Use this form to an abandon a declared homestead. File it at the County Recorder's Office in the county where your property is located.

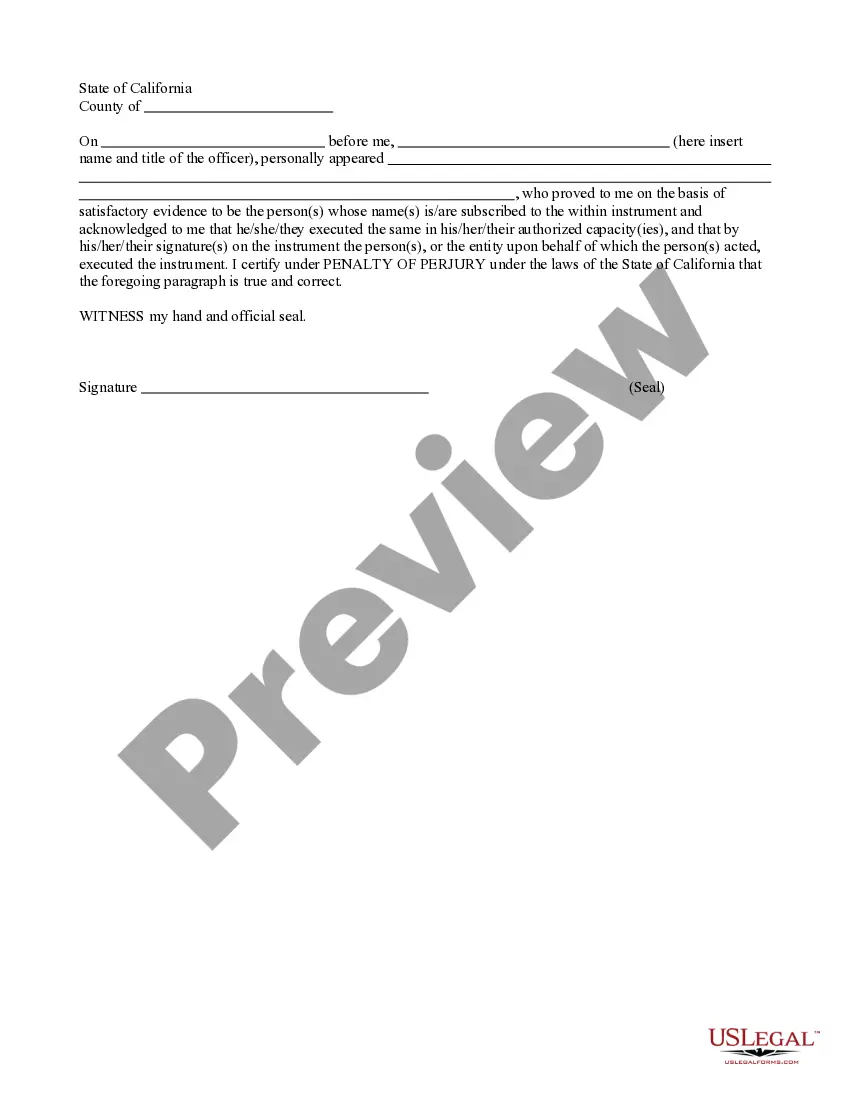

In California, a Declaration of Homestead form is a legal document that provides protection for homeowners against the forced sale of their primary residence or declared homestead due to financial difficulties or creditors' claims. Filing a Declaration of Homestead form can help safeguard a portion of the homeowner's equity in the property, up to a specified amount, from being seized by creditors. The purpose of this form is to establish and declare a homestead exemption, which is a legal protection available to homeowners to secure their property as a primary residence. By completing and recording this form with the county recorder's office, homeowners can avail themselves of the benefits and limitations provided under California law concerning a homestead exemption. The primary type of Declaration of Homestead form in California is known as the "Declaration of Homestead — Single Declaration" (Form DE-111). This form is utilized by single individuals or a married person who is the sole homeowner, declaring their intention to claim a homestead exemption on their primary residence. For married homeowners who jointly own their primary residence, there is the "Declaration of Homestead — Joint Declaration" (Form DE-221). This form allows both spouses to declare and protect their home from creditors, ensuring that both their shares of the equity in the property are safeguarded. Additionally, there is a specific type of homestead exemption available for elderly or disabled individuals called the "Declaration of Homestead — Elder/Disabled" (Form DE-222). This form caters to individuals who meet specific age or disability criteria and offers additional protection beyond what is provided by the regular homestead exemptions. It is important to note that each Declaration of Homestead form must be completed accurately, signed by the homeowners, and notarized. Once the form is properly executed, it should be filed with the county recorder's office in the county where the property is located. This ensures that the homestead exemption is legally recognized and recorded, providing the desired protections. In conclusion, the Declaration of Homestead form in California is a crucial legal document that homeowners can utilize to protect their primary residences from creditor claims. By filing the appropriate form, whether it be the single, joint, or elder/disabled declaration, homeowners can secure a portion of their equity and maintain a sense of security amidst financial hardships.