the property transfer, which is crucial for protecting your rights against future claims. To ensure maximum protection and transparency, it is recommended to record your California quitclaim deed without consideration. This step enhances security for both parties involved.